Get the free BORROWER APPLICATION FOR CREDIT APPLICANT CO-BUYER...

Show details

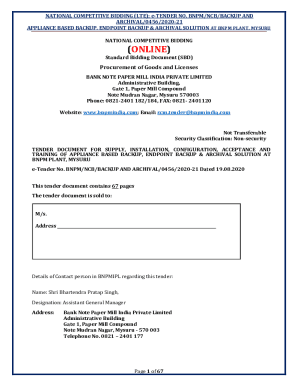

BORROWER APPLICATION FOR CREDIT LAST NAME APPLICANT FIRST NAME CO-BUYER FOR: MIDDLE NAME HOME ADDRESS HOW LONG THERE? APT. SOCIAL SECURITY NUMBER DATE OF BIRTH YRS CITY STATE HOME PHONE (ZIP COUNTRY

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your borrower application for credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your borrower application for credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing borrower application for credit online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit borrower application for credit. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out borrower application for credit

How to fill out a borrower application for credit:

01

Start by gathering all the necessary documents and information. This may include your identification documents, proof of income, employment history, and any other financial details that may be required.

02

Carefully read through the application form to ensure you understand all the questions and requirements. Take note of any specific instructions or supporting documents that need to be attached.

03

Begin by providing your personal information, such as your full name, date of birth, and contact information. Be sure to double-check the accuracy of these details as any errors could lead to delays or rejections.

04

Moving on to the financial section, provide accurate details about your income sources, including your employment status, monthly salary or income, any additional sources of income, and any outstanding debts or liabilities.

05

Fill in the details of your employment history, including your current and previous employers, job titles, and duration of employment. If there are any gaps in your employment history, be prepared to provide a valid explanation.

06

Complete the section related to your assets and liabilities. This may include information about your properties, investments, bank accounts, loans, and credit cards. Provide accurate information about each item to enable the lender to assess your financial situation effectively.

07

Be prepared to provide references, such as previous lenders, landlords, or personal references. Ensure that you have obtained consent from these individuals beforehand, as lenders may contact them to verify your character or financial reliability.

08

Review the completed application form thoroughly, ensuring all fields have been appropriately filled out. Double-check all the attached documents and make sure they are securely attached to the application.

09

Sign and date the application form. By doing so, you certify that all the information provided is true and accurate to the best of your knowledge.

Who needs a borrower application for credit:

01

Individuals who are looking to apply for any type of loan, including personal loans, auto loans, mortgages, or credit cards, will typically need to submit a borrower application for credit.

02

Business owners or entrepreneurs seeking business financing, lines of credit, or commercial loans will also be required to fill out borrower applications.

03

Anyone wishing to obtain credit from financial institutions or lenders, whether it's for personal or business purposes, will need to complete a borrower application for credit as part of the lending process.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is borrower application for credit?

Borrower application for credit is a form filled out by individuals or businesses when requesting a loan or credit line from a financial institution.

Who is required to file borrower application for credit?

Any individual or business seeking a loan or credit line from a financial institution is required to file a borrower application for credit.

How to fill out borrower application for credit?

To fill out a borrower application for credit, applicants need to provide personal or business financial information, employment history, credit history, and any other relevant details requested by the financial institution.

What is the purpose of borrower application for credit?

The purpose of borrower application for credit is for financial institutions to assess the creditworthiness of the applicant and determine if they qualify for the requested loan or credit line.

What information must be reported on borrower application for credit?

Applicants must report personal or business financial information, employment history, credit history, and any other relevant details requested by the financial institution.

When is the deadline to file borrower application for credit in 2023?

The deadline to file borrower application for credit in 2023 is typically determined by the financial institution providing the loan or credit line.

What is the penalty for the late filing of borrower application for credit?

The penalty for the late filing of borrower application for credit may vary depending on the financial institution, but it could result in the delay or denial of the loan or credit line.

How can I send borrower application for credit to be eSigned by others?

Once you are ready to share your borrower application for credit, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit borrower application for credit online?

With pdfFiller, the editing process is straightforward. Open your borrower application for credit in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I edit borrower application for credit on an iOS device?

Create, modify, and share borrower application for credit using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your borrower application for credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.