Get the free 01 I 1E OPPFR CLTf F 0 FRI0 0(TOBFR 1Q4S 'd EBER 7

Show details

01 I 1E OP PFR Clef F 0 FRI0 0(TO BFR 1Q4S'd EVER 7 October Afternoon in the Beard Valley INTO 'TRIANGLE OCTOBER. L4 Page 2 Summer Lightning Published for all employees of The International Nickel

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 01 i 1e oppfr form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 01 i 1e oppfr form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 01 i 1e oppfr online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 01 i 1e oppfr. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out 01 i 1e oppfr

To fill out 01 i 1e oppfr, follow these steps:

01

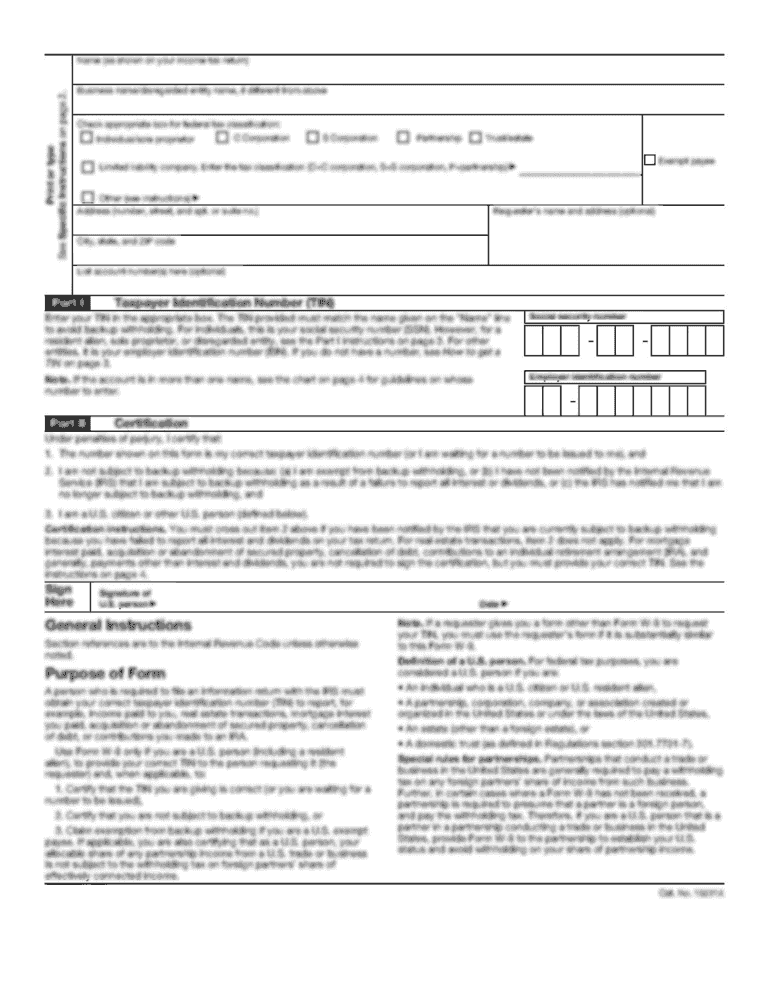

Start by entering your personal information such as your name, address, and contact details. This will help to identify you and ensure that the form is filled out correctly.

02

Move on to the section that requires specific details related to the purpose of the form. Depending on the nature of 01 i 1e oppfr, this could involve providing information about your employment history, financial status, or any other relevant details. Make sure to read the instructions carefully to understand what information is required in each section.

03

Double-check your answers to ensure accuracy. It is essential to review all the information you have entered before submitting the form. This will help to avoid any mistakes or errors that could lead to delays or complications.

Who needs 01 i 1e oppfr?

01 i 1e oppfr may be required by individuals or organizations in specific situations. Here are a few examples of who might need this form:

01

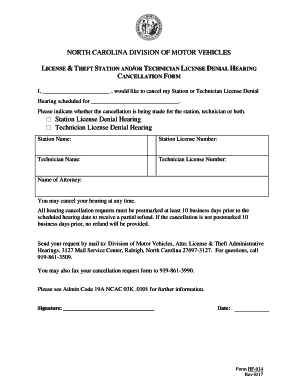

Job Applicants: Some employers may require applicants to fill out 01 i 1e oppfr as part of the application process. This allows them to gather necessary information about the applicant's qualifications, work experience, and other relevant details.

02

Financial Institutions: Banks or other financial institutions may request 01 i 1e oppfr from individuals who are applying for loans, credit cards, or other financial services. This form helps them assess the applicant's financial situation and determine their eligibility.

03

Government Agencies: Various government agencies may use 01 i 1e oppfr for different purposes, such as collecting data for statistical analysis, conducting research, or enforcing regulations. Individuals may be required to fill it out if they are involved in activities that fall under the jurisdiction of these agencies.

Remember, the need for 01 i 1e oppfr may vary depending on the specific circumstances and requirements of the situation at hand. It is always advisable to consult the instructions or seek guidance from the relevant authority to ensure you are filling out the form correctly and meeting the necessary obligations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 01 i 1e oppfr?

01 i 1e oppfr stands for a specific financial report required by the tax authorities.

Who is required to file 01 i 1e oppfr?

All individuals and businesses meeting certain criteria are required to file 01 i 1e oppfr.

How to fill out 01 i 1e oppfr?

01 i 1e oppfr can be filled out electronically or manually, following the guidelines provided by the tax authorities.

What is the purpose of 01 i 1e oppfr?

The purpose of 01 i 1e oppfr is to report financial information to the tax authorities for proper tax assessment.

What information must be reported on 01 i 1e oppfr?

01 i 1e oppfr requires reporting of income, expenses, assets, and liabilities.

When is the deadline to file 01 i 1e oppfr in 2023?

The deadline to file 01 i 1e oppfr in 2023 is typically April 15th.

What is the penalty for the late filing of 01 i 1e oppfr?

The penalty for late filing of 01 i 1e oppfr can include monetary fines and interest charges.

How do I modify my 01 i 1e oppfr in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your 01 i 1e oppfr as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I get 01 i 1e oppfr?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific 01 i 1e oppfr and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I complete 01 i 1e oppfr on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your 01 i 1e oppfr. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your 01 i 1e oppfr online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.