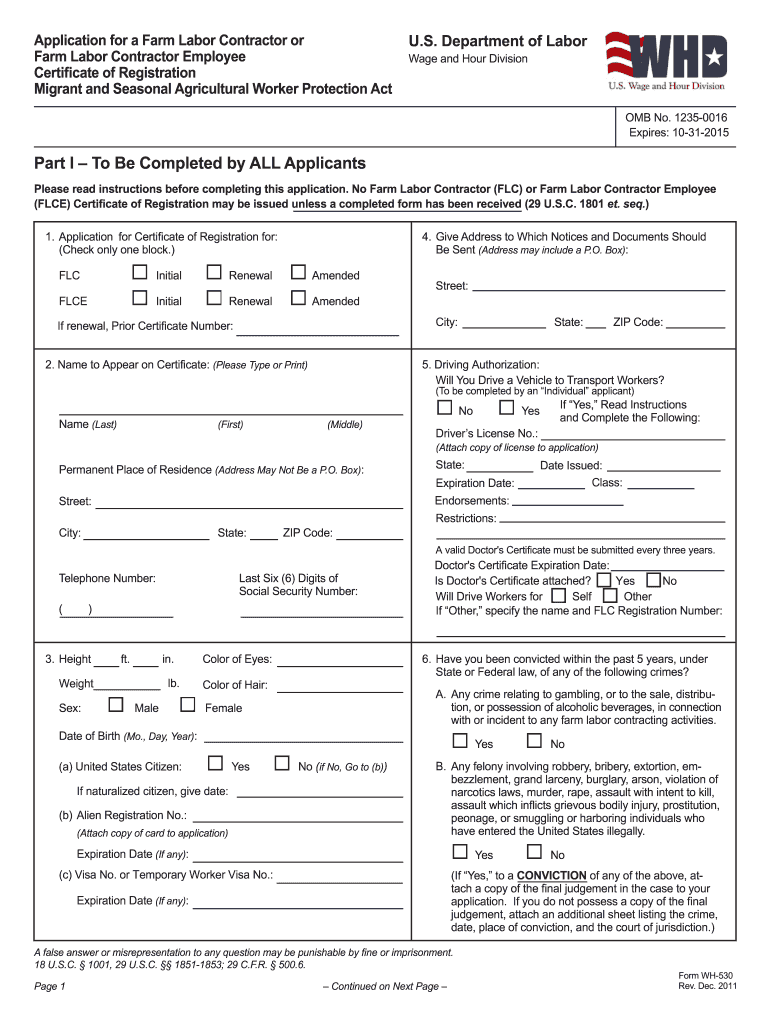

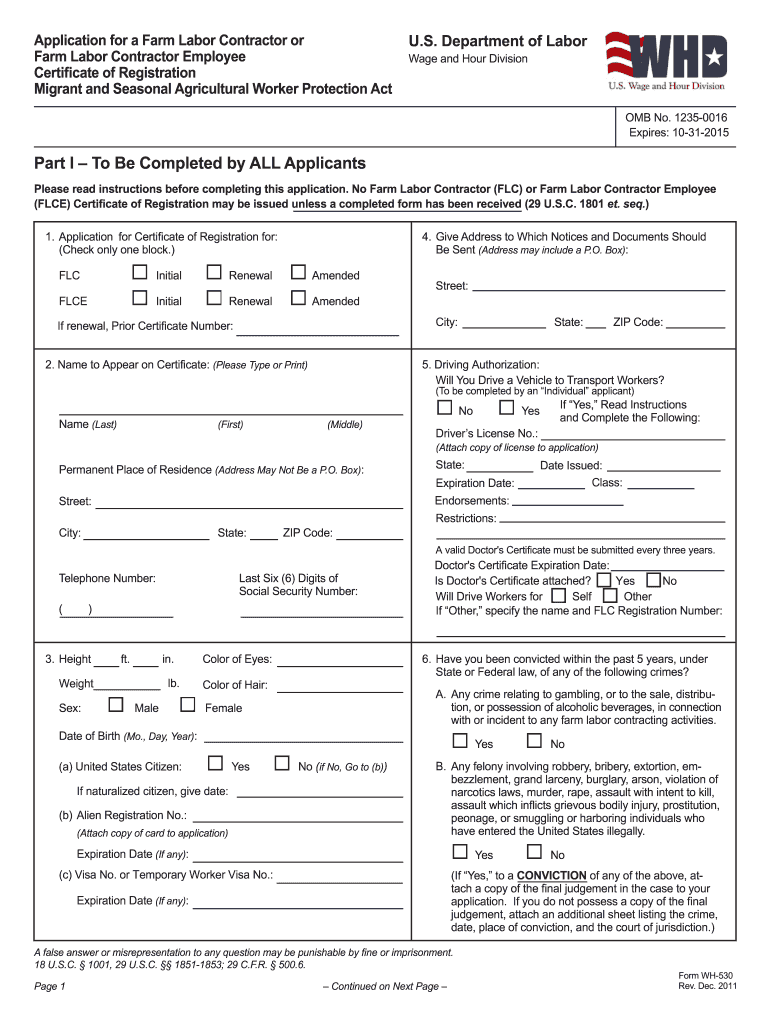

DOL WH-530 2011-2024 free printable template

Get, Create, Make and Sign

Editing wh 530 online

How to fill out wh 530 form

How to fill out 2011 WH 530 fill:

Who needs 2011 WH 530 fill:

Video instructions and help with filling out and completing wh 530

Instructions and Help about 2011 wh530 form fillable

So the purpose of this video is to show you how to fulfill an empty continuous ink system this is our combined cartridge version which basically means all the cartridges are in one block not separate not separated and have one big chip on it so the first thing to do is to remove all plugs on the continuous ink system, so this one has 8 plugs depending on which model you choose could have 10 12 14 or 16 so with the correct colored ink we're going to make a clean cut around the top of the ink, and I'll explain why you need a clean cut if you made a clean cut you can actually pour it is very slowly no mess that's all if you don't make a clean cut it can't go everywhere so if you don't make the clean cut then you probably have to use a syringe method, so initially we're going to fill this to us all the way up till as much as we can get it which will probably not far off the top, so the cartridges aren't following to you eventually it will go down, and you'll be able to pull the remainder they are made of these into the continuous ink system so on to the second color which is the scion again just make sure that you pour it very slowly we can go everywhere onto the yellow, and we do sell these and pre-filled with dye based or pigment ink, and we offer them empty for those customers that wish to try sublimation ink or edible ink the last remaining color, so I need to make sure you've got the right colored ink I've got the wrong color link here this is why magenta, so I need a magenta you need to make sure you the right color in the right pot and have a magenta ink here, so I'm going to port magenta ink into the continuous ink system okay make sure that you get a clean cut on top of your bottle pour in as much as you can probably tell it's about 85 90 percent full so once you've done that using the screwdriver that came in the pack you need to remove the plugs on the top of the cartridge are shown here and then with the syringe provided we're going to put it into that and prime it so if you've, anyone wants to rings you will have to wash it out and dry basically before you move to the next color we're alternatively you may have four syringes or one for each pull-up, so it says it firmly into the whole white family it will go, and then you need to draw back, so you'll see and then just hold it so what you actually see is you can't see it on the side of this one where the cartridge is actually filling now with ink so as soon as you see a drop of ink in the bottom of the cartridge or in the bottom of the syringe the lines fall there we are I'm going to stop we've finished I'm going to raise it up in the air now and remove with a square bucket in the excess ink just a little, and then I'm going to remove the syringe so the reason I've put it up in the air is basically because they're gravity-fed if I keep it lower ink will keep or announcer lift it up in the air and then put the plug in, so again I'm going to repeat the process now for the other four colors...

Fill form : Try Risk Free

People Also Ask about wh 530

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your wh 530 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.