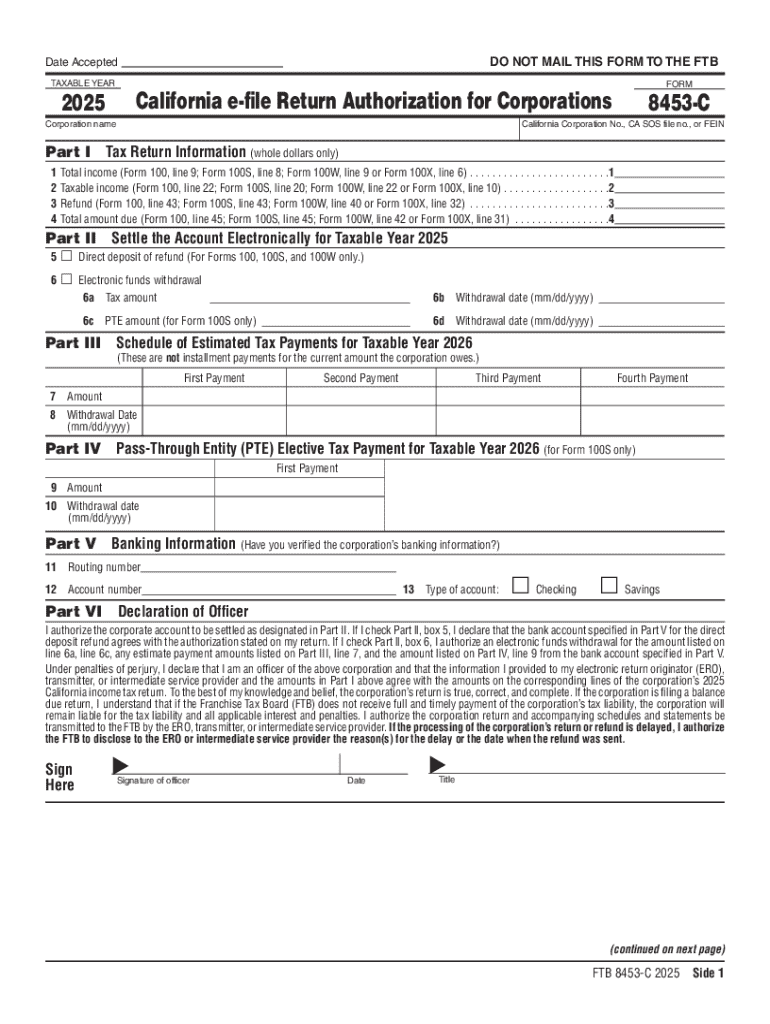

Get the free California e-file Return Authorization Form 8453-OL

Get, Create, Make and Sign california e-file return authorization

Editing california e-file return authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out california e-file return authorization

How to fill out california e-file return authorization

Who needs california e-file return authorization?

California E-File Return Authorization Form: A Comprehensive How-to Guide

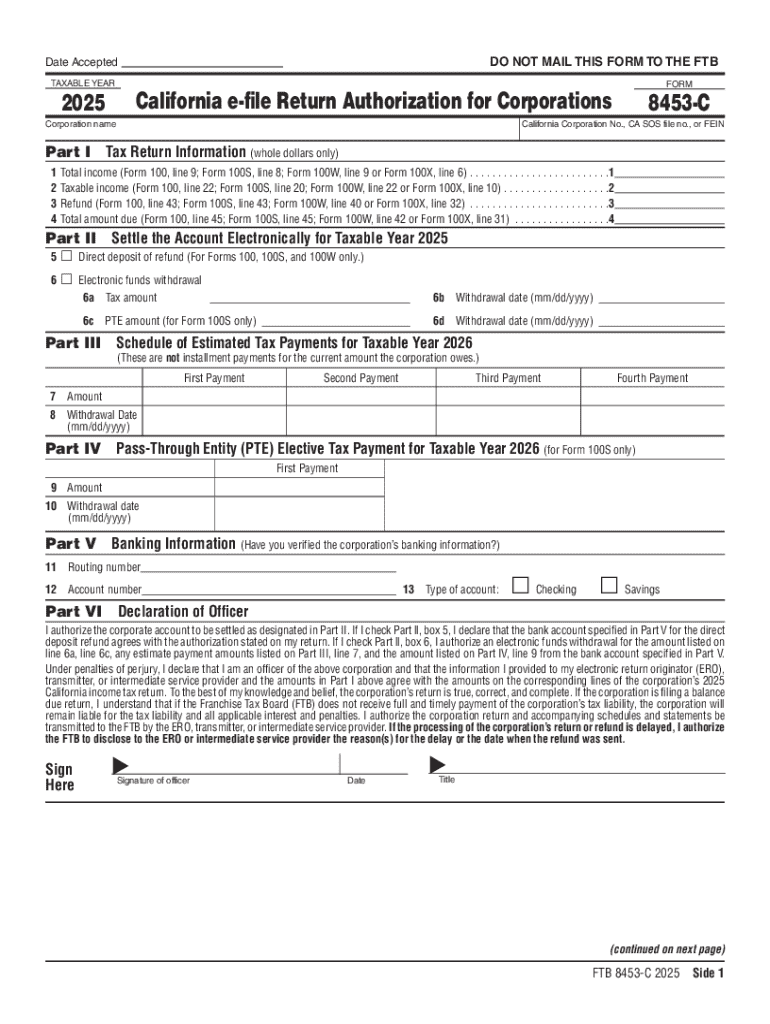

Understanding the California E-File Return Authorization Form

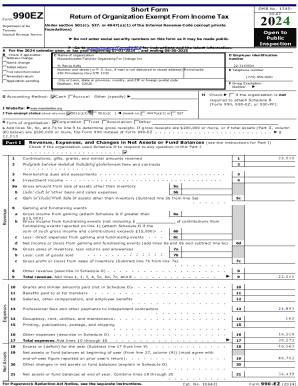

The California E-File Return Authorization Form is a crucial document in the state’s tax filing process, enabling taxpayers to give consent to their tax preparers to submit their returns electronically. This form is particularly important and serves to streamline the e-filing process for both individuals and tax professionals. Given the increasing integration of technology in tax procedures, the e-file Return Authorization Form has become essential for complying with state regulations.

E-filing is a fast and efficient way for taxpayers to submit their tax returns, minimizing paperwork and reducing the chances of errors associated with manual submissions. By utilizing the California E-File Return Authorization Form, taxpayers affirm their desire for electronic filing, which can lead to quicker refunds and an overall smoother filing experience. Among its numerous benefits, this form contributes to faster processing times and provides a secure method for submitting sensitive information.

Who needs to use the California E-File Return Authorization Form?

The California E-File Return Authorization Form must be completed and submitted by any taxpayer who chooses to file their returns electronically. This includes individual taxpayers, joint filers, and those using tax preparers. Individuals who earn above a certain income threshold or those who itemize deductions are generally encouraged to take advantage of e-filing due to its efficiency.

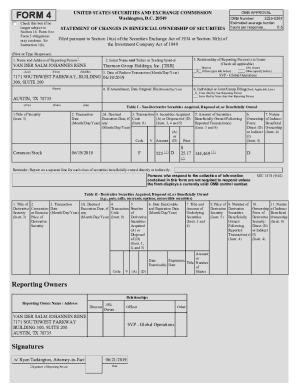

Tax professionals play a pivotal role in the e-filing landscape, as they are often the ones preparing and submitting returns on behalf of their clients. Understanding how to properly navigate the e-file Return Authorization Form is essential for tax preparers, especially when managing multiple returns, as accurate authorization can prevent future complications.

Preparing to fill out the form

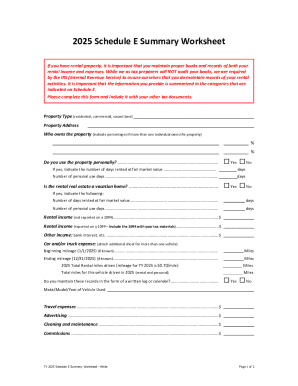

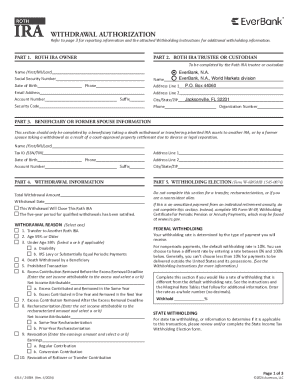

Before diving into filling out the California E-File Return Authorization Form, it's vital to gather all required information and documentation. Personal identification information such as name, Social Security number, and address must be carefully entered into the form. Additionally, knowledge of income details and any tax deductions is crucial, as these elements play a significant role in accurately reporting financial information.

For a seamless filling process, utilizing the right tools can be beneficial. pdfFiller is a reliable platform that simplifies document preparation, allowing users to fill out forms electronically. Its cloud-based solution means that you can access your forms from anywhere, making document management straightforward. Having everything organized and accessible through pdfFiller ensures that you have everything you need at your fingertips for hassle-free completion of the California E-File Return Authorization Form.

Step-by-step guide to completing the California E-File Return Authorization Form

Completing the California E-File Return Authorization Form is a straightforward process when followed step by step. Here’s how to navigate it:

Common mistakes to avoid when filling out the form

Mistakes in filling out the California E-File Return Authorization Form can have significant consequences. One common error is misunderstanding the personal information requirements, where people may mis-enter their Social Security numbers or spell their names incorrectly. Such oversights can delay the filing process or even lead to rejected submissions.

Another frequent mistake is providing incomplete authorizations or incorrect signatures. Every field must be filled out as specified for the form to be valid. To prevent these issues, it's wise to adopt a meticulous approach—consider double-checking entries against other documents for accuracy before submitting the form.

FAQs about the California E-File Return Authorization Form

As with any official documentation, questions often arise concerning the California E-File Return Authorization Form. Some common queries include the procedure to follow if a mistake is made after submission. Typically, if an error is detected post-submission, it’s advisable to contact your tax preparer or the state tax office for guidance.

Another frequent concern is whether one can opt-out of e-filing altogether. Certain taxpayers may be eligible to file paper returns instead if they prefer, but they must ensure they meet the required criteria set by the state. Lastly, if there is a need to update your submission, you will need to file an amended return and follow the state’s guidelines accordingly.

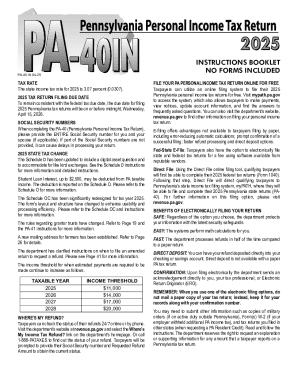

Understanding the e-file process and mandatory requirements

E-filing in California has specific mandatory requirements that taxpayers must adhere to. The California Franchise Tax Board mandates that certain income thresholds dictate when an e-file is required. Generally, taxpayers with an adjusted gross income exceeding $1,000,000 need to submit electronically. There are specific types of returns, such as individual income tax and some corporation returns, that qualify for e-filing, ensuring that the process aligns with both federal and state obligations.

Failing to e-file when required can lead to penalties, including the imposition of additional interest on unpaid taxes. Taxpayers must remain informed of these requirements to prevent financial repercussions and maintain compliance with state laws.

E-file opt-out record

An e-file opt-out record allows certain taxpayers to request a deviation from mandatory e-filing protocols. To opt-out, individuals must take specific steps, starting by confirming their eligibility to file a paper return instead. It’s important to be aware that not all taxpayers qualify for this exemption, and those who wish to opt-out must ensure that their tax preparer submits a formal request to the California Franchise Tax Board.

Taxpayers should keep documentation of their opt-out request as a precaution for any future inquiries related to their filing submission.

Using interactive tools for e-filing with pdfFiller

Utilizing tools such as pdfFiller can significantly enhance the e-filing experience for both individuals and tax professionals. pdfFiller provides a range of features that simplify the process—from easy access to forms and templates to built-in editing options that allow for seamless document updates. The collaborative features enable teams managing multiple authorizations to work together efficiently, ensuring everybody involved has access to the necessary documents.

Security is another essential aspect of e-filing that pdfFiller prioritizes. Users can sign and manage documents securely within the platform, ensuring that sensitive tax information remains protected throughout the entire filing process. With cloud capabilities, files can be accessed and modified conveniently, providing a comprehensive solution for document management.

Additional tools and resources for California tax filers

There are numerous tools and resources available for California tax filers that can aid in the preparation and submission of their returns. Taxpayers are encouraged to visit official California tax websites for the most accurate and updated information regarding various tax forms and filing instructions. Additionally, finding related forms pertinent to specific tax situations can make the e-filing process more manageable.

User testimonials for platforms like pdfFiller can also provide insight into successful tax filing experiences. Feedback from fellow users highlights the advantages of using interactive tools and how they streamline document creation and management, ultimately leading to a more efficient filing experience.

Language options and accessibility features

Recognizing the diversity of California's population, access to the California E-File Return Authorization Form in multiple languages can be invaluable for non-English speakers. pdfFiller provides translation tools that help broaden accessibility, ensuring that language barriers do not prevent individuals from submitting their tax returns accurately.

Moreover, the platform's user-friendly interface coupled with accessibility features supports taxpayers who may require adjustments to interface settings to complete their forms comfortably. These considerations demonstrate the commitment to inclusivity in the tax filing process, fostering a sense of community among California taxpayers.

Related content and forms

When preparing for tax season, it's important to be aware of other related forms required for California tax filing. Familiarizing yourself with forms beyond the e-file Return Authorization Form can ensure comprehensive compliance with state tax laws. Quick links to additional forms can usually be found on the same platforms where you access the California E-File Return Authorization Form.

This interconnected approach to navigating tax forms not only saves time but also enhances understanding of the overall filing process. As taxpayers, taking the initiative to explore relevant articles and guidelines on platforms like pdfFiller can enrich the filing experience by providing essential insights and assistance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my california e-file return authorization directly from Gmail?

How do I complete california e-file return authorization on an iOS device?

How do I edit california e-file return authorization on an Android device?

What is california e-file return authorization?

Who is required to file california e-file return authorization?

How to fill out california e-file return authorization?

What is the purpose of california e-file return authorization?

What information must be reported on california e-file return authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.