Get the free Loan proceeds were included in the total contributions maintained as of the last day...

Show details

Texas Ethics Commission P.O. Box 12070 Austin, Texas 787112070 (512)4635800 CORRECTION AFFIDAVIT FOR CANDIDATE/OFFICEHOLDER 1 CANDIDATE/ OFFICEHOLDER NAME 1 of 18 PAGE # MS / MRS / MR FIRST Mr. MI

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your loan proceeds were included form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan proceeds were included form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing loan proceeds were included online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit loan proceeds were included. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

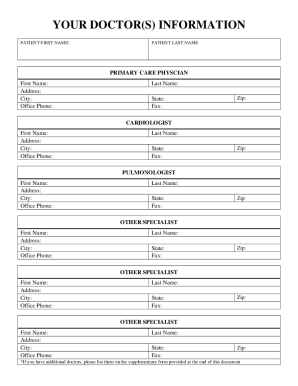

How to fill out loan proceeds were included

To fill out loan proceeds were included, follow the steps below:

01

Gather all the necessary loan documentation, such as loan agreement, loan statement, and any other relevant paperwork.

02

Open the loan proceeds worksheet or form provided by the lender. Make sure to read the instructions carefully before proceeding.

03

Enter the loan amount in the designated field. This is the total amount of money you borrowed from the lender.

04

Specify the purpose of the loan proceeds. Are they intended for personal use, business investment, or other specific purposes?

05

Break down the loan proceeds into different categories if required. For example, if a portion of the loan was used for purchasing inventory, allocate that amount accordingly.

06

Describe the nature of the loan proceeds in detail. This may involve providing information on the specific assets or activities the loan funds were utilized for.

07

Verify all the calculations and ensure that the loan proceeds' distribution is accurately represented on the form.

08

Review the form for any errors or omissions before submitting it to the lender.

Who needs loan proceeds were included:

01

Individuals who have borrowed money from a lender and have been instructed to fill out a loan proceeds form or worksheet.

02

Business owners who have taken out a loan for business purposes and need to account for the allocation of the funds.

03

Organizations or institutions that offer loans and require borrowers to document how the loan proceeds were used for compliance or reporting purposes.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is loan proceeds were included?

Loan proceeds include the money received from a loan that must be reported on your tax return.

Who is required to file loan proceeds were included?

Anyone who has received loan proceeds during the tax year is required to report it on their tax return.

How to fill out loan proceeds were included?

You can report loan proceeds on your tax return by including the amount under the appropriate section for income from loans or debts.

What is the purpose of loan proceeds were included?

The purpose of reporting loan proceeds is to accurately document all sources of income and ensure compliance with tax laws.

What information must be reported on loan proceeds were included?

You must report the total amount of loan proceeds received during the tax year.

When is the deadline to file loan proceeds were included in 2023?

The deadline to file loan proceeds for the tax year 2023 is typically April 15, unless an extension is requested.

What is the penalty for the late filing of loan proceeds were included?

The penalty for late filing of loan proceeds can vary depending on the amount unreported and the reason for the delay. It is best to consult with a tax professional for specific details.

How do I modify my loan proceeds were included in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your loan proceeds were included and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I modify loan proceeds were included without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including loan proceeds were included, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I fill out loan proceeds were included on an Android device?

Complete loan proceeds were included and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your loan proceeds were included online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.