Get the free Local Budget Law and Notice of Property Tax Forms and Instructions for Urban Renewal...

Show details

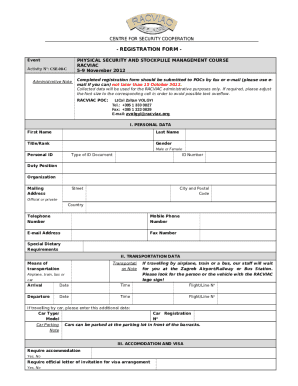

Clear This Page FORM UR1 NOTICE OF BUDGET HEARING June 9, 2015 7:30 City Center Development A public meeting of they will be held on at (Date) (Governing body) a.m. at p.m. 13125 SW Hall Blvd., Tigard,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your local budget law and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your local budget law and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing local budget law and online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit local budget law and. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out local budget law and

How to fill out local budget law and?

01

Read and understand the local budget law: Start by thoroughly reading and understanding the local budget law. Familiarize yourself with the requirements, regulations, and guidelines outlined in the law.

02

Gather all necessary information: Collect all the relevant financial and budget-related information that will be required to fill out the local budget law. This may include revenue and expenditure data, projected income, and expenses, as well as any other financial details essential for the budgeting process.

03

Analyze past budgets: Examine previous local budgets to gain insights into the allocation of resources, the financial health of the organization, and any potential areas for improvement. Learn from past experiences and ensure that mistakes are not repeated.

04

Prepare a budget outline: Create a comprehensive budget outline that covers the different components of the local budget, such as revenue sources, expenses, departmental allocations, and any specific funding requirements. This will serve as a framework for constructing the final budget.

05

Consult with relevant stakeholders: Collaborate with different stakeholders, such as department heads, finance staff, and community representatives, to ensure that all perspectives are considered. Seek input and gather feedback to make informed decisions during the budgeting process.

06

Allocate resources: Determine the allocation of funds to various departments and programs based on their needs, priorities, and available resources. Ensure that the budget reflects the goals and objectives outlined in the local budget law.

07

Revise and finalize the budget: Review and revise the budget draft to address any discrepancies, inaccuracies, or inconsistencies. Make necessary adjustments and seek legal advice if required. Once all revisions have been made, finalize the budget document.

Who needs local budget law and?

01

Local government authorities: Local budget laws are primarily developed for and applicable to local government authorities, including city councils, municipalities, and regional governments. These entities utilize local budget laws to establish and manage their budgets, ensuring effective and transparent financial planning and resource allocation.

02

Administrative and financial staff: The administrative and financial staff within local government bodies are directly involved in implementing and managing the local budget law. They require a thorough understanding of the law's provisions to accurately fill out the budget forms and ensure compliance.

03

Auditors and oversight bodies: Auditors and oversight bodies play a crucial role in ensuring accountability and transparency in the budgeting process. They rely on the local budget law to assess the appropriateness of budget allocations, adherence to financial regulations, and the efficient use of public funds.

04

Citizens and residents: Local budget laws can also be of interest and importance to the general public. Citizens and residents may want to understand how their tax dollars are being allocated, the priorities being set by the local government, and the impact of the budget on the community's services and infrastructure.

In summary, filling out the local budget law requires a thorough understanding of the law itself, gathering necessary information, analyzing past budgets, preparing a budget outline, consulting stakeholders, allocating resources, revising and finalizing the budget. The local budget law is essential for local government authorities, administrative and financial staff, auditors, oversight bodies, and citizens to ensure proper financial planning, resource allocation, and transparency.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is local budget law and?

Local budget law refers to the legislation that governs the budget allocation and spending at the local government level.

Who is required to file local budget law and?

Local government agencies and departments are required to file local budget law.

How to fill out local budget law and?

Local budget law is typically filled out by detailing the planned expenditures and revenues for the upcoming fiscal year.

What is the purpose of local budget law and?

The purpose of local budget law is to ensure that local governments are transparent in their financial dealings and are accountable for how taxpayer money is spent.

What information must be reported on local budget law and?

Information such as revenue sources, expenditures, budgeted amounts for various departments, and any proposed changes to tax rates must be reported on local budget law.

When is the deadline to file local budget law and in 2023?

The deadline to file local budget law in 2023 is usually set by individual local governments, but it is typically around the beginning of the fiscal year.

What is the penalty for the late filing of local budget law and?

The penalty for late filing of local budget law can vary depending on the local government, but it may result in fines or other disciplinary actions.

How do I modify my local budget law and in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your local budget law and and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I edit local budget law and from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your local budget law and into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send local budget law and to be eSigned by others?

When your local budget law and is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Fill out your local budget law and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.