Get the free SBA Revisions to Third Party Lender Agreement

Get, Create, Make and Sign sba revisions to third

Editing sba revisions to third online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sba revisions to third

How to fill out sba revisions to third

Who needs sba revisions to third?

SBA revisions to third form: A comprehensive guide

Understanding the SBA third form revisions

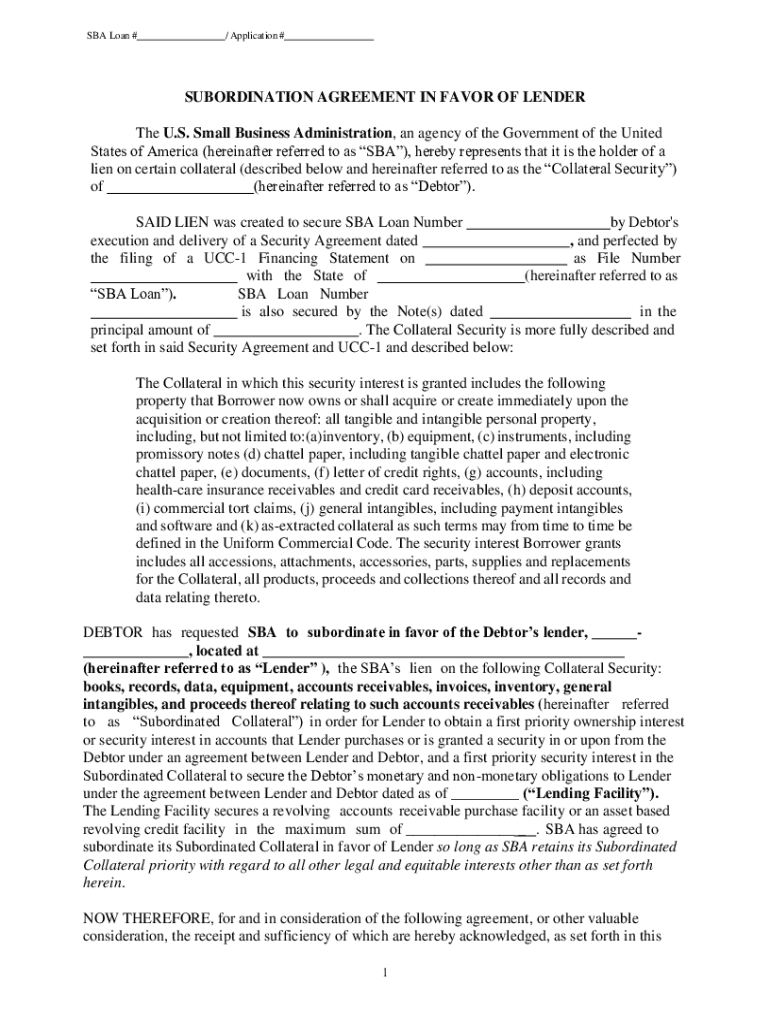

The SBA third form is a crucial document for many borrowers seeking loans or financial assistance from the Small Business Administration (SBA). With recent revisions, it's essential for users to understand its purpose, importance, and the key changes that have been introduced. The revisions aim to streamline the application process and enhance the clarity and accessibility of the form for various stakeholders.

The purpose of these revisions is to not only simplify the application process but also to ensure that applicants understand the eligibility criteria for SBA programs. Previously, applicants faced numerous challenges due to unclear instructions or outdated requirements. The recent enhancements focus on providing a user-friendly experience while ensuring compliance with government regulations.

Navigating the SBA third form

Accessing the SBA third form has become easier for users thanks to various digital tools provided by the SBA. To locate the form, visit the official SBA website where the document is prominently displayed in their resources section. Users can also download the form in PDF format, allowing for offline access and completion.

For those who prefer a more interactive experience, using PDF editing tools can facilitate easy access and filling out of the form. By utilizing software like pdfFiller, users can effortlessly edit PDF documents directly in their web browser, without the need for traditional printing and scanning.

Once you access the form, understanding its layout and sections is vital. Each section is designed to gather specific information from the applicant, such as personal details, business specifics, and financial data. Familiarize yourself with these sections to improve the efficiency of your application process.

Detailed instructions for completing the form

Completing the SBA third form requires careful attention to detail in various sections. Begin with personal information, where you enter your name, address, and contact details. Accurate and up-to-date information in this section is crucial, as it serves as the foundation of your application.

Following personal information, adequately filling out the business details is essential. This may include the business name, structure, and nature of the operations. Financial data is another critical section, demanding precise figures that represent your business's financial health and projections. Moreover, supporting documentation must be included for verification of the provided information.

Many applicants fall into common pitfalls while completing the form. One frequent issue is submitting incomplete sections, leading to processing delays. Additionally, misunderstanding new requirements could lead to rejection of the application. To avoid these mistakes, carefully read the instructions and double-check each section before submission.

Editing and managing your form with pdfFiller

pdfFiller is an indispensable tool for managing your SBA third form efficiently. This platform allows users to import the SBA third form directly and edit it seamlessly. Whether you need to correct an error, add additional information, or format your document, pdfFiller provides an intuitive interface that simplifies the editing process.

Beyond just editing, pdfFiller offers electronic signatures, which are increasingly important in today's digital landscape. Applying an electronic signature to the SBA third form ensures that your signature is secure and legally binding. Furthermore, you can invite team members for review and collaboration, allowing for diverse input and refining the application before its final submission.

Submitting the SBA third form

Preparing for submission of the SBA third form involves a few key steps. First, conduct a final review of the application to ensure all sections are completed accurately. A checklist can be invaluable at this stage to validate that you've included all necessary documentation and provided complete information.

When it comes to submission methods, applicants can choose to submit their forms online, which is often the preferred and quickest method. The SBA website provides clear instructions for online submissions. Alternatively, you may find options for mailing or faxing the application if an online submission isn’t feasible for your circumstances. It's important to stay informed about submission deadlines to avoid any delays.

Updates and additional guidance on SBA third form revisions

Staying updated with recent announcements and updates from the SBA regarding the third form is vital for applicants. The SBA frequently issues crucial notifications that may impact eligibility requirements or application processes. By actively following the SBA’s official communication channels, applicants can remain informed and responsive to any changes that affect their submission.

FAQs are also an excellent resource for understanding the nuances surrounding the SBA third form changes. Common questions revolve around specific eligibility criteria changes, submission processes, and document requirements. Knowing where to find answers allows applicants to circumvent potential confusion or missteps in their applications.

Enhancing your form experience with additional tools

To optimize your experience with the SBA third form, utilizing interactive tools offered by pdfFiller can significantly enhance your workflow. The platform features a template library that allows users to customize various forms according to their needs. This capability makes it easier to adjust the SBA third form in line with specific application requirements.

Besides templating, pdfFiller provides additional document management features that enable users to track changes and maintain version control. Furthermore, mobile capabilities allow users to edit and fill the form on the go, making it highly convenient for individuals with busy schedules or who frequently travel.

What to expect next: planning for future SBA revisions

Remaining proactive about potential future SBA revisions is crucial for applicants and users of the third form. The government often adjusts regulations in response to economic shifts and user feedback. By staying informed, you can prepare for how such changes might impact your application process.

Regularly checking for announcements and engaging with the SBA community through forums or social media can provide insights into expected updates. Being prepared for these changes positions you to efficiently adapt your documentation and submissions as necessary, ensuring continued compliance with government requirements.

User experiences and testimonials

User experiences with the SBA third form have underscored the impact of recent revisions on facilitators of the application process. Many borrowers have shared success stories detailing how simplified navigation and clearer instructions have directly contributed to a smoother application journey. Individuals report feeling empowered to complete the form with confidence, backed by the comprehensive guidance provided.

Furthermore, real-world applications of the SBA third form showcase how precise changes have improved accessibility for various businesses across the United States. Between government updates and community feedback, it's evident that the revisions are making a palpable difference in how borrowers approach their financing strategies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sba revisions to third to be eSigned by others?

How can I get sba revisions to third?

How do I edit sba revisions to third on an Android device?

What is sba revisions to third?

Who is required to file sba revisions to third?

How to fill out sba revisions to third?

What is the purpose of sba revisions to third?

What information must be reported on sba revisions to third?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.