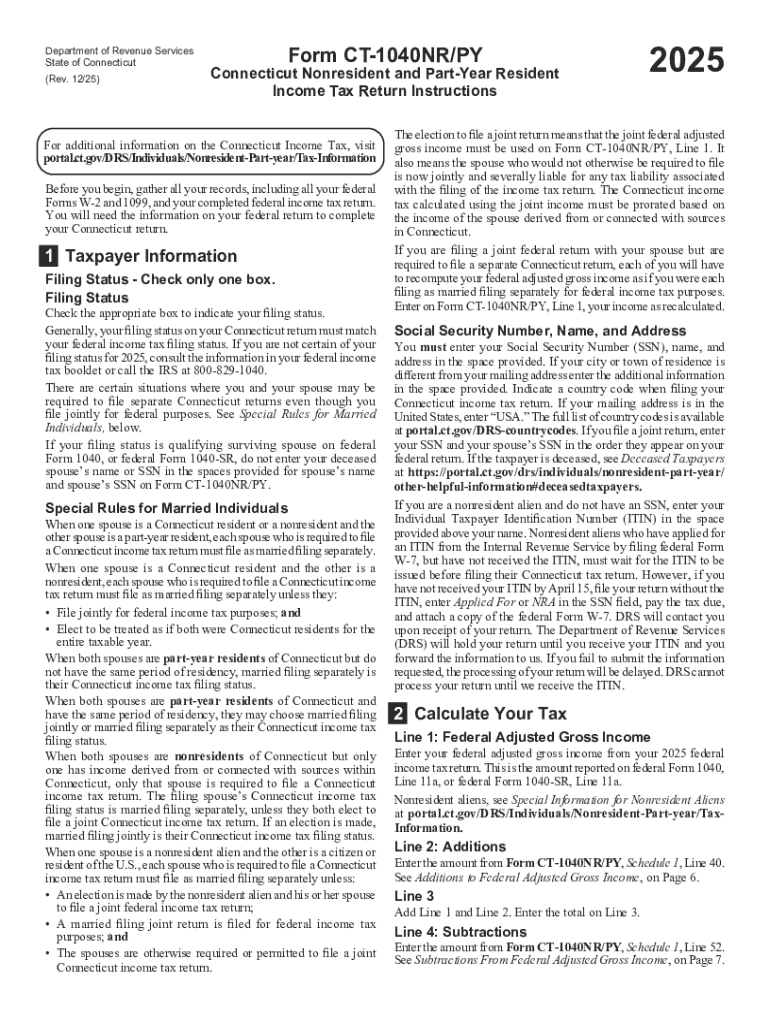

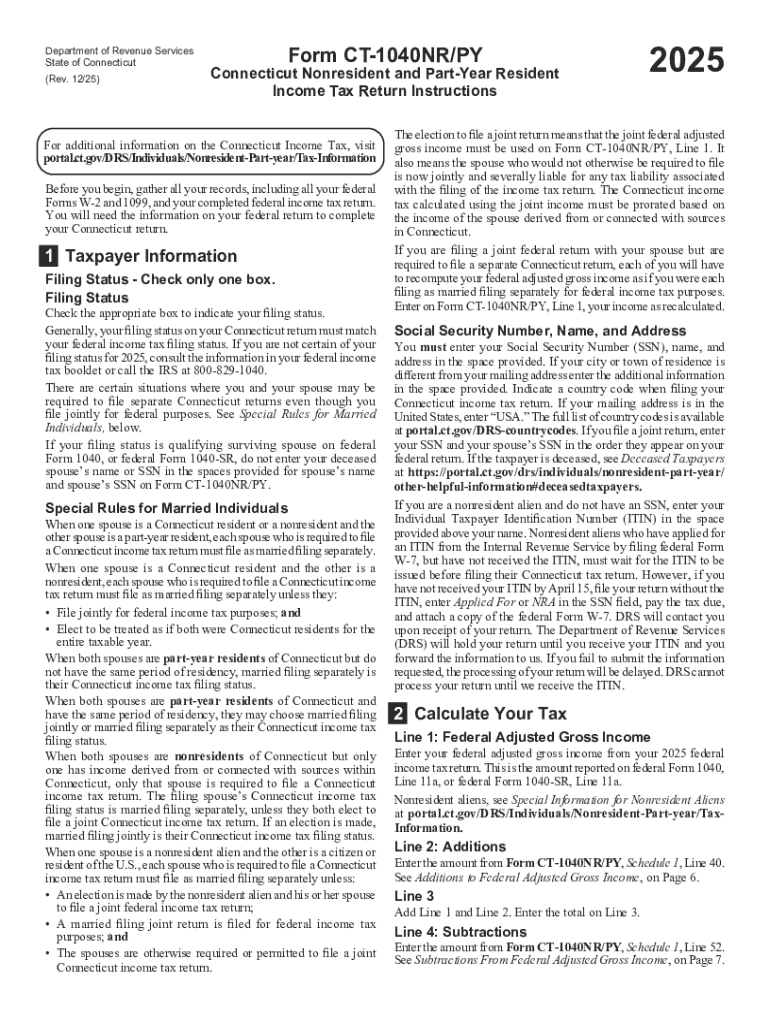

Get the free Form CT-1040NR/PY Connecticut Nonresident and Part-Year Resident Income Tax Return I...

Get, Create, Make and Sign form ct-1040nrpy connecticut nonresident

How to edit form ct-1040nrpy connecticut nonresident online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form ct-1040nrpy connecticut nonresident

How to fill out form ct-1040nrpy connecticut nonresident

Who needs form ct-1040nrpy connecticut nonresident?

Form CT-1040NR/PY Connecticut Nonresident Form: A Comprehensive Guide

Understanding the Connecticut nonresident income tax

Connecticut's tax system operates on a progressive income tax structure where tax rates increase with income levels. Nonresidents, who earn income in Connecticut but do not reside in the state, must navigate this complex system to ensure compliance. A nonresident is typically defined as an individual who is not domiciled in Connecticut, meaning their primary and permanent home is in another state.

Filing the CT-1040NR/PY is essential for nonresidents as it allows them to report their Connecticut-source income, claim deductions, and ensure they pay the correct amount of income tax due. Failure to file could lead to penalties and interest, which can be substantial, especially if significant income was earned in the state.

Key features of the CT-1040NR/PY form

The CT-1040NR/PY serves as the official income tax return for nonresidents and part-year residents of Connecticut. It is specifically designed to capture the nuances of income earned from Connecticut sources, which may differ significantly from that of residents. Nonresidents must use this form to report income from wages, rents, and other sources attributable to their time spent in Connecticut.

Unlike the resident forms, the CT-1040NR/PY requires taxpayers to allocate income earned within Connecticut versus income earned elsewhere. Understanding these differences is crucial, as it can impact tax calculations and potential refunds.

Essential information before you begin

Before diving into the CT-1040NR/PY, it’s crucial to ensure you meet certain requirements. First, confirm that you have earned income from Connecticut sources within the tax year. This could include wages from employment within the state, rental income from properties situated in Connecticut, or business income derived from local operations.

The deadline for filing the CT-1040NR/PY is the same as that for resident returns, typically April 15, unless an extension is filed. Gather necessary documentation before you start filling out the form, including personal identification information, all relevant income sources, and any deductions and credits you plan to claim. Being organized with this information can streamline the filing process.

Step-by-step guide to completing the CT-1040NR/PY

Completing the CT-1040NR/PY requires careful attention to detail. First, download the form from the Connecticut Department of Revenue Services website, making sure you have the most current version to ensure compliance with any recent tax law changes.

eSigning and submission process

Utilizing eSigning for your CT-1040NR/PY can significantly streamline your filing process. The ease and security of electronic signatures provide an efficient way to submit documents without the hassle of traditional mailing methods. Using pdfFiller's features, signing your documents digitally ensures that your submission is treated with the same weight as a handwritten signature.

After completing and signing your form, you have options for submission. You can either e-file, which is generally faster and can expedite any refunds due, or mail the form directly to the tax department. If mailing, ensure that you send it to the right address marked for nonresident returns and consider using a traceable mailing option to confirm receipt.

Common mistakes to avoid when filing

Understanding common errors that people make when filing the CT-1040NR/PY can save you time and money. One of the most frequent mistakes is incorrectly identifying your residency status. Many taxpayers inadvertently file the wrong form, which can lead to unnecessary complications and penalties.

Another area where errors arise is in reporting income. Ensure you report all Connecticut-source income accurately and completely. Missing income can trigger audits or penalties, making it essential to double-check your figures. To avoid delays, be prompt in submitting your return and correct any mistakes as soon as they are realized.

Frequently asked questions (FAQs)

Many nonresidents have questions regarding the tax implications of their status. A common query relates to the tax rate for nonresidents. Connecticut imposes a flat income tax rate for nonresidents, which can vary based on income levels. Always confirm the current rate, as this can change annually.

Another frequent question involves amending a previously filed CT-1040NR/PY. If you discover errors after submission, you can file a correction using the amended return process outlined by the Connecticut Department of Revenue Services. Additionally, if you find yourself unable to pay taxes owed, it’s vital to communicate with the department to explore payment plans or other options.

When to seek professional assistance

Navigating the complexities of the Connecticut tax code may require professional assistance in specific scenarios. If you have multiple income sources, different types of income, or if you're unsure of your filing status, consulting a tax preparer can save you time and reduce anxiety. Professionals can provide tailored advice designed to fit your unique circumstances.

Selecting a competent tax professional requires care. Look for someone with experience in Connecticut tax law and who understands nonresident tax nuances. Alternatively, services like pdfFiller can assist with complex returns, providing tools for document management and submission, ensuring that all forms are correctly filled and eSigned.

Additional tools and resources

Using tools and resources available online can significantly enhance your experience as you prepare your tax return. Interactive calculators help estimate your tax liability based on your unique income, making it easier to plan ahead. Furthermore, templates and examples of completed CT-1040NR/PY forms can serve as valuable references, guiding you through the filling-out process.

Access to official state resources can further clarify any confusion. The Connecticut Department of Revenue Services website contains detailed guides, FAQs, and additional support materials that can help navigate the filing process smoothly. These resources empower taxpayers to file correctly and on time.

Unlocking the benefits of using pdfFiller

pdfFiller simplifies the form management process, making it easier than ever to edit PDFs, collaborate with teams, and eSign documents from anywhere. Its cloud-based platform is designed to accommodate users who need flexibility in document creation. Whether you are filing simple returns or managing more complicated paperwork, pdfFiller can streamline these tasks, saving users time and reducing errors.

The collaborative features allow teams to work together on documents without the hassle of multiple file versions and confusion. Being able to access documents and forms remotely means that gathering necessary information to file taxes can be done conveniently, enhancing productivity and helping taxpayers meet deadlines without stress.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in form ct-1040nrpy connecticut nonresident without leaving Chrome?

Can I create an electronic signature for the form ct-1040nrpy connecticut nonresident in Chrome?

How do I edit form ct-1040nrpy connecticut nonresident straight from my smartphone?

What is form ct-1040nrpy connecticut nonresident?

Who is required to file form ct-1040nrpy connecticut nonresident?

How to fill out form ct-1040nrpy connecticut nonresident?

What is the purpose of form ct-1040nrpy connecticut nonresident?

What information must be reported on form ct-1040nrpy connecticut nonresident?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.