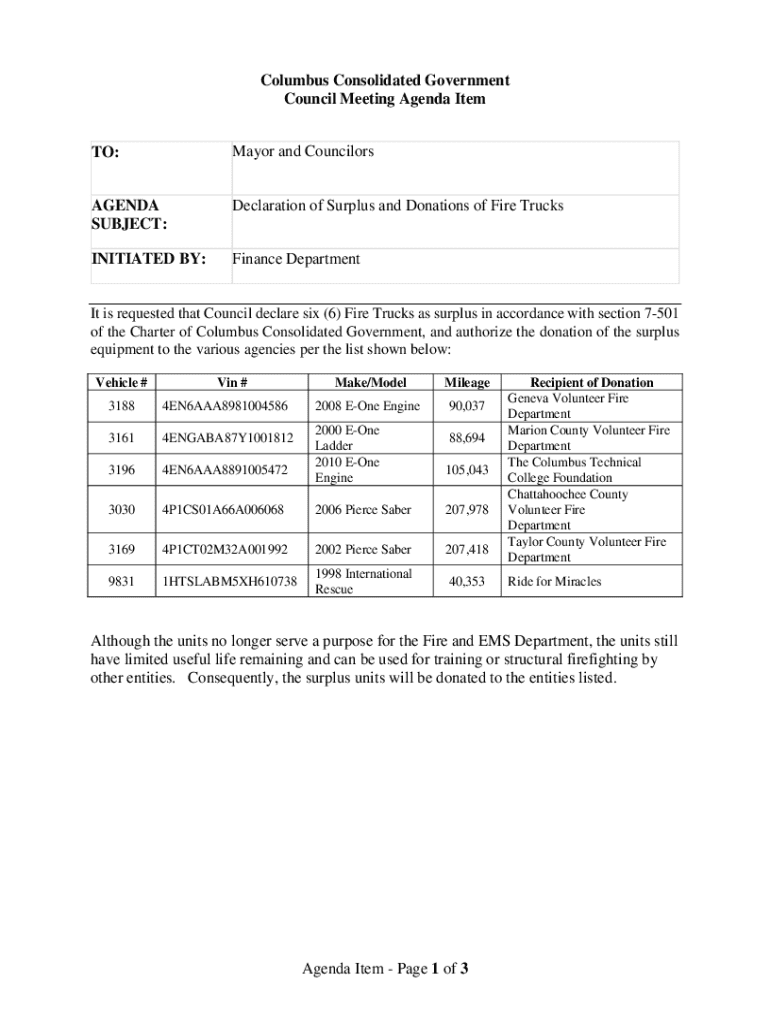

Get the free Declaration of Surplus and Donations of Fire Trucks

Get, Create, Make and Sign declaration of surplus and

How to edit declaration of surplus and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out declaration of surplus and

How to fill out declaration of surplus and

Who needs declaration of surplus and?

Declaration of surplus and form

Understanding the declaration of surplus

A declaration of surplus refers to the formal announcement or notification that certain items or assets are deemed surplus, meaning they are no longer necessary for the organization or individual to function effectively. Surplus items can include outdated equipment, excess inventory, or any resources that are no longer required for operational needs. Declaring surplus is not just an organizational formality; it plays a crucial role in efficient asset management.

The importance of declaring surplus items lies in the ability of an organization to optimize resources, reduce costs, and create space for newer assets. For example, a school might declare surplus when they upgrade technology in classrooms, allowing them to clear out old computers that are no longer usable. By managing surplus items effectively, businesses and teams can reclaim funds and make better use of their resources.

Common scenarios for surplus declaration often include the annual inventory review, policy changes resulting in obsolete equipment, or company mergers leading to duplicate resources. Each case can vary significantly in complexity and impact, but the underlying goal remains the same: to manage assets in the best possible manner.

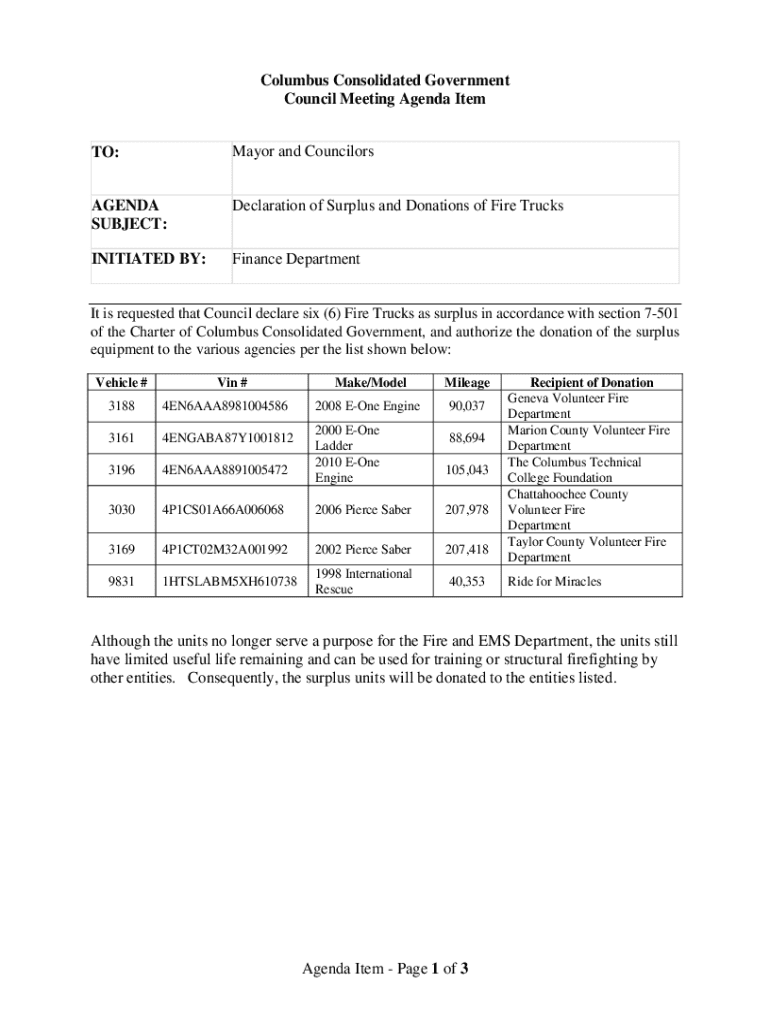

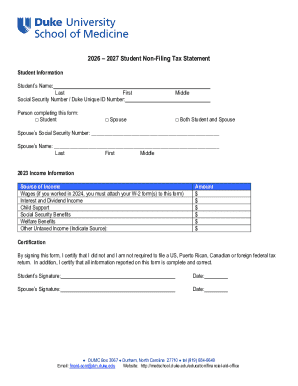

Overview of the declaration of surplus form

The declaration of surplus form is the official document used to identify and authorize items deemed surplus. The primary purpose of this form is to formalize the declaration process, ensuring that all items classified as surplus are documented, approved, and tracked appropriately. This helps organizations manage their assets effectively and transparently.

The form is typically used by departments within organizations, state agencies, and entities that need to assess and report on surplus items regularly. It may also be leveraged by nonprofits or educational institutions that wish to declare surplus for donation purposes. Understanding who needs to use this form is crucial, as compliance with relevant guidelines ensures the organization operates smoothly and stays in good standing.

Related forms and documents may include asset management reports, disposal authorization forms, and inventory audit documents. These additional records complement the declaration of surplus form, providing greater context and support for the declaration process.

Detailed breakdown of the declaration of surplus form

Understanding the structure of the declaration of surplus form is essential for accurate completion. Each section of the form serves a specific purpose and needs to be filled out with careful consideration. Below, we break down the form section by section.

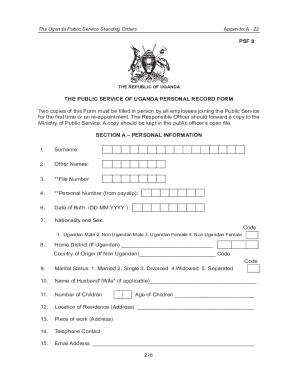

A. Personal information

The first section of the form collects personal information about the individual or organization making the surplus declaration. Required fields typically include the name, title, department, and contact information. Accuracy in this section is critical, as incorrect contact info can lead to complications during the approval process.

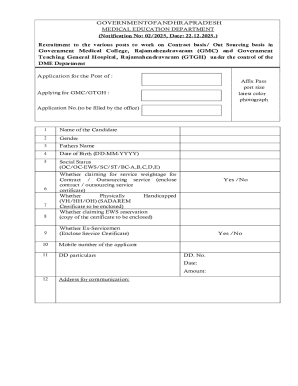

B. Description of surplus items

This section requires a detailed description of each surplus item. Listing items effectively involves specifying their condition, model, and any relevant serial numbers. Grouping items by category and using clear language will facilitate better understanding and processing. For example, instead of writing 'chairs,' specify '10 wood-framed classroom chairs, lightly used.'

. Reason for declaration

The next section outlines the reasoning behind the surplus declaration. Acceptable reasons might include obsolescence, redundancy, or changes in business direction. Crafting a strong justification ensures that reviewers can understand and support your request. Providing specific examples or context enhances the persuasive power of this rationale.

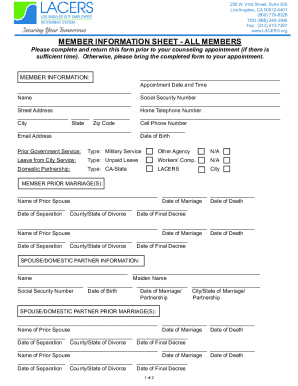

. Valuation of surplus items

Valuation of surplus items is crucial for asset management. Various methods for valuation might include appraisals, market comparisons, or depreciation calculations. Documenting prior appraisals or providing estimates helps establish the worth of the items involved and can bolster your declaration.

E. Approval signatures

The final section of the form requests approval signatures. This typically includes endorsements from supervisors or managers who are responsible for asset management. The collection of proper signatures is important as it signals that the declaration has been reviewed and is authorized for processing.

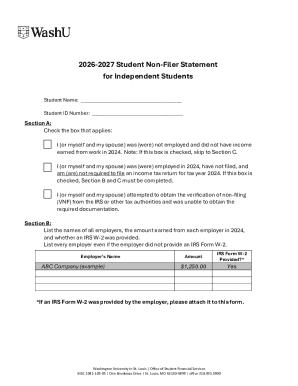

Step-by-step instructions for completing the form

Filling out the declaration of surplus form accurately involves preparation and attention to detail. Start by gathering necessary documentation such as item descriptions, valuations, and any prior appraisals before initiating the form. Understanding the organization’s regulations related to surplus declaration can also clarify the context and requirements needed.

Your mock-up example should align structurally with the actual form, showcasing how to fill out each section clearly. Make use of a visual guide with fillable fields, displaying how information should be input. Be mindful of common mistakes such as incorrect item descriptions, miscalculations in valuation, and missing signatures. These errors can cause delays in processing and impact the subsequent steps involved in managing surplus items.

Editing and customizing the declaration of surplus form

Editing the declaration of surplus form is simple with pdfFiller. Users can begin by uploading and accessing the form directly on the platform. The editing interface allows users to make necessary modifications, ensuring that all entries accurately reflect the current organizational status of the items.

Collaborating with team members on the form is made easier through real-time editing features. Team members can comment and provide feedback directly on the form, promoting more efficient communication during the decision-making process.

Electronic signing and submission

In today’s fast-paced environment, electronic signing (eSigning) is essential for expediting the declaration process. With pdfFiller, users can sign the declaration of surplus form digitally, ensuring security and legality. The ease of eSigning allows for quicker approvals and expedited processing.

Once completed, the form can be submitted through various options, depending on organizational protocols. Whether it's sending via email, uploading to a database, or using an internal management system, clear guidance on submission processes helps facilitate a smooth transition from declaration to action.

Managing your declared surplus items

Post-declaration, it's imperative to keep track of declared items. Effective tracking involves maintaining accurate records of those items, which could include sale results, donations, or disposal actions. This management ensures that organizations can monitor the lifecycle of assets and stay compliant with various regulations.

Handling unsold or unclaimed surplus can be tricky. Organizations should have clear policies on what happens to these items. Options might include further marketing to potential buyers, donating them to charities, or recycling. Reporting significant changes after submission protects the organization from compliance issues by ensuring all adjustments are captured and documented.

Frequently asked questions (faq)

Errors after submission are not uncommon. If mistakes are identified post-submission, organizations should have a process in place to amend or correct the declaration. Contacting the relevant department for guidance is the best course of action.

For those unsure where to direct their inquiries, typically, the finance or procurement department can assist. Understanding the process and knowing whom to contact can significantly improve the accompanying experience.

Testimonials and case studies

User experiences with the declaration of surplus form can vary significantly. Case studies revealing how other organizations successfully declared surplus not only offer inspiration but also provide practical insights. These testimonials often highlight the ease of using pdfFiller’s services to streamline the process, improve tracking, and make collaboration a breeze. This showcases how adopting digital solutions can be transformational.

For instance, a charitable organization shared a story of how they effectively decluttered their storage and used the funds from sold surplus items to fund their community programs, largely facilitated by the transparent and user-friendly templates provided by pdfFiller.

Additional considerations

Declaring surplus also carries legal implications. Failure to declare can lead to regulatory fines or penalties, particularly for public sector organizations. Ensuring an organized inventory review process is vital to current compliance standards and maintains the integrity of the institution.

Furthermore, the financial impact of declaring surplus items can also be felt in inventory audits and financial reporting. Accurate reporting can lead to tax benefits or improved asset valuations. Looking to the future, managing these items effectively creates opportunities to build better processes for surplus management, with an emphasis on teamwork in tracking and documenting surplus items appropriately.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my declaration of surplus and in Gmail?

How can I modify declaration of surplus and without leaving Google Drive?

How do I edit declaration of surplus and online?

What is declaration of surplus and?

Who is required to file declaration of surplus and?

How to fill out declaration of surplus and?

What is the purpose of declaration of surplus and?

What information must be reported on declaration of surplus and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.