Get the free u e -,0 5

Show details

In 792 1 u e, 0 5 T e an Indy UCI NC n e t n e try h K y eye H t s o CNI C né l ho o D LST AA, X l

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your u e -0 5 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your u e -0 5 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit u e -0 5 online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit u e -0 5. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out u e -0 5

How to fill out U E -0 5?

01

Gather the necessary information: Before starting the process of filling out U E -0 5, gather all the required information. This includes personal details like your name, address, social security number, and contact information. Additionally, you may also need details about your previous employment, such as the employer's name, address, and dates of employment.

02

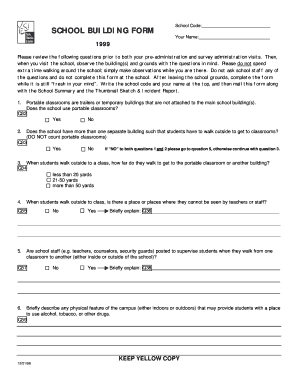

Understand the purpose of the form: U E -0 5 refers to the Unemployment Eligibility Form 05, which is used to determine an individual's eligibility for unemployment benefits. Familiarize yourself with the purpose of the form and its sections.

03

Complete personal information: Begin by filling out your personal information accurately and legibly. Provide your full name, current address, contact number, and any other required details. Ensure that all information provided is up-to-date and correct.

04

Provide employment details: In this section, you will need to provide information about your previous employment(s). Include the employer's name, address, contact information, and dates of employment. It is essential to provide accurate details to avoid any complications with the application process.

05

Answer eligibility questions: The U E -0 5 form will contain a series of eligibility questions that determine whether or not you qualify for unemployment benefits. Carefully read and answer each question according to your specific circumstances. It is crucial to be truthful and provide any necessary supporting documentation when required.

06

Sign and date the form: Once you have completed all the necessary sections, ensure that you sign and date the form correctly. Your signature is a confirmation that the provided information is true and accurate to the best of your knowledge.

Who needs U E -0 5?

01

Individuals seeking unemployment benefits: Anyone who wishes to apply for unemployment benefits will typically need to fill out the U E -0 5 form. This form helps determine eligibility and collects necessary information from the applicant.

02

State labor departments: State labor departments utilize the U E -0 5 form as a standard requirement in the application process for unemployment benefits. This form assists them in assessing an individual's eligibility based on the provided information.

03

Employers and human resource departments: Employers and HR departments may require employees who are filing for unemployment benefits to complete the U E -0 5 form. This enables them to provide the necessary details and confirm employment history for verification purposes.

It is important to note that specific regulations and requirements for the U E -0 5 form may vary depending on the location and governing labor laws. It is advisable to consult with your local labor department or unemployment office for precise instructions on how to fill out this form accurately.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is u e -0 5?

u e -0 5 refers to a specific tax form issued by the IRS for reporting certain types of income.

Who is required to file u e -0 5?

Individuals or entities who receive income that falls under the reporting requirements of u e -0 5 are required to file this form.

How to fill out u e -0 5?

To fill out u e -0 5, you will need to provide information about the income you received and any withholdings that may have occurred.

What is the purpose of u e -0 5?

The purpose of u e -0 5 is to report certain types of income to the IRS for tax purposes.

What information must be reported on u e -0 5?

Information such as the amount of income received, any federal tax withheld, and the recipient's identification number must be reported on u e -0 5.

When is the deadline to file u e -0 5 in 2023?

The deadline to file u e -0 5 in 2023 is typically January 31st, but it is always best to check with the IRS for any changes or extensions.

What is the penalty for the late filing of u e -0 5?

The penalty for late filing of u e -0 5 can vary depending on the circumstances, but it may include fines or interest charges on any unpaid taxes.

How can I send u e -0 5 to be eSigned by others?

u e -0 5 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I complete u e -0 5 online?

With pdfFiller, you may easily complete and sign u e -0 5 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I make changes in u e -0 5?

The editing procedure is simple with pdfFiller. Open your u e -0 5 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Fill out your u e -0 5 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.