Get the free U.S. Trade in Goods by State, by NAICS-Based Product - FRED

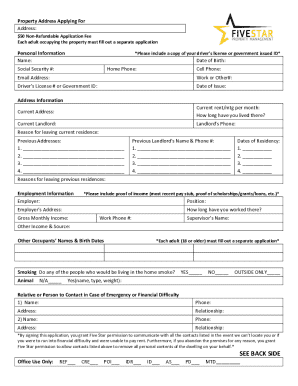

Get, Create, Make and Sign us trade in goods

How to edit us trade in goods online

Uncompromising security for your PDF editing and eSignature needs

How to fill out us trade in goods

How to fill out us trade in goods

Who needs us trade in goods?

A comprehensive guide to the US Trade in Goods Form

Understanding the US Trade in Goods Form

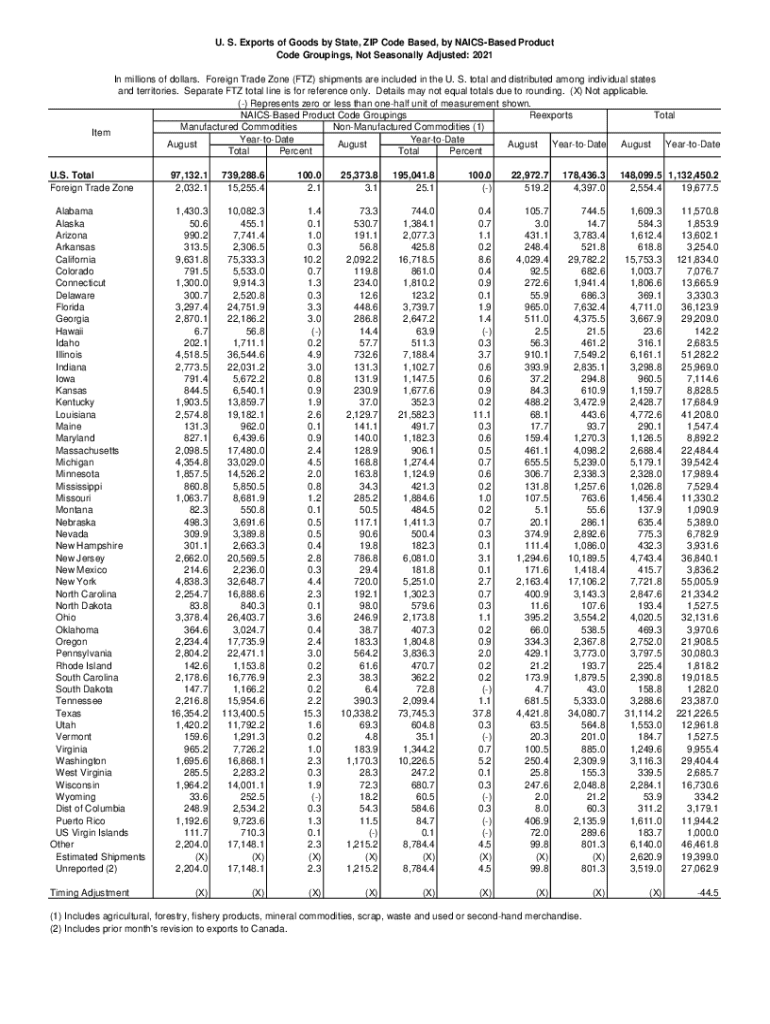

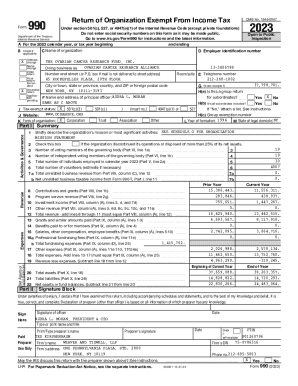

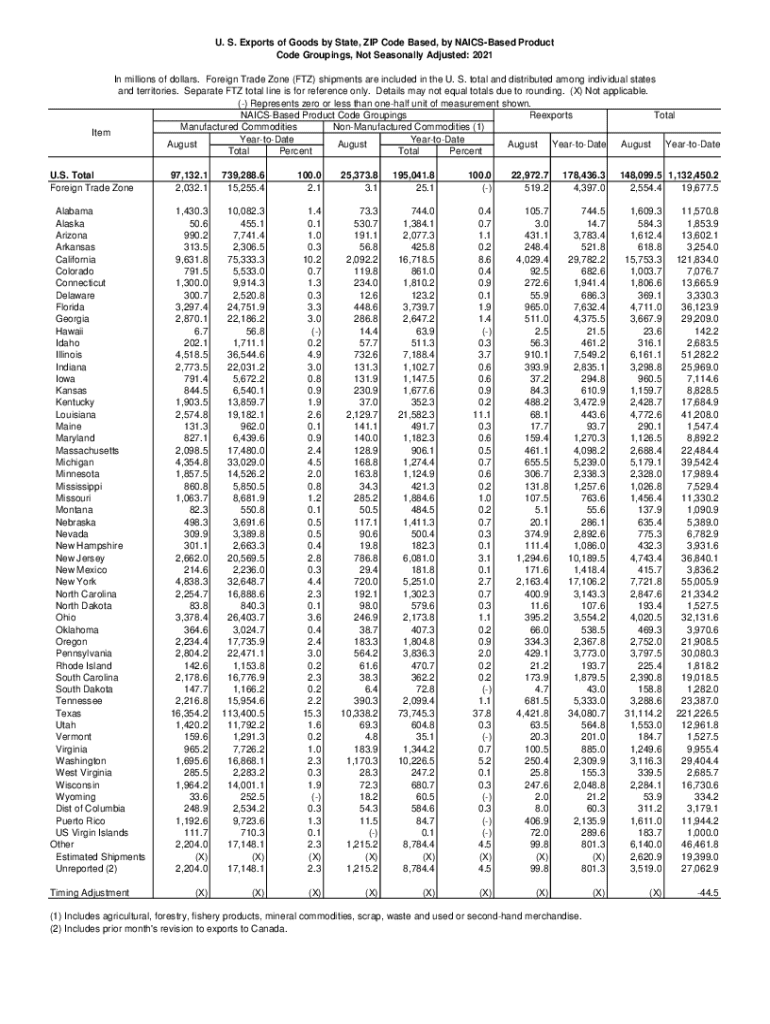

The US Trade in Goods Form plays a pivotal role in international commerce, allowing businesses to report the export and import of goods across borders accurately. This document is essential for ensuring compliance with U.S. customs regulations and international trade agreements. The form primarily distinguishes between exports and imports, providing critical data that informs trade statistics, tariffs, and policy decisions.

Exports refer to goods sent from the U.S. to foreign countries, while imports are goods brought into the U.S. from abroad. Accurate reporting of these transactions not only streamlines the customs process but also helps in assessing the economic impact of trade activities. In an increasingly interconnected global market, understanding the intricacies of the US Trade in Goods Form is more important than ever.

Navigating the US Trade in Goods requirements

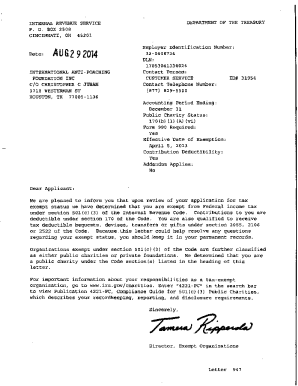

The completion of the US Trade in Goods Form is governed by a comprehensive legal and regulatory framework. U.S. trade regulations are designed to promote fair trade practices while protecting national interests. Various agencies, including the U.S. Customs and Border Protection (CBP), the Department of Commerce, and the International Trade Administration (ITA), oversee compliance with these regulations.

Each agency plays a unique role in the documentation and regulation of trade activities. CBP, for example, is responsible for ensuring that all imports and exports meet legal standards while collecting duties and tariffs on traded goods. Familiarizing yourself with these agencies can greatly enhance your understanding of the US Trade in Goods Form and the requirements for successful completion.

Step-by-step guide to completing the US Trade in Goods Form

Completing the US Trade in Goods Form can be straightforward if approached methodically. Here’s a comprehensive breakdown of the steps involved in this critical process.

1. Preparation: Gathering necessary information

Before filling out the form, it's essential to gather all necessary documentation and data. This includes key information such as:

2. Filling out the US Trade in Goods Form

With your information in hand, the next step is to fill out the form. It's organized into several key sections:

3. Common mistakes to avoid

Completing the US Trade in Goods Form can be daunting, and traders often make mistakes that can lead to complications. Here are common errors and tips to prevent them:

Tools and resources for managing your US Trade in Goods Form

The process of managing the US Trade in Goods Form can be significantly enhanced by using the right tools.

1. Interactive tools

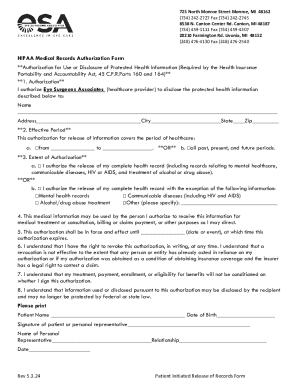

Utilizing interactive tools, such as those available through pdfFiller, allows for seamless editing and signing of your form. You can easily upload, edit, and add your information directly on the platform, making the process more efficient. For example, pdfFiller’s features enable you to annotate and share documents instantly.

2. Compliance checklists

Creating a compliance checklist is an indispensable resource for ensuring that you have included everything necessary in your US Trade in Goods Form. A comprehensive checklist might include:

Special considerations for different types of trade

Different scenarios in trade necessitate unique considerations when filling out the US Trade in Goods Form.

Exporting vs. importing: key considerations

Exporters often need to be mindful of compliance with export regulations specific to the destination country. This might include obtaining necessary licenses or adhering to specific trade agreements. On the other hand, importers must focus on understanding tariffs and duties applicable to their goods in order to avoid unexpected costs upon arrival.

E-commerce and the US Trade in Goods Form

For online businesses, the rules can be slightly different. E-commerce often involves cross-border transactions that require particular attention to detail in the US Trade in Goods Form, especially regarding shipping methods and item classifications. E-commerce businesses are encouraged to factor in additional documentation such as customs forms and shipping envelopes that are compliant with both U.S. and foreign regulations.

Frequently asked questions (FAQs) about the US Trade in Goods Form

Navigating the requirements of the US Trade in Goods Form can raise several questions. Here are answers to some frequently asked questions concerning this critical process.

What if make a mistake after submission?

Correcting a mistake after submission often involves notifying the relevant customs authority immediately. It may be necessary to submit a corrected form or additional documentation to rectify any errors. The sooner the mistake is addressed, the better, as it can help prevent delays and potential fines.

How does this form impact duties and tariffs?

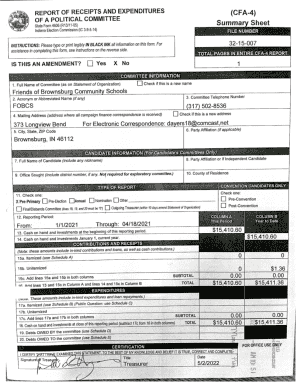

The US Trade in Goods Form directly influences the assessment of duties and tariffs because it provides critical information regarding the nature and value of the goods being traded. Accurate information ensures proper calculation of duties, allowing businesses to remain compliant and avoid costly penalties.

Where can find assistance if needed?

For assistance, traders can consult a customs broker or trade compliance expert who specializes in these forms. Additionally, platforms like pdfFiller offer customer support services that can provide guidance on filling out and managing your trade documentation.

Success stories and best practices

Several businesses exemplify best practices in completing the US Trade in Goods Form. For instance, a local electronics exporter streamlined its customs process by consistently using accurate HTS codes and maintaining an organized filing system for all trade documentation. This approach significantly reduced delays and fines due to incorrect paperwork.

Experts suggest that traders also maintain good relationships with customs officials, which can foster trust and ease the process of handling customs forms. These professional networks can also be invaluable in acquiring the latest updates on regulations and practices.

Conclusion: Enhancing your trade experience

Utilizing pdfFiller can dramatically enhance the efficiency of completing and managing your US Trade in Goods Form. With its user-friendly platform designed for document management, users can edit, eSign, and collaborate seamlessly, ensuring compliance with regulations. Staying updated on changing trade regulations can empower trade professionals to navigate the complexities of international commerce confidently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send us trade in goods for eSignature?

How can I get us trade in goods?

How do I complete us trade in goods on an Android device?

What is us trade in goods?

Who is required to file us trade in goods?

How to fill out us trade in goods?

What is the purpose of us trade in goods?

What information must be reported on us trade in goods?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.