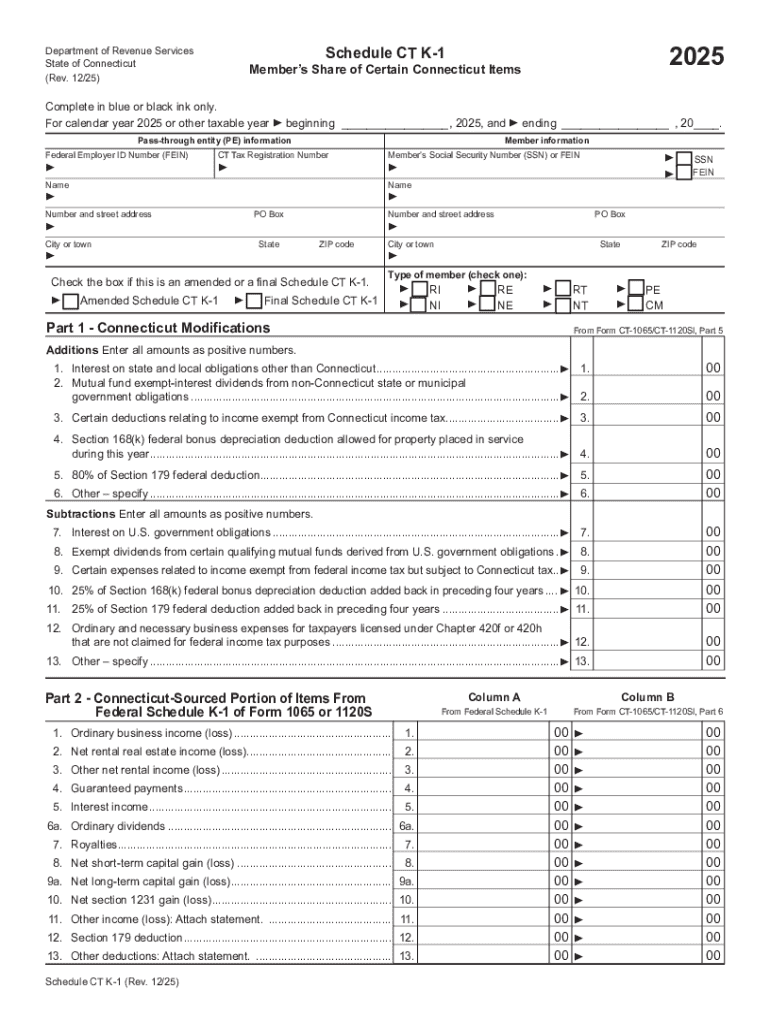

Get the free Online Schedule CT K-1, Member's Share of ...

Get, Create, Make and Sign online schedule ct k-1

Editing online schedule ct k-1 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out online schedule ct k-1

How to fill out online schedule ct k-1

Who needs online schedule ct k-1?

Your Guide to the Online Schedule CT K-1 Form

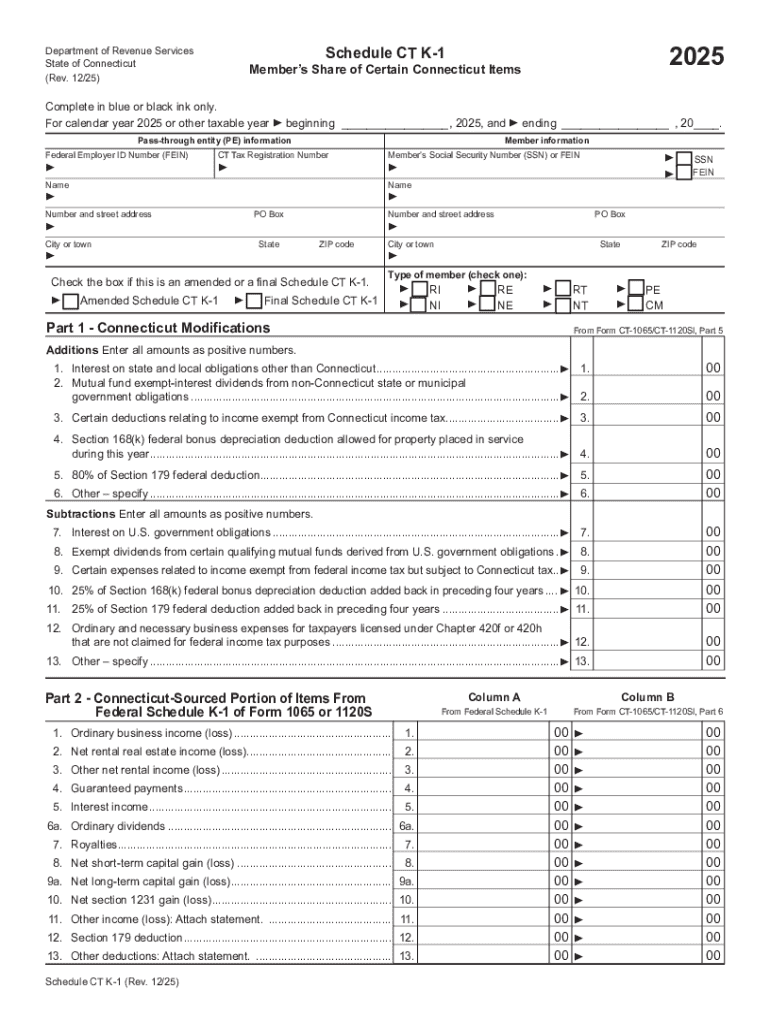

Understanding the CT K-1 Form

The CT K-1 Form, formally known as the Schedule CT K-1, is a critical component for tax reporting in Connecticut. This document serves to report a partner's share of income, deductions, credits, and other relevant information relating to partnerships or limited liability companies (LLCs). As a taxpayer, understanding the K-1 Form's purpose not only aids in completing your tax return accurately but ensures compliance with the state’s revenue code.

The importance of the CT K-1 cannot be overstated, particularly for Connecticut residents and nonresidents involved in partnerships. It ensures that all income and deductions are reported correctly, and it plays a key role in calculating a partner's overall tax liability. Without accurate completion of the K-1 Form, partners may face discrepancies in their income tax returns, potentially leading to audits or penalties.

Who needs to file a CT K-1?

Essentially, the CT K-1 Form is required for any taxpayer who is part of a partnership. Specifically, this can include individuals who are partners in a business as well as LLC members. If you receive income from a partnership, you must file the K-1 Form as part of your overall income tax return (Form CT-1040 or CT-1040NR).

Certain scenarios will prompt the need for K-1 filing, such as when a partnership has earned a profit, incurred shared losses, or received income from business operations. Regardless of the specific case, if it relates to your share as a partner or member, you will need to prepare and submit the CT K-1.

Preparing for the online Schedule CT K-1 Form

Before diving into the preparation of the online Schedule CT K-1 Form, gathering the necessary information is essential. Each partner should have personal details ready, including their Social Security number (SSN) or Tax Identification Number (TIN), as well as specific financial documents that detail the partnership's profit and loss statements for the year as disclosed on the partnership's tax return.

Additionally, having records of all payments, distributions, and income allocations related to the partnership can streamline the process. Specifically, it's prudent to tabulate how much income you received during the tax year, any deductions attributed to you, and any credits for which you might be eligible.

Setting up your pdfFiller account

To efficiently handle your CT K-1 Form, creating a pdfFiller account is a key step. Begin by visiting pdfFiller's website, where you'll find an option to 'Sign Up.' Fill in the required details, such as your email address and password, to create your account. Once completed, confirm your email to activate your account. This process is straightforward and usually takes just a few minutes.

Using pdfFiller gives you a multitude of benefits, particularly for document management. The platform not only allows seamless access to your forms from anywhere but also enables easy editing, eSigning, and sharing of documents, making collaboration with partners or accountants simple and efficient.

Step-by-step instructions to complete the online Schedule CT K-1 Form

Accessing the online form via pdfFiller is a simple first step in completing your CT K-1 Form. After logging into your account, use the search bar to locate the K-1 form template specifically designed for Connecticut taxpayers. Once found, click on the form to begin editing.

Completing the form

Filling out the K-1 Form involves a structured approach. The form is divided into three main parts:

As you fill out these sections, accuracy is paramount. Any discrepancies in income or deductions can create issues when it’s time to file your personal income tax return with the Connecticut Department of Revenue Services (DRS).

Editing options

pdfFiller offers substantial editing options that can enhance the process of filling out your K-1 Form. You can easily edit text, insert images, and add annotations. This capability is especially useful if you need to modify any pre-filled information that doesn't accurately represent your share of the partnership’s finances.

Ensuring accuracy before submission

Before finally submitting your K-1 Form, take a moment to review for common pitfalls. Ensure all required fields are filled out correctly and double-check that amounts entered align with your partnership's records. A helpful review checklist would include:

Completing this thorough check can help avoid potential troubles when filing your personal return.

eSigning and submitting your completed CT K-1 Form

eSigning with pdfFiller makes the finalization of your K-1 Form efficient. Electronic signatures have become trusted for their security and legality, making it easier for partners to authorize documents without the need for physical presence. Once your K-1 Form is completely filled out, look for the eSign option within pdfFiller; it offers a straightforward process to add your signature.

To eSign your K-1 Form, follow these simple steps: select 'eSign' from the options, choose to add or create a signature, then place it where needed on the document. Once satisfied, you can save your signed form. This secure digital method not only saves time but also streamlines communication among stakeholders.

Submitting the form

After eSigning, submission of your completed CT K-1 Form can occur either through e-filing or traditional mail. For e-filing, ensure that you have all the necessary software and follow Connecticut’s electronic filing guidelines. Alternatively, if you choose to submit by mail, ensure the form is sent to the appropriate department within the Connecticut DRS, allowing sufficient time for processing before tax deadlines.

Filing your K-1 Form in a timely manner is essential to mitigate any potential penalties or issues related to your tax return.

Managing your CT K-1 Form and related documentation

Once your CT K-1 Form is submitted, managing your forms and related documents becomes paramount. pdfFiller's features allow for easy storage and organization of tax documents, which can simplify future filing processes.

You can store your K-1 Form along with other documents in a central location. This holistic approach to document management helps avoid the hassle of searching for important papers during tax season or at the time of an audit.

Sharing the K-1 Form with partners or advisors

pdfFiller simplifies the process of sharing your K-1 Form with partners or tax advisors. By using the platform’s share feature, you can easily send the K-1 document via email or generate a shareable link. This flexibility ensures that all stakeholders can access necessary information seamlessly, fostering better communication.

Tracking changes and history

One of the notable benefits of using pdfFiller for managing your CT K-1 Form is the ability to track changes and document history. This feature is invaluable, especially during audits, as it provides a clear record of all modifications made to the document. Keeping track of edits not only provides accountability but fortifies your position should any issues arise concerning your tax filings.

FAQs about the CT K-1 Form

When it comes to common concerns regarding the CT K-1 Form, several frequently asked questions (FAQs) arise that many taxpayers encounter. One common issue is understanding eligibility for receiving a K-1. Generally, anyone involved in a partnership that generates taxable income in Connecticut must receive a K-1 form. Furthermore, there may also be questions regarding deadlines for filing or how to handle discrepancies between the K-1 and personal income reports.

In addition to eligibility, troubleshooting common issues can help with anxiety when filing. Misreported income, missing deductions, or incomplete information are frequent concerns. Make sure to consult with your tax professional for suspicious entries, and utilize the review checklist we have discussed previously.

Benefits of using pdfFiller for your CT K-1 Form needs

Using pdfFiller streamlines the entire process of filling out your CT K-1 Form. The platform significantly enhances your document management experience by allowing easy editing, signing, and storing of forms, which can be beneficial for individuals or teams managing their tax documents.

Importantly, pdfFiller's cloud-based solution allows for access from anywhere, meaning users are not restricted to one machine or location. This feature is crucial for those who may need to collaborate with partners or advisors while away from the office.

Collaboration features

The multi-user collaboration capabilities of pdfFiller further emphasize why it's the choice for many individuals and business teams managing important documents. This feature allows multiple users to work on a document simultaneously, promoting efficient workflow and ensuring every partner's input is easily integrated. Sharing responsibilities in filling out the K-1 Form can save precious time and eliminate the task burden placed on a single individual.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify online schedule ct k-1 without leaving Google Drive?

How can I send online schedule ct k-1 to be eSigned by others?

How do I edit online schedule ct k-1 online?

What is online schedule ct k-1?

Who is required to file online schedule ct k-1?

How to fill out online schedule ct k-1?

What is the purpose of online schedule ct k-1?

What information must be reported on online schedule ct k-1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.