Get the free To declare surplus the City-owned vacant land municipally

Show details

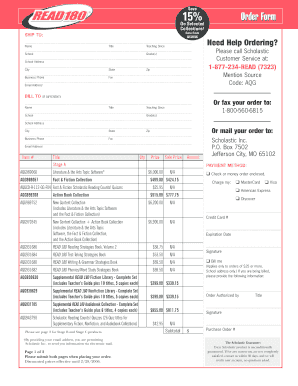

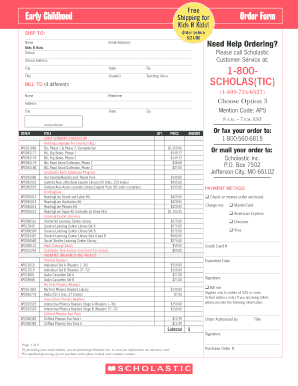

DELEGATED APPROVAL FORM DECLARE SURPLUS TRACKING NO.: 2012-128 Approved pursuant to the Delegated Authority contained in Government Management Committee Item GM6.18 entitled Policy with Respect to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign to declare surplus form

Edit your to declare surplus form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your to declare surplus form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing to declare surplus form online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit to declare surplus form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out to declare surplus form

How to Fill Out to Declare Surplus Form:

01

Gather all relevant information and documents: Before starting to fill out the surplus form, make sure you have all the necessary information and documents readily available. This may include details about the item or property being declared as surplus, its current condition, acquisition details, and any supporting documents such as receipts or appraisal reports.

02

Understand the specific requirements of the surplus form: Familiarize yourself with the specific requirements of the surplus form you are filling out. Each form may have different sections or fields that need to be completed, so it is important to read the instructions carefully before proceeding.

03

Provide accurate and complete information: Ensure that all the information you provide on the surplus form is accurate and complete. Double-check the spelling of names, addresses, and other details to avoid any errors. Incomplete or incorrect information can lead to delays or complications in the surplus declaration process.

04

Describe the item or property in detail: Provide a detailed description of the item or property being declared as surplus. Include relevant information such as its specifications, quantity, condition, and any unique attributes. This description should be clear and concise to help the recipient of the surplus form understand what is being declared.

05

Attach supporting documents if required: If there are any supporting documents that need to be submitted along with the surplus form, ensure that they are properly attached. This may include invoices, photographs, warranties, or any other relevant documents that provide additional information or evidence about the item or property being declared as surplus.

06

Review and sign the form: Before submitting the surplus form, carefully review all the information you have provided. Make sure there are no mistakes or omissions. Once you are satisfied with the accuracy and completeness of the form, sign and date it as required. Your signature indicates that the information provided is true and correct to the best of your knowledge.

Who needs to declare surplus form:

01

Individuals or organizations with items or properties they no longer need: Anyone who has items or properties they no longer need or want can declare them as surplus. This may include individuals, businesses, government agencies, educational institutions, or nonprofit organizations.

02

Government agencies or departments with excess or underutilized assets: Government agencies or departments often need to declare surplus forms for items or properties they no longer require or have excess of. This can include furniture, equipment, vehicles, or real estate that is no longer needed for their operations.

03

Organizations involved in asset management or liquidation: Organizations that specialize in asset management or liquidation may also be required to fill out surplus forms. These organizations help their clients sell or dispose of surplus assets in a strategic and organized manner. Filling out surplus forms allows them to document and track these assets throughout the process.

Remember to always check the specific guidelines and regulations of your local jurisdiction or organization when filling out surplus forms, as they can vary based on location and industry.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete to declare surplus form online?

pdfFiller has made filling out and eSigning to declare surplus form easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit to declare surplus form in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing to declare surplus form and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I edit to declare surplus form on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute to declare surplus form from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is to declare surplus form?

The surplus form is a document used to report any excess or unused items or funds within an organization.

Who is required to file to declare surplus form?

All departments or individuals within an organization who have excess items or funds that need to be reported are required to file the surplus form.

How to fill out to declare surplus form?

The surplus form typically requires information such as the description of the surplus item, quantity, condition, and the reason for declaring it surplus.

What is the purpose of to declare surplus form?

The purpose of the surplus form is to ensure transparency and proper management of organization resources by identifying and properly disposing of excess items or funds.

What information must be reported on to declare surplus form?

The surplus form must include details about the surplus item including description, quantity, condition, and reason for declaring it surplus.

Fill out your to declare surplus form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

To Declare Surplus Form is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.