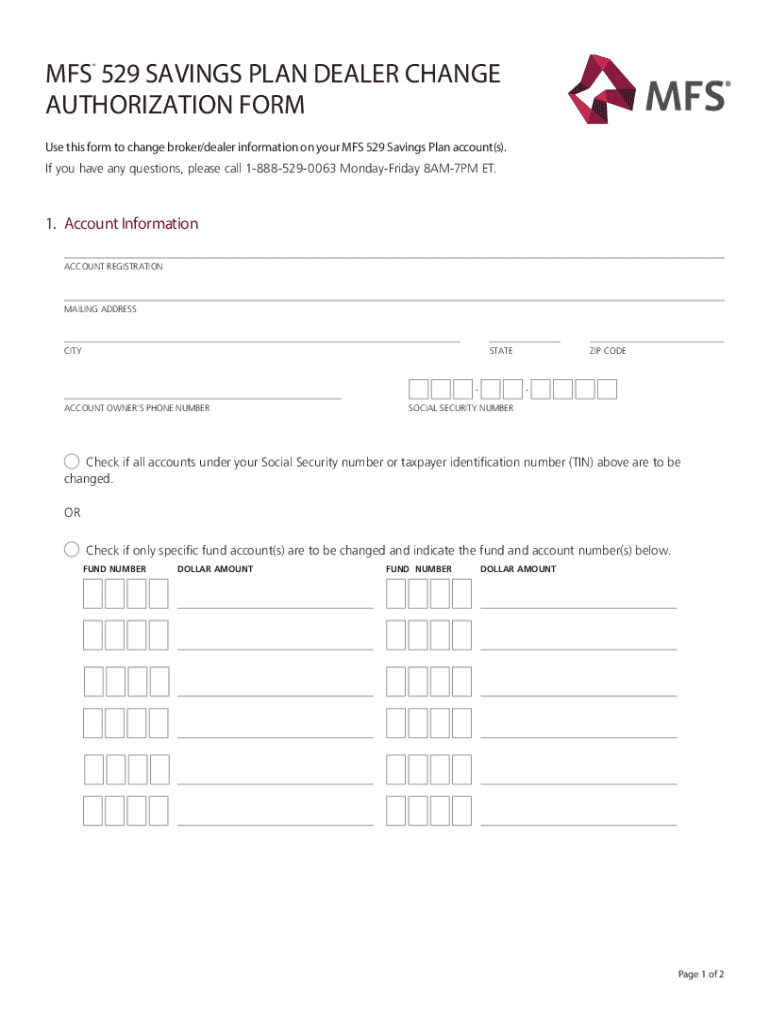

Get the free MFS 529 SAVINGS PLAN DEALER CHANGE AUTHORIZATION FORM

Get, Create, Make and Sign mfs 529 savings plan

Editing mfs 529 savings plan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mfs 529 savings plan

How to fill out mfs 529 savings plan

Who needs mfs 529 savings plan?

A comprehensive guide to the MFS 529 savings plan form

Overview of the MFS 529 savings plan

The MFS 529 Savings Plan is a critical tool for families looking to save for future educational expenses. Designed to help individuals build a fund that grows tax-free, it serves as an effective vehicle for college savings. With rising tuition costs, understanding the mechanics and benefits of a 529 plan is essential for long-term financial planning.

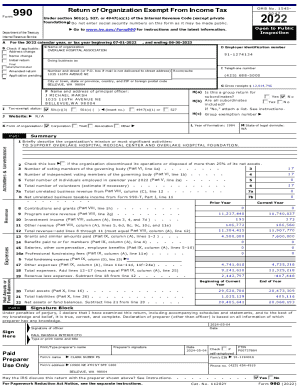

529 plans, including the MFS option, offer substantial tax benefits. Contributions to these plans grow tax-deferred, and withdrawals for qualified education expenses are tax-free. Through careful documentation, such as the correct forms and information, applicants can ensure they maximize contributions and benefits.

Types of MFS 529 savings plan forms

The MFS 529 Savings Plan encompasses several key forms necessary for account management and transitions. Each form plays a crucial role in the lifecycle of the plan, making familiarization important for both new and seasoned investors.

Key forms include: account opening forms, contribution forms, and change of beneficiary forms. Each type has its own unique focus and function, catering to specific circumstances or needs of the user. Familiarizing yourself with these forms can help streamline the savings process.

Step-by-step guide to completing the MFS 529 savings plan form

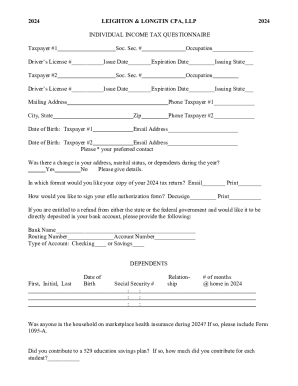

Completing the MFS 529 Savings Plan form requires careful preparation. Start by gathering necessary documents including your Social Security number, beneficiary details, and bank information. Understanding these prerequisites can mitigate errors and omissions.

Be mindful of important deadlines to ensure timely submissions. With forms potentially impacting valuable tax benefits, a lack of preparation can lead to costly mistakes or missed opportunities.

How to edit and sign your MFS 529 savings plan form

Editing and signing the MFS 529 Savings Plan form can be made easier with digital tools like pdfFiller. This platform offers user-friendly features that allow for quick corrections, ensuring forms are always accurate and compliant.

Utilizing pdfFiller’s digital signature capabilities streamlines the signing process, making it easier than ever for users to finalize their documents securely. The significance of eSigning cannot be underestimated, as it enhances the efficiency and security of document handling.

Submitting your MFS 529 savings plan form

Submitting the MFS 529 Savings Plan form requires adherence to specific guidelines. Users can choose between online submissions, sending forms by mail, or delivering in person to ensure they meet necessary timelines.

To ensure successful submission, double-check completed forms for accuracy and ensure all necessary signatures are included. Tracking your submission can prevent any potential inconveniences, allowing users to follow up as needed.

Managing your MFS 529 savings plan account

After successfully submitting the MFS 529 Savings Plan form, ongoing account management becomes essential. Users should take advantage of management tools available through the platform. These tools allow for monitoring account performance, making necessary updates, and facilitating beneficiary changes.

Utilizing interactive features offered by pdfFiller ensures that account management is straightforward, enabling users to efficiently navigate their accounts from any location.

Frequently asked questions about MFS 529 savings plan forms

Navigating the MFS 529 Savings Plan form can lead to various questions. Common inquiries include what to do if you make a mistake on a submitted form and how long processing tends to take. Understanding these aspects can alleviate concerns during the application process.

Having troubleshooting steps available can empower users to resolve common issues independently. For example, if corrections are necessary, pdfFiller provides easy methods to amend forms before finalizing.

Case studies and testimonials

Real-life examples and testimonials provide valuable insights into the experiences of MFS 529 plan applicants. Many users have shared their success stories, highlighting the ease of use and benefits of utilizing the forms available through pdfFiller.

These first-hand accounts reinforce how proper form completion and digital management can lead to better education funding outcomes. User experiences can motivate new applicants, demonstrating how to navigate the process with confidence.

Educational resources for planning and saving

For continued education on MFS 529 plans, users can access various resources tailored to deepen their understanding. These include articles, webinars, and guides available through pdfFiller, assisting users in making informed decisions.

Arming oneself with knowledge about savings strategies and tax implications can significantly improve planning outcomes. Engaging with these educational tools further encourages proactive management of 529 plans.

Using pdfFiller for other document needs

While focusing on the MFS 529 Savings Plan form, it’s essential to recognize that pdfFiller offers a suite of document management solutions beyond this specific need. From personal to professional documents, users can simplify countless tasks with this versatile platform.

Whether it’s generating contracts, tax forms, or any other essential documents, pdfFiller empowers users to create, edit, and manage files efficiently. This comprehensive capability makes it an invaluable resource for individuals and teams alike.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit mfs 529 savings plan from Google Drive?

Can I sign the mfs 529 savings plan electronically in Chrome?

Can I create an electronic signature for signing my mfs 529 savings plan in Gmail?

What is mfs 529 savings plan?

Who is required to file mfs 529 savings plan?

How to fill out mfs 529 savings plan?

What is the purpose of mfs 529 savings plan?

What information must be reported on mfs 529 savings plan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.