Get the free Schedule K-1 (Form 1065) Guide: Partner Tax Reporting

Get, Create, Make and Sign schedule k-1 form 1065

How to edit schedule k-1 form 1065 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule k-1 form 1065

How to fill out schedule k-1 form 1065

Who needs schedule k-1 form 1065?

Understanding Schedule K-1 Form 1065: A Comprehensive Guide

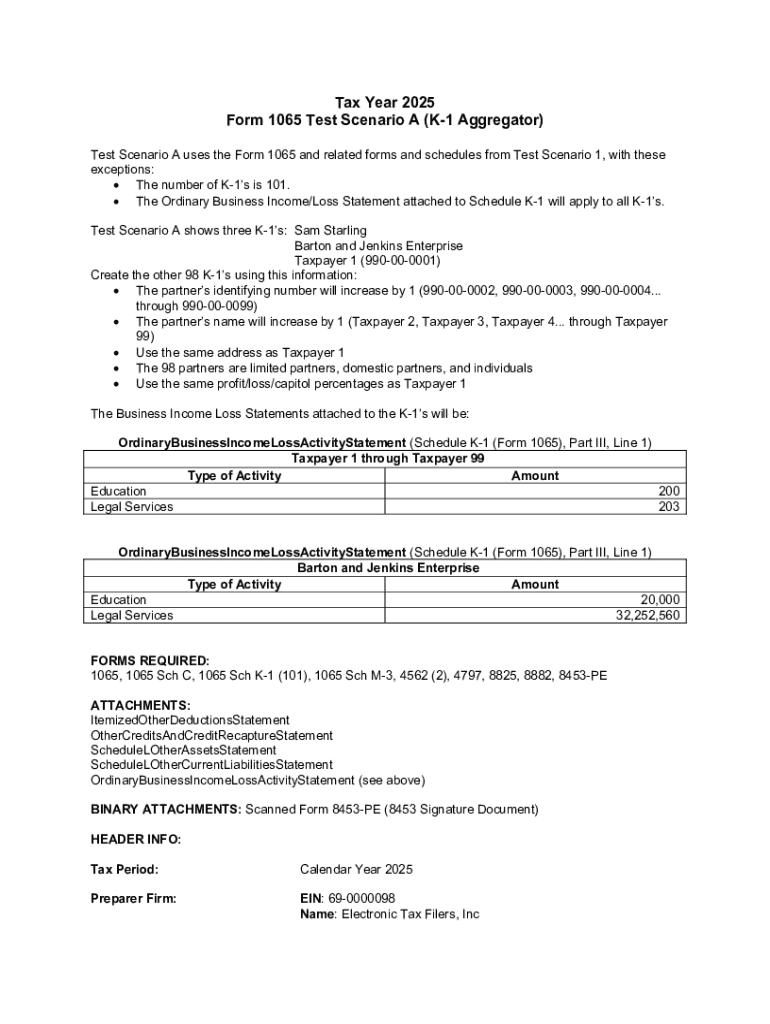

Overview of Schedule K-1

Schedule K-1 is a tax document used to report income, deductions, and credits from partnerships, S corporations, and certain LLCs. For individuals and entities participating in these business structures, the K-1 serves as critical information for income reporting on their personal tax returns. Each partner or member receives their own K-1 that details their share of the entity’s financial outcomes.

The purpose of Schedule K-1 in taxation is to detail the income and expenses flowing through from the partnership or corporation. This allows for accurate personal tax reporting under the U.S. tax code. Because partnerships and LLCs are generally pass-through entities, income is taxed at the individual level rather than at the company level, emphasizing the importance of understanding K-1.

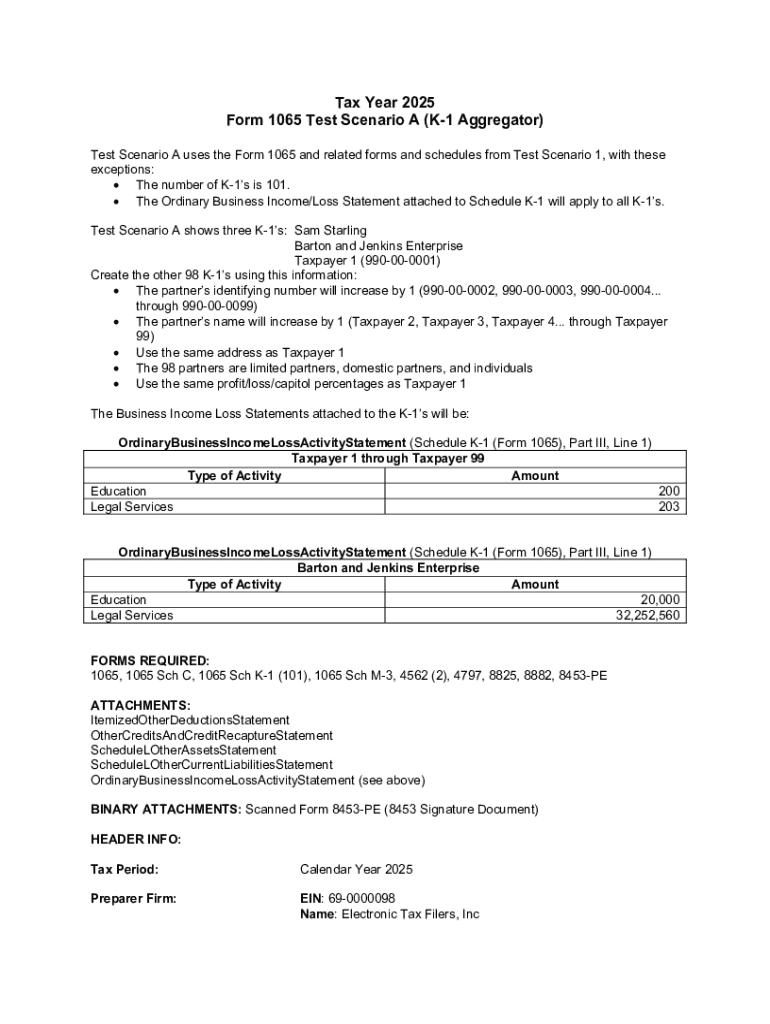

Understanding Form 1065 and its connection to Schedule K-1

Form 1065 is the U.S. Return of Partnership Income, a critical document for partnerships to report their income, deductions, gains, and losses. It captures the entity's financial activity over the tax year and its results are allocated to individual partners through Schedule K-1. This connection is vital; without Form 1065, partners wouldn’t know how to report their share of the business’s financial outcomes.

The role of Schedule K-1 in reporting income cannot be overstated. Each partner’s share of income, deductions, and credits is reported on their K-1, reflecting the partnership's results and ensuring proper tax filings. The flow-through nature of partnerships emphasizes that profits and losses appear on individual tax returns, often leading to complex tax situations that require careful documentation.

Detailed breakdown of Schedule K-1 information

Schedule K-1 consists of several boxes, each providing key financial information relevant to the recipient's tax reporting. Understanding these components is essential for accurate tax filings.

Distributions, allocations, and credits in K-1 are important for understanding how profits will be taxed. Partners need to assess these allocations carefully to ensure they accurately reflect their earnings and avoid errors in their tax returns.

How to read and interpret your Schedule K-1

Reading Schedule K-1 can be daunting due to the multitude of tax terms and numbers, but breaking it down can simplify the process. Each box is filled out based on the partnership's activities and the partner's allocated share.

Common terms used in this process include partnerships which refer to collaborative business entities, and shareholders, who are individuals owning shares in an S corporation. Understanding these definitions supports clarity when interpreting K-1.

Utilizing Schedule K-1 for tax filing purposes

Incorporating Schedule K-1 into your personal tax return requires diligent preparation. It is important to use this information accurately to ensure compliance with tax laws and correct reporting of income.

Consulting with tax advisors may further ensure that you meet all necessary requirements and optimize your tax credits.

Frequently asked questions (FAQs) about Schedule K-1

Questions commonly arise regarding the distribution and management of Schedule K-1 among partners. Here are answers to some of the most frequent inquiries.

Tips for managing your Schedule K-1 documents

Proper organization of your Schedule K-1 documents is crucial for efficient tax filing and record-keeping. A structured approach to managing these forms will assist in timely submissions and accurate reporting.

Common mistakes to avoid with Schedule K-1

Accuracy when handling Schedule K-1 can significantly impact your tax outcomes. Here are common pitfalls to watch out for.

To improve accuracy, double-check figures and consult tax professionals if needed.

Interactive tools to simplify your Schedule K-1 experience

Utilizing interactive tools can streamline your experience with Schedule K-1. Tools designed for editing and signing documents, like pdfFiller, empower users to manage K-1s efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

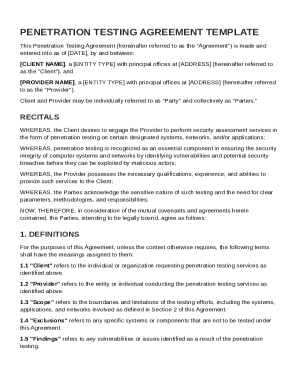

How do I edit schedule k-1 form 1065 in Chrome?

Can I create an electronic signature for the schedule k-1 form 1065 in Chrome?

Can I edit schedule k-1 form 1065 on an iOS device?

What is schedule k-1 form 1065?

Who is required to file schedule k-1 form 1065?

How to fill out schedule k-1 form 1065?

What is the purpose of schedule k-1 form 1065?

What information must be reported on schedule k-1 form 1065?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.