Get the free GAP Protection

Show details

GAP Protection Guaranteed Automobile Protection Commitment To You have a vested interest in your complete satisfaction with your total vehicle buying experience. In fact, that is exactly why this

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your gap protection form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gap protection form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gap protection online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit gap protection. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out gap protection

How to fill out gap protection:

01

Start by reviewing your current insurance policies. Determine if there are any gaps in coverage that need to be addressed.

02

Research and compare different gap protection insurance providers. Look for a company that offers coverage that aligns with your specific needs and budget.

03

Contact the chosen gap protection insurance provider. Request a quote and ask any questions you may have about the coverage.

04

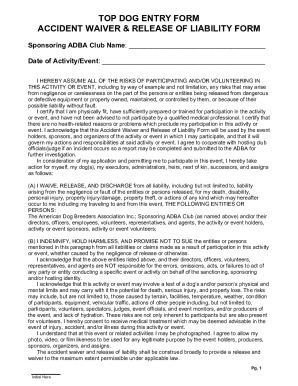

Fill out the application form accurately and thoroughly. Provide all requested information, including personal details, current insurance policies, and any additional information required.

05

Review the terms and conditions of the gap protection insurance policy before signing. Make sure you understand the coverage limits, deductibles, and any exclusions or limitations.

06

Pay the premium for the gap protection insurance policy. Ensure that you understand the payment schedule and any applicable fees or penalties for non-payment.

07

Keep a copy of the filled-out application and the signed policy for your records.

08

Follow up with the insurance provider to confirm that your gap protection policy is active and effective.

Who needs gap protection?

01

Individuals or businesses with existing insurance policies that may have coverage gaps.

02

Those who want to ensure they have financial protection in case of unexpected events or losses not covered by their primary insurance policies.

03

People who want added peace of mind and the assurance that their financial interests are protected in various scenarios, such as accidents, theft, natural disasters, or other unforeseen incidents.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

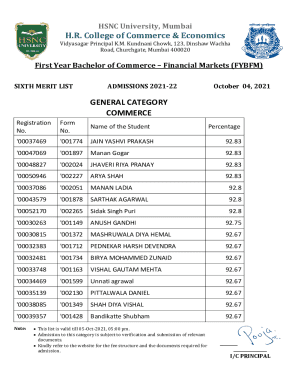

What is gap protection?

Gap protection is a type of insurance coverage that helps cover the difference between the actual cash value of a vehicle and the amount still owed on a loan or lease.

Who is required to file gap protection?

Gap protection is typically required for individuals who are financing or leasing a vehicle.

How to fill out gap protection?

To fill out gap protection, you will need to provide details about your vehicle, loan or lease agreement, and your insurance policy.

What is the purpose of gap protection?

The purpose of gap protection is to protect individuals from financial loss in the event that their vehicle is totaled or stolen and the insurance payout is less than the amount owed on the loan or lease.

What information must be reported on gap protection?

The information that must be reported on gap protection includes the vehicle's make, model, and VIN number, the loan or lease amount, and the insurance policy details.

When is the deadline to file gap protection in 2023?

The deadline to file gap protection in 2023 will vary depending on the individual's loan or lease agreement, but it is typically within a few months of purchasing or leasing the vehicle.

What is the penalty for the late filing of gap protection?

The penalty for the late filing of gap protection can vary depending on the terms of the loan or lease agreement, but it may result in the individual being responsible for paying the difference between the insurance payout and the amount owed on the loan or lease.

How do I edit gap protection straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing gap protection.

How do I complete gap protection on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your gap protection from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I edit gap protection on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute gap protection from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your gap protection online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.