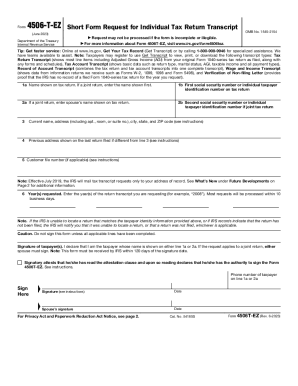

Who needs Form 4506T-EZ?

4506T-EZ is an Internal Revenue Service Form the full name of which is the Short Form Request for Individual 2012 Tax Return Transcript. The form should be filed by individuals who need to request a tax return transcript for the current and previous three years. If a taxpayer’s fiscal year on the file 1040 Form does not coincide with a calendar year, they may not file the IRS form 4506T-EZ; they must fill out form 4506-T for this purpose.

What is the purpose of the IRS 4506T-EZ form?

The submission of the form to the IRS is the only way to inform the agency about the taxpayer’s necessity to be issued the Individual Tax Return Transcript. The requesting individual may require it for various purposes, but the most common is meeting the requirements of a lending institution. Indeed, lending institutions providing mortgages and student loans typically demand their borrowers provide their individual tax return reports to make sure to eliminate the possibility of fraud.

How soon should I get my Individual Tax Return Transcript?

The Short Form Request for Individual Tax Return Transcript does not have any specific deadline or a due date for submission, as it can be filed whenever the need arises. However, the claiming taxpayer should bear in mind that the IRS will require certain amount of time of process the request -- typically it takes up to 10 business days after the receipt of the 4506T-EZ form.

What information should be given on the Short Form Request for Individual Tax Return Transcript?

The following data should be entered on the Form 4506T-EZ:

-

Name and SSN of the person (s) filing the tax return;

-

Current and previous addresses;

-

Name, address and phone of the third party that should receive the transcript;

-

Years requested;

-

Signature of the taxpayer or taxpayers.