Get the free Unique Tax Registry Form (RUT) and help

Get, Create, Make and Sign unique tax registry form

How to edit unique tax registry form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out unique tax registry form

How to fill out unique tax registry form

Who needs unique tax registry form?

Unique Tax Registry Form - How to Guide

Understanding the unique tax registry form

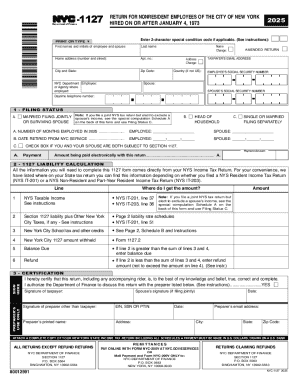

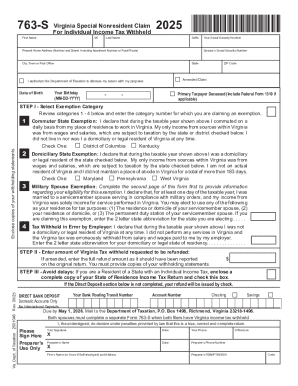

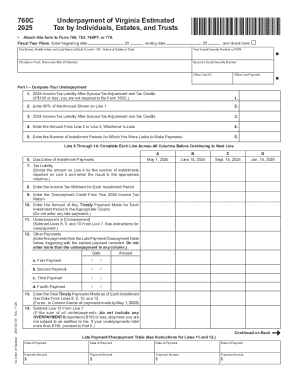

The Unique Tax Registry Form is a critical document essential for tax compliance across various jurisdictions. Designed to gather necessary tax-related information from individuals and businesses, this form serves as a foundation for reporting income, deductions, and credits. Through proper completion, taxpayers can ensure correct assessment of their tax obligations.

Using this form is crucial for maintaining good standing with tax authorities. Non-compliance can lead to costly penalties, audits, or even legal issues. Therefore, grasping the significance of the Unique Tax Registry Form is vital for taxpayers seeking to navigate their financial responsibilities accurately.

Who needs to complete the unique tax registry form?

Both individuals and businesses may need to complete the Unique Tax Registry Form. Specific requirements may vary; typically, anyone who earns income—whether through employment, self-employment, or capital gains—must file this form. Businesses, including sole proprietors, partnerships, and corporations, must also submit accurate tax information using this registry.

Certain situations necessitate filing the form, such as starting a new business, changing tax status, or reporting significant income fluctuations. Even if you believe your tax situation is straightforward, it's essential to confirm requirements specific to your state or region, as laws can differ.

Benefits of using the unique tax registry form

Utilizing the Unique Tax Registry Form streamlines your tax obligations effectively. Accurate reporting minimizes errors and helps in organizing information systematically, ensuring taxpayers meet their deadlines without issues. This proactive approach carefully details finances, making preparation for tax season less stressful.

Moreover, proper completion of the Unique Tax Registry Form aids in avoiding penalties associated with inaccurate submissions. Ensuring compliance can lead to access to potential tax benefits or refunds that might otherwise go unnoticed. This document acts as a safety net, providing clarity and structure for taxpayers and aiding in the financial planning process.

Preparing to fill out the unique tax registry form

Before diving into filling out the Unique Tax Registry Form, gather essential information to ensure a smooth process. Personal identification details are required, including tax identification numbers, social security numbers, and contact information. Additionally, have your financial data ready, such as income statements, bank statements, and records of deductions or credits you plan to claim.

It’s also crucial to familiarize yourself with specific regulations and requirements specific to your state or region, as certain jurisdictions may have additional information required on the form. Utilizing tools like pdfFiller can streamline the process, allowing you to manage your documents effectively in a cloud-based system.

Tools to assist in completing the unique tax registry form

Employing recommended software and platforms can significantly enhance the efficiency of completing the Unique Tax Registry Form. pdfFiller offers a variety of features specifically designed for editing, signing, and sharing documents, which can save valuable time. With its user-friendly interface, you can effortlessly input your information, adjust formatting, and ensure everything is accurate before submission.

Explore online resources, including instructional articles, templates, and video tutorials to further assist you in filling out the form. Utilizing these tools makes the overall process far more manageable and minimizes confusion.

Step-by-step guide to filling out the unique tax registry form

Accessing the Unique Tax Registry Form is the first step to ensure proper filing. You can find the form online through state or federal tax authority websites, and pdfFiller provides additional resources for easy access. The pdfFiller platform enables you to locate, edit, and customize the form without hassle.

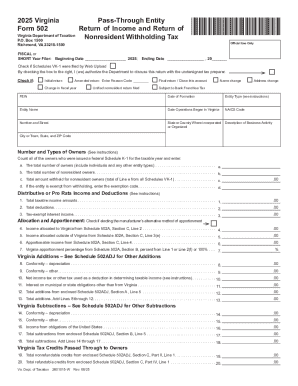

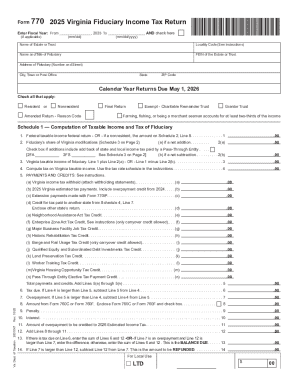

Once you have the form, you’ll proceed with completing each section meticulously. The sections typically include:

Take your time to review each section before moving forward and ensure that all details are accurate.

Editing and customizing your unique tax registry form

pdfFiller's editing tools allow for an efficient way to customize the Unique Tax Registry Form. Within the platform, you can enhance the format, add annotations, or insert additional information as needed. These features facilitate a streamlined experience tailored to your specific needs, allowing you to produce a polished document ready for submission.

Utilize tips on formatting to maintain clarity, ensuring that your entries are legible and organized. Moreover, adding annotations can provide context for reviewers, highlighting specific parts of your submission that may need further explanation.

Signing and submitting the unique tax registry form

Adhering to best practices for eSigning your Unique Tax Registry Form is vital. pdfFiller allows you to securely sign online, ensuring that your signature meets all legal requirements. Even in a digital environment, it’s crucial that your signature is authentic and verifiable.

Once signed, you'll need to determine how to submit the form—either electronically or by mail. Electronic submission is often more efficient, but ensure you stay within key deadlines and avoid any discrepancies that could delay processing.

Managing your unique tax registry form after submission

After submitting the Unique Tax Registry Form, tracking your submission status becomes paramount. Ensure you have confirmation of receipt, which can typically be verified online or through official channels. Keeping a record is essential for your files; it can safeguard against potential challenges.

If you discover an error post-submission, know the steps for amending your forms. Contact the respective authority promptly to rectify mistakes, and maintain copies for every document you submit to safeguard your interests.

Potential issues and FAQs regarding the unique tax registry form

Common problems arise when filling out the Unique Tax Registry Form, often stemming from misinterpretation of sections or missing vital information. Understand the form's requirements to minimize discrepancies, ensuring that all entries align with your documentation.

Frequently asked questions often include inquiries about filing deadlines and processing times. By staying informed and proactive, you can tackle any uncertainties head-on and prepare for tax season with confidence.

Additional tools and resources for document creation

Beyond the Unique Tax Registry Form, pdfFiller offers an extensive library for document creation that supports various needs. Leveraging a cloud-based document management system allows for seamless collaboration, offering features that maximize productivity and efficiency.

Explore related forms and templates within the pdfFiller platform to streamline your tax documentation process, ensuring that each form is meticulously prepared and easily accessible from any location.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in unique tax registry form without leaving Chrome?

How do I edit unique tax registry form on an iOS device?

How can I fill out unique tax registry form on an iOS device?

What is unique tax registry form?

Who is required to file unique tax registry form?

How to fill out unique tax registry form?

What is the purpose of unique tax registry form?

What information must be reported on unique tax registry form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.