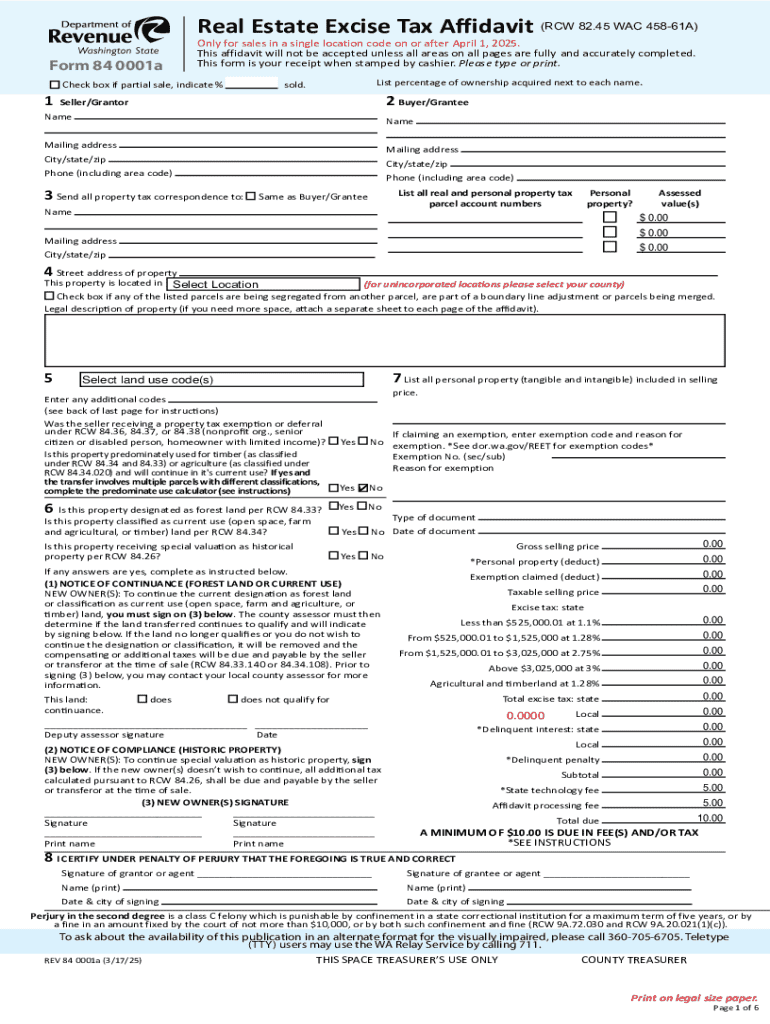

Get the free Real Estate Excise Tax Affidavit (RCW 82.45 WAC 4586- ... - dor wa

Get, Create, Make and Sign real estate excise tax

Editing real estate excise tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out real estate excise tax

How to fill out real estate excise tax

Who needs real estate excise tax?

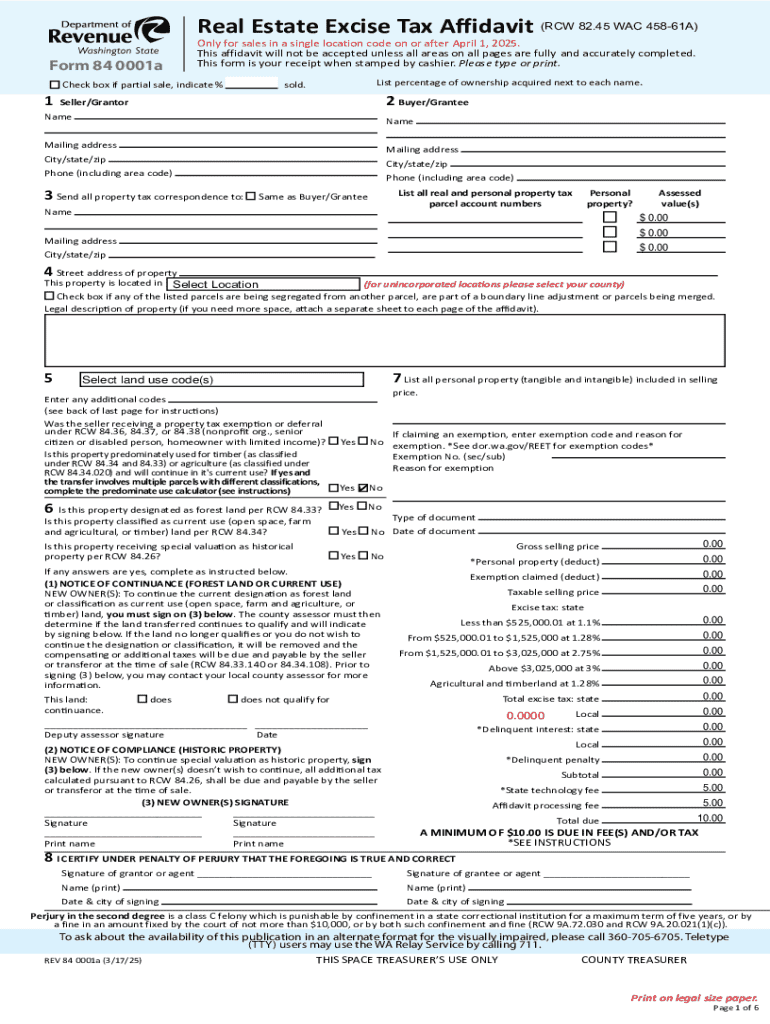

A Comprehensive Guide to the Real Estate Excise Tax Form

Understanding real estate excise tax

Real estate excise tax (REET) is a tax imposed on the sale of real property, levied by state and local governments. This tax is typically calculated as a percentage of the sale price and is critical for funding local infrastructure and services. Therefore, understanding its function is crucial for anyone involved in real estate transactions.

Adhering to REET regulations is essential as failure to comply can result in financial penalties or legal challenges. Each state has different rules that govern REET, and it's essential to familiarize yourself with the requirements in your area to ensure proper compliance.

What is the real estate excise tax form?

The real estate excise tax form is a critical document required when transferring ownership of real property. This form contains vital information about the transaction, which helps determine the amount of tax owed. Accurately completing this form is essential in ensuring compliance with state law.

Key components of the form are organized into three main parts, which include essential details that validate the transaction and establish taxation.

Who needs to fill out the real estate excise tax form?

Both individuals and businesses involved in a real estate transaction are required to fill out the real estate excise tax form. Regardless of whether the property is a residential or commercial space, the form is crucial in establishing tax liability.

Common scenarios requiring the form include the sale of a home, investment properties, or commercial buildings. Each scenario has unique tax implications and may affect the requirements and the eventual tax owed.

Step-by-step guide to filling out the real estate excise tax form

Filling out the real estate excise tax form can seem daunting, but breaking it down into manageable steps simplifies the process. It's essential to gather all necessary information and documents prior to starting.

Begin with gathering all relevant documentation.

Next, complete each part of the form, starting with Part A, which captures seller information. Ensure accuracy and clarity, as this will directly affect the processing of your document.

In Part B, enter complete details for the buyer. Follow this with Part C, where you will include transaction details and calculate the tax due based on the sale price.

For accurate tax calculations, it is necessary to know the specific tax rate applicable in your jurisdiction. This can usually be found on your local tax authority's website. Performing simple calculations can help verify the tax due amount.

Finally, review the completed form meticulously to ensure accuracy and compliance before submission.

Editing and managing your real estate excise tax form

Once you've filled out the real estate excise tax form, utilizing tools like pdfFiller can significantly enhance your document management experience. This cloud-based service aims to streamline the process of editing, sharing, and collaboration.

With pdfFiller, users can edit the form effortlessly, making necessary corrections or updates. Additionally, it offers collaborative features that allow teams to work together in real-time, which can be highly beneficial during a property transaction.

Signing the real estate excise tax form

Signing the real estate excise tax form is an essential step that legitimizes the document. pdfFiller provides digital signature options that are user-friendly and legally binding. Understanding the legality of electronic signatures is crucial in ensuring the form is executed properly.

To collect signatures from all relevant parties, utilize pdfFiller’s functionality to send signature requests directly through the platform. This ensures that all signatures are coordinated and documented efficiently, thus preventing any delays in the filing process.

Submitting the real estate excise tax form

Once your real estate excise tax form is complete and signed, the next phase is submission. There are several methods available for submitting this form.

Online submission is often the quickest method, with many jurisdictions permitting electronic filing through their tax authority websites. Conversely, if you prefer traditional methods, you can mail the form to the appropriate department.

Frequently asked questions about the real estate excise tax form

It is common to have questions regarding the real estate excise tax form, especially concerning its requirements and processes. Many individuals and businesses find themselves seeking clarification to ensure compliance and to avoid making costly mistakes.

Some frequently asked questions involve common filing issues, available exceptions, and how to contact local tax authorities for assistance. It’s essential to perform thorough research or consult with professionals if you encounter specific challenges.

Additional tools and resources

Utilizing additional resources can further ease your experience with the real estate excise tax form. pdfFiller's interactive form tools offer a range of templates and guides designed to assist users through the complexities of tax documentation.

Furthermore, there are webinars and specific educational resources available that cover essential topics related to real estate taxes, ensuring individuals and teams are well-equipped with the knowledge needed for managing their affairs.

Best practices for managing real estate tax documents

Managing real estate tax documents efficiently is essential for long-term success. Developing an organized filing system will make it easier to locate critical documents when needed. This includes maintaining both physical and digital copies of all relevant documentation.

It is imperative to keep track of all property transactions and related tax forms. This practice not only ensures compliance but also helps in future scenarios where you or your business may require evidence of past transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in real estate excise tax?

How can I fill out real estate excise tax on an iOS device?

How do I fill out real estate excise tax on an Android device?

What is real estate excise tax?

Who is required to file real estate excise tax?

How to fill out real estate excise tax?

What is the purpose of real estate excise tax?

What information must be reported on real estate excise tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.