Get the free Financial Institutions Bond for Investment Firms - 1st Party - Hartford ...

Show details

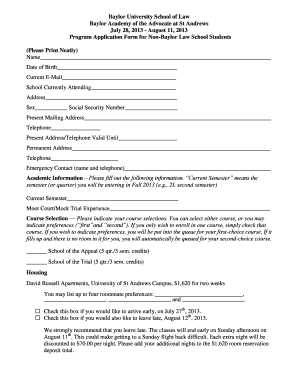

APPLICATION FOR FINANCIAL INSTITUTION BOND FOR INVESTMENT FIRMS NON-CUSTODIAL INVESTMENT ADVISORS (FIRST PARTY) Agency Name: Hartford Agency Code: Application is hereby made by (Name of Advisor):

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your financial institutions bond for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial institutions bond for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

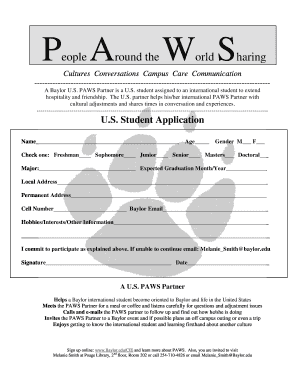

Editing financial institutions bond for online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit financial institutions bond for. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

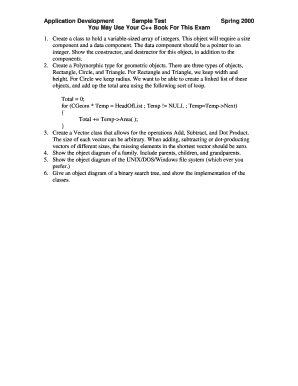

How to fill out financial institutions bond for

How to fill out a financial institutions bond:

01

Begin by collecting all required documentation, including the application form for the bond. This form can usually be obtained from the bonding company or insurance company offering the bond.

02

Fill out the application form carefully and accurately. Provide all requested information, such as the name and address of the financial institution, the bond amount required, and any other necessary details.

03

Also, attach any necessary supporting documents, such as financial statements, proof of assets, or other required paperwork. These documents may be necessary to assess the financial stability of the institution and determine the appropriate bond amount.

04

Pay close attention to any specific instructions or requirements provided by the bonding company. These instructions may include details on the payment process, any additional fees or premiums, or specific conditions that need to be met.

05

Review the completed application form and supporting documents to ensure accuracy and completeness. Double-check all information provided and make any necessary corrections before submitting.

Who needs a financial institutions bond:

01

Financial institutions, such as banks, credit unions, or mortgage companies, typically need a financial institutions bond. This bond serves as a form of protection for customers and the general public, ensuring that the institution operates honestly and ethically.

02

It is typically a regulatory requirement for financial institutions to obtain a bond as part of their licensing or registration process. This ensures that the institution meets certain financial and operational standards.

03

Additionally, a financial institutions bond may be needed when seeking certain types of contracts or partnerships. Other businesses or government agencies may require a bond as a condition of doing business or entering into a professional relationship.

Overall, the financial institutions bond is essential for providing assurance to customers and stakeholders that the institution is financially sound and can fulfill its obligations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is financial institutions bond for?

Financial institutions bond is a type of insurance that protects a financial institution against losses caused by employee dishonesty, robbery, or forgery.

Who is required to file financial institutions bond for?

Banks, credit unions, investment firms, and other financial institutions are required by law to have financial institutions bond coverage in place.

How to fill out financial institutions bond for?

To fill out a financial institutions bond, the institution must provide information about their operations, number of employees, level of coverage needed, and other relevant details to the insurance provider.

What is the purpose of financial institutions bond for?

The purpose of financial institutions bond is to protect financial institutions from financial losses due to employee dishonesty or criminal activities.

What information must be reported on financial institutions bond for?

Information such as the institution's name, address, type of operations, number of employees, coverage amounts, and any previous claims history must be reported on the financial institutions bond.

When is the deadline to file financial institutions bond for in 2023?

The deadline to file financial institutions bond in 2023 is typically determined by the insurance provider, but it is recommended to file it well before the current policy expires to avoid any lapses in coverage.

What is the penalty for the late filing of financial institutions bond for?

The penalty for late filing of financial institutions bond can vary depending on the insurance provider, but it can result in a lapse in coverage and potential financial losses for the institution.

How do I modify my financial institutions bond for in Gmail?

financial institutions bond for and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send financial institutions bond for to be eSigned by others?

To distribute your financial institutions bond for, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I make changes in financial institutions bond for?

With pdfFiller, the editing process is straightforward. Open your financial institutions bond for in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Fill out your financial institutions bond for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.