Get the free GST/HST Information for Charities

Show details

GST/HST Information for CharitiesRC4082(E) Rev. 10Is this guide for you? This guide explains how the goods and services tax/harmonized sales tax (GST/HST) applies to you as a registered

charity or

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your gsthst information for charities form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gsthst information for charities form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gsthst information for charities online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit gsthst information for charities. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

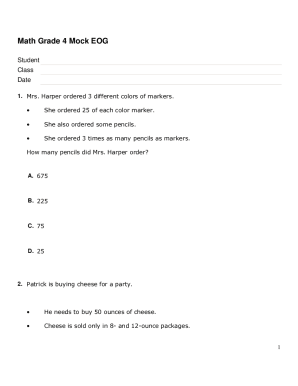

How to fill out gsthst information for charities

How to fill out gsthst information for charities:

01

Gather all necessary documents: Before filling out the gsthst information for charities, make sure you have all the required documents at hand. These documents may include annual financial statements, donation receipts, and any other relevant records.

02

Determine the charity's eligibility: Ensure that the charity is eligible to claim the gsthst refund. It should be a registered charity with a valid charitable registration number issued by the Canada Revenue Agency (CRA). If the charity is not registered, it will not be able to claim the refund.

03

Include all relevant details: Start by providing the charity's legal name, address, and registration number. Fill out other required information, such as the reporting period and the total amount of gsthst paid or payable.

04

Categorize gsthst expenses: Separate the gsthst expenses into categories, such as office supplies, fundraising costs, and program expenses. This helps in accurately reporting the expenses and claiming the gsthst refund on eligible expenses.

05

Calculate the refundable amount: Once you have categorized the expenses, calculate the refundable amount by subtracting any ineligible expenses or exemptions from the total gsthst paid or payable.

06

Complete the gsthst information form: Fill out the gsthst information form provided by the CRA. Ensure that all the information is accurately recorded and double-check for any errors or omissions.

Who needs gsthst information for charities?

01

Registered charities: The primary audience for gsthst information for charities is registered charities in Canada. They need this information to claim the gsthst refund on eligible expenses incurred during their charitable activities.

02

Canada Revenue Agency (CRA): The CRA, being the governing body responsible for tax administration, requires gsthst information from charities to validate their claims and ensure compliance with the regulations.

03

Donors and supporters: Donors and supporters of registered charities might also be interested in gsthst information to understand how their donations and contributions are being utilized and how the gsthst refund can benefit the charity's operations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is gsthst information for charities?

GST/HST information for charities includes details on the Goods and Services Tax/Harmonized Sales Tax that charities collect, claim, and remit.

Who is required to file gsthst information for charities?

Charities registered for GST/HST are required to file GST/HST information for charities.

How to fill out gsthst information for charities?

GST/HST information for charities can be filled out using the appropriate forms provided by the tax authorities, ensuring all relevant information is accurately reported.

What is the purpose of gsthst information for charities?

The purpose of GST/HST information for charities is to track and ensure compliance with GST/HST regulations for charitable organizations.

What information must be reported on gsthst information for charities?

Information such as sales revenue, GST/HST collected, input tax credits claimed, and remittances made must be reported on GST/HST information for charities.

When is the deadline to file gsthst information for charities in 2023?

The deadline to file GST/HST information for charities in 2023 is typically one month after the end of the reporting period.

What is the penalty for the late filing of gsthst information for charities?

Penalties for late filing of GST/HST information for charities can include fines and interest charges on outstanding amounts.

How can I edit gsthst information for charities from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your gsthst information for charities into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an electronic signature for signing my gsthst information for charities in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your gsthst information for charities and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I edit gsthst information for charities on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign gsthst information for charities. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Fill out your gsthst information for charities online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.