Get the free r/USCIS - Form I-864 household count - Is this correct?

Get, Create, Make and Sign ruscis - form i-864

Editing ruscis - form i-864 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ruscis - form i-864

How to fill out ruscis - form i-864

Who needs ruscis - form i-864?

A Comprehensive Guide to the -864 Form: Understanding and Completing the Affidavit of Support

Understanding the -864 form: The affidavit of support

The I-864 form, known as the Affidavit of Support, is a crucial document for anyone looking to sponsor an immigrant in the United States. Primarily required in family-based immigration scenarios, this form affirms the sponsor's commitment to supporting the immigrant financially, ensuring they will not become a public charge.

The importance of the I-864 cannot be overstated; sponsors are legally obligated to ensure the immigrant can maintain a certain level of income, reflecting a promise to support them in their transition to a new life in the US.

Who needs to file the -864 form?

Sponsors must meet specific eligibility criteria, typically being a US citizen or permanent resident aged 18 or older. Additional factors include meeting certain income requirements, generally at least 125% above the federal poverty level for their household size.

The beneficiaries—those receiving sponsorship—must be either immediate relatives or other eligible family members, highlighting the personal connection necessary for this process.

Navigating the -864 form: Key components

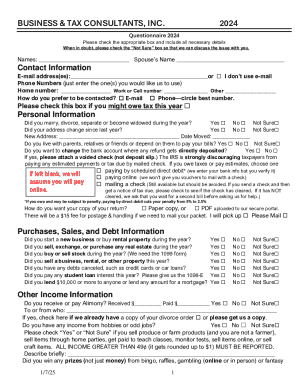

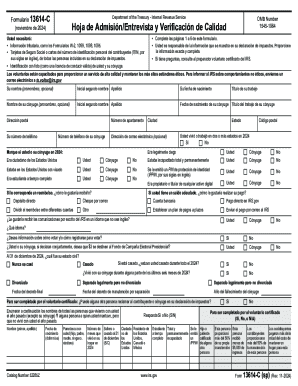

The I-864 form comprises several essential sections; understanding each can streamline the application process. The form requests detailed information about the sponsor's financial situation, including income, assets, and household size.

Accurate information is critical; missing or erroneous data can result in delays or denials. It’s invaluable to read the instructions carefully, as each section involves specific queries essential for evaluating the sponsorship capacity.

Common mistakes to avoid

Several common mistakes can occur when filling out the I-864 form. Missing signatures, failing to provide complete information, and not including necessary financial documentation are frequent pitfalls. These errors not only delay the process but can also jeopardize approval.

It’s advisable to review each section meticulously and, if possible, have a second set of eyes go over the completed documentation to catch any oversights.

Step-by-step guide to completing the -864 form

Step 1: Gathering necessary documentation

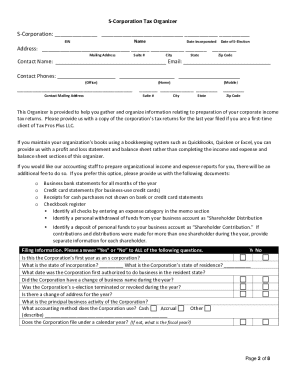

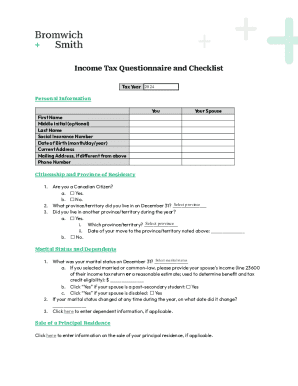

Before starting the I-864 form, gather all necessary supporting documentation. Key documents include tax returns, proof of employment, pay stubs, and any other verification of income.

Organizing paperwork efficiently is paramount. Consider using a dedicated folder or digital tools like pdfFiller to streamline your document management process.

Step 2: Filling out the form

Each section of the I-864 form requires specific information, ranging from personal data to financial details. For instance, Section A may ask for the sponsor’s name and address, while Section B delves into the sponsor's income sources.

Clarity is key. Using clear, legible handwriting or completing the form digitally can enhance the professionalism of your submission. Ensuring completeness will protect against unnecessary delays.

Step 3: Signatures and dates

After filling the form, don’t forget the importance of signatures. All relevant parties, including joint sponsors if applicable, must sign the form for it to be valid.

If there are discrepancies or missing signatures, it can lead to further complications. Ensure every party involved in the sponsorship signs, and include dates to signify when the form was completed.

Specific situations and considerations

-864 form for joint sponsors

In cases where a primary sponsor cannot meet financial requirements, they may enlist a joint sponsor. This individual must also file a separate I-864 form, however, they share the same financial responsibilities as the primary sponsor.

When filling out the joint sponsor section, it’s essential to follow the same guidelines: complete financial information, signatures, and accurate personal data to validate the joint sponsorship.

Exemptions and waivers

Certain situations exempt individuals from the I-864 requirement, such as when the immigrant is a child of a US citizen or if the sponsor themselves are exempt from financial norms due to active military service.

For special circumstances, such as financial hardship, there may be options for requesting waivers. It is crucial to understand these provisions and consider consulting an immigration attorney for guidance.

Submitting your -864 form

Once completed, the next step is submitting your I-864 form. This can be done electronically or via paper submission, depending on the USCIS requirements for your specific case.

For paper submissions, it’s advisable to use a secure mailing option that allows for tracking. Always send copies of your documentation and a cover letter to ensure clarity on what is being submitted.

Tracking submission status

After submitting, consider utilizing USCIS tools and resources to monitor your application status. It’s important to stay informed, and there are various online platforms available for tracking.

If there’s a delay or any issue, maintaining open lines of communication with USCIS can help clarify the problem or expedite the process.

Post-submission: What to expect next

After submission, the timeline for an immigrant visa or adjustment of status can vary. Generally, sponsors can expect several weeks to months before hearing back from USCIS regarding their application.

Understanding where the I-864 fits into the overall immigration process is part of being prepared. The form is just one key component within a larger framework of documentation and processes required for the immigrant to secure their visa.

Addressing requests for evidence (RFEs)

USCIS may issue a Request for Evidence (RFE) if they require further information before proceeding with an application. Preparing for RFEs means keeping all documentation organized and ready for quick reference.

Responding thoroughly and within designated time frames can help ensure approval and expedite the resolution of the application.

Leveraging pdfFiller for your -864 form

Using pdfFiller to complete your I-864 form can significantly enhance your experience. With interactive tools available, users can easily fill out forms, edit as necessary, and collaborate with relevant stakeholders.

The platform offers features that simplify editing, signing, and managing the I-864, allowing for an efficient and user-friendly experience.

Collaborating with stakeholders

Collaborating on the I-864 is made easier through pdfFiller's sharing options. Whether it's coordinating with co-sponsors or communicating with legal advisors, the platform allows for seamless interaction and edits.

With pdfFiller, tracking changes and maintaining shared access can streamline the documentation process while ensuring everyone involved stays informed and engaged.

Frequently asked questions about the -864 form

Many questions arise regarding the I-864 form, primarily concerning who qualifies as a sponsor, what happens during processing, and how errors can affect outcomes. Addressing these questions proactively is vital for a successful submission.

Providing clarity on concerns such as financial verification and timing expectations will contribute to a smoother application process. Moreover, preparing a final checklist ensures that all required items are in order before submission.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find ruscis - form i-864?

Can I create an electronic signature for the ruscis - form i-864 in Chrome?

How do I complete ruscis - form i-864 on an Android device?

What is ruscis - form i-864?

Who is required to file ruscis - form i-864?

How to fill out ruscis - form i-864?

What is the purpose of ruscis - form i-864?

What information must be reported on ruscis - form i-864?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.