Get the free High-deductible health plan with a health savings account (HSA)

Show details

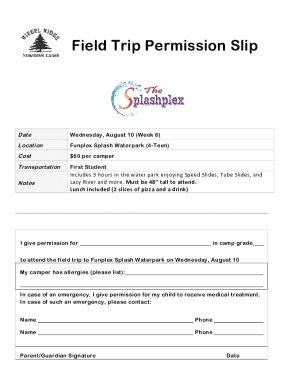

GHA 2014 Health Savings AdvantageSMHighdeductible health plan with a health savings account (HSA)(800) 8216136 GHA.comCODESelf Only341 Self + Family342Enrollment checklist 1. Research health plans.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your high-deductible health plan with form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your high-deductible health plan with form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit high-deductible health plan with online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit high-deductible health plan with. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

How to fill out high-deductible health plan with

How to fill out high-deductible health plan:

01

Determine your healthcare needs: Before filling out a high-deductible health plan, it's essential to assess your healthcare needs. Consider factors like your age, existing medical conditions, and anticipated medical expenses to decide if a high-deductible plan is suitable for you.

02

Research available plans: Explore different high-deductible health plans offered by insurance providers. Compare their deductibles, premiums, coverage options, and network of healthcare providers to find the plan that aligns with your needs and budget.

03

Understand the terms and conditions: Thoroughly read and understand the terms and conditions of the high-deductible health plan. Pay attention to details such as the deductible amount, out-of-pocket maximum, co-payments, and coverage limits. This will help you make informed decisions and avoid unexpected costs.

04

Complete the application accurately: Once you've chosen a high-deductible health plan, fill out the application form accurately. Enter your personal information, including your name, address, social security number, and any other required details. Double-check the form for any errors or missing information before submitting it.

05

Choose a primary care physician: Many high-deductible health plans require you to select a primary care physician. Research healthcare providers in your area and select one who is part of the plan's network. This ensures you receive coordinated and cost-effective care.

06

Review and pay your premiums: After submitting the application, the insurance provider will inform you about the premium amount and payment methods. Carefully review the premium details, payment schedule, and due dates. Make timely payments to maintain continuous coverage.

07

Understand your deductible and out-of-pocket expenses: Familiarize yourself with the deductible amount – the sum you must pay before the insurance coverage kicks in. Additionally, understand the out-of-pocket expenses you may incur, such as co-payments or coinsurance, for various medical services. Being aware of these costs helps you budget for healthcare expenses effectively.

Who needs high-deductible health plan:

01

Individuals with excellent health: High-deductible health plans can be suitable for individuals who are generally healthy and require minimal healthcare services. These plans typically have lower premiums, making them a cost-effective option for those who don't anticipate frequent medical visits or ongoing treatment.

02

Young and healthy individuals: Young adults who are relatively healthy and have fewer healthcare needs often opt for high-deductible health plans. This demographic may prefer to save on monthly premiums and contribute to a Health Savings Account (HSA) for future medical expenses.

03

Individuals seeking flexibility: High-deductible health plans offer flexibility in terms of healthcare choices. They allow individuals to visit any healthcare provider without referrals, and some plans cover preventive care even before meeting the deductible. This flexibility appeals to those who value freedom in their healthcare decisions.

Remember, it's crucial to evaluate your individual circumstances and consult with a healthcare professional or insurance advisor to determine if a high-deductible health plan aligns with your specific needs and financial situation.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is high-deductible health plan with?

A high-deductible health plan is a health insurance plan with lower premiums and higher deductibles.

Who is required to file high-deductible health plan with?

Employers offering high-deductible health plans are required to file the necessary forms.

How to fill out high-deductible health plan with?

You can fill out a high-deductible health plan form electronically or by mail.

What is the purpose of high-deductible health plan with?

The purpose of filing high-deductible health plan forms is to provide information to the IRS about the health coverage offered to employees.

What information must be reported on high-deductible health plan with?

High-deductible health plan forms must include information about the employer, employees, and the health coverage offered.

When is the deadline to file high-deductible health plan with in 2023?

The deadline to file high-deductible health plan forms in 2023 is February 28th.

What is the penalty for the late filing of high-deductible health plan with?

The penalty for late filing of high-deductible health plan forms can vary based on the number of days past the deadline.

Where do I find high-deductible health plan with?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific high-deductible health plan with and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for the high-deductible health plan with in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your high-deductible health plan with in seconds.

How do I fill out high-deductible health plan with using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign high-deductible health plan with and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your high-deductible health plan with online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.