Get the free Kentucky Department of Revenue 42A740ES0003 - revenue ky

Show details

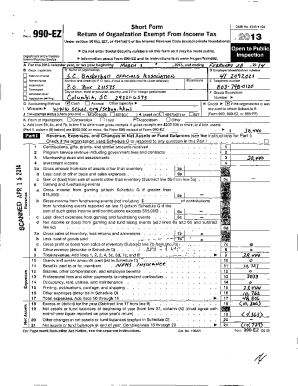

KENTUCKY ESTIMATED TAX VOUCHER INSTALLMENT 1 2012 INDIVIDUAL INCOME TAX Form 740-ES For FISCAL year filers ONLY FISCAL year ending / ARAB AAB AAAA ARAB AAB AAAA CCC CCD CC CCD CCC CCD CC CCD 12/31/2012

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your kentucky department of revenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kentucky department of revenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing kentucky department of revenue online

Follow the guidelines below to use a professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit kentucky department of revenue. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

How to fill out kentucky department of revenue

How to fill out Kentucky Department of Revenue:

01

Gather all necessary information and documents: Before starting to fill out the Kentucky Department of Revenue forms, make sure you have all the required information and documents ready. This may include your Social Security number, W-2 forms, financial statements, and any other relevant records.

02

Choose the appropriate form: The Kentucky Department of Revenue website provides various forms depending on your specific tax situation. Select the form that corresponds to your needs, such as individual income tax return, business tax return, or sales and use tax return.

03

Fill out personal information: Begin by entering your personal information accurately. This usually includes your name, address, Social Security number, and filing status. Double-check all the details to avoid any errors.

04

Provide income details: Proceed to enter your income information. This includes wages, salaries, tips, interest, dividends, and any other sources of income. If you have multiple sources of income, ensure that you report each one accurately.

05

Deductions and credits: If you are eligible for any deductions or credits, make sure to claim them appropriately. These may include deductions for expenses such as mortgage interest, medical expenses, or higher education expenses. Additionally, be aware of any tax credits you qualify for, like the Earned Income Tax Credit or the Child Tax Credit.

06

Review and double-check: Once you have completed all the necessary sections, thoroughly review your form for any errors or omissions. It's crucial to ensure that all the information provided is accurate and up to date. Mistakes could delay your tax refund or result in penalties.

07

Submitting your form: After you have reviewed everything and are satisfied that your form is complete and accurate, you can submit it to the Kentucky Department of Revenue. Make sure to follow the instructions provided on the form or on the department's website for submission methods, such as electronic filing or mailing a physical copy.

Who needs Kentucky Department of Revenue?

01

Individuals: Any individual who earns income in Kentucky, whether it is from a job, business, investments, or other sources, may need to file with the Kentucky Department of Revenue. This includes both residents and non-residents who meet the state's filing requirements.

02

Businesses: All businesses operating in Kentucky, including corporations, partnerships, sole proprietorships, and LLCs, are required to file tax returns and pay any applicable taxes to the Kentucky Department of Revenue. The specific forms and requirements vary depending on the type of business.

03

Non-profit organizations: Non-profit organizations operating in Kentucky may also have certain tax obligations that need to be fulfilled by filing with the Kentucky Department of Revenue. These obligations could include filing for exemption or reporting any income generated.

04

Individuals receiving Kentucky-sourced income: Even if you do not live in Kentucky, if you receive income from sources within the state, you may need to file a tax return with the Kentucky Department of Revenue. This could apply to rental income, royalties, or other Kentucky-based earnings.

It is important to note that these points are general guidelines and may not cover every specific scenario. It's advisable to consult the Kentucky Department of Revenue's official website or seek professional tax advice to ensure compliance with all requirements.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is kentucky department of revenue?

The Kentucky Department of Revenue is the state agency responsible for collecting taxes and administering tax laws in the state of Kentucky.

Who is required to file kentucky department of revenue?

Individuals, businesses, and organizations that owe taxes or have tax obligations in Kentucky are required to file with the Kentucky Department of Revenue.

How to fill out kentucky department of revenue?

To fill out the Kentucky Department of Revenue forms, taxpayers must gather relevant financial information, complete the forms accurately, and submit them electronically or by mail.

What is the purpose of kentucky department of revenue?

The purpose of the Kentucky Department of Revenue is to ensure compliance with tax laws, collect taxes in a fair and efficient manner, and fund public services and programs in the state.

What information must be reported on kentucky department of revenue?

Taxpayers are required to report their income, deductions, credits, and any other relevant financial information on the Kentucky Department of Revenue forms.

When is the deadline to file kentucky department of revenue in 2023?

The deadline to file Kentucky Department of Revenue in 2023 is April 17, 2023.

What is the penalty for the late filing of kentucky department of revenue?

The penalty for late filing of Kentucky Department of Revenue is 5% of the tax due per month, up to a maximum of 25%.

Can I create an eSignature for the kentucky department of revenue in Gmail?

Create your eSignature using pdfFiller and then eSign your kentucky department of revenue immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit kentucky department of revenue straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing kentucky department of revenue.

How do I fill out the kentucky department of revenue form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign kentucky department of revenue and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your kentucky department of revenue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.