Get the free Gift Acceptance Policy - Winthrop University

Show details

Winthrop University Foundation Gift Acceptance Policy Updated September 2014 Winthrop University Foundation Gift Acceptance Policy Table of Contents Purpose and Philosophy 5 Definitions 5 General

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

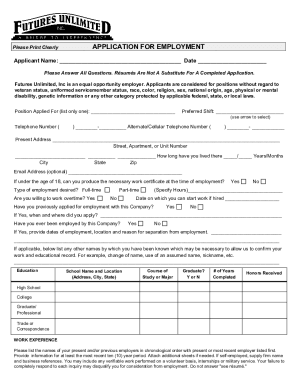

Edit your gift acceptance policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift acceptance policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gift acceptance policy online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gift acceptance policy. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

How to fill out gift acceptance policy

How to fill out a gift acceptance policy?

01

Start by reviewing your organization's mission and values to determine the types of gifts that align with your goals. Consider what types of gifts you are willing to accept and any restrictions or limitations you may have.

02

Next, outline the purpose of your gift acceptance policy. Clearly state why your organization requires a formal policy and how it will benefit both the organization and its donors.

03

Identify key stakeholders who should be involved in the development and approval process of the gift acceptance policy. This may include board members, legal counsel, finance department, and fundraising staff.

04

Conduct research to understand any legal or regulatory requirements related to gift acceptance in your jurisdiction. Ensure that your policy complies with these laws and regulations.

05

Decide on the specific parameters of the gifts you will accept. Consider whether you will accept monetary donations, assets, real estate, securities, or in-kind contributions. Define any restrictions or criteria for each type of gift.

06

Develop procedures for gift review and acceptance. Determine how gifts will be evaluated, accepted, and acknowledged. Consider establishing a gift acceptance committee or designate specific staff members responsible for reviewing and accepting gifts.

07

Address any potential conflicts of interest that may arise from accepting certain gifts. Implement a clear process for identifying and addressing these conflicts, such as requiring board members or employees to disclose personal relationships or financial interests.

08

Consider including a section on donor recognition and stewardship. Outline how your organization will acknowledge and express gratitude to donors, as well as how you will report on the impact of their gifts.

Who needs a gift acceptance policy?

01

Nonprofit organizations: Nonprofits often rely on charitable giving to support their activities. Having a gift acceptance policy ensures that donations align with the organization's mission and values.

02

Educational institutions: Schools, colleges, and universities often receive donations from alumni, parents, and other supporters. A gift acceptance policy helps ensure that these donations are in line with the institution's goals and guidelines.

03

Healthcare organizations: Hospitals, clinics, and medical research institutions frequently receive substantial monetary and in-kind donations. A gift acceptance policy helps guide decision-making to ensure that these donations are appropriate and meet the organization's needs.

04

Cultural organizations: Museums, libraries, art galleries, and other cultural institutions often accept donations of artwork, historical artifacts, or other valuable items. A gift acceptance policy helps ensure that these donations align with the organization's collection and preservation goals.

In conclusion, developing and adhering to a gift acceptance policy is essential for organizations that rely on philanthropy to further their missions. It provides a framework for accepting and managing gifts, ensuring that they align with the organization's goals and values.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is gift acceptance policy?

A gift acceptance policy is a set of guidelines and procedures that dictate how an organization will handle donations and gifts.

Who is required to file gift acceptance policy?

Nonprofit organizations and charities are typically required to have a gift acceptance policy in place.

How to fill out gift acceptance policy?

Gift acceptance policies can be filled out by outlining the organization's criteria for accepting donations, procedures for reviewing gifts, and guidelines for acknowledgement.

What is the purpose of gift acceptance policy?

The purpose of a gift acceptance policy is to ensure that an organization's donations are accepted in a manner that aligns with its mission and values.

What information must be reported on gift acceptance policy?

Information that must be reported on a gift acceptance policy includes criteria for accepting gifts, procedures for reviewing gifts, and guidelines for acknowledging donors.

When is the deadline to file gift acceptance policy in 2023?

The deadline to file a gift acceptance policy in 2023 will vary depending on the organization and its specific requirements.

What is the penalty for the late filing of gift acceptance policy?

Penalties for late filing of a gift acceptance policy can vary depending on the organization and any applicable regulations.

How can I manage my gift acceptance policy directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your gift acceptance policy and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I fill out gift acceptance policy using my mobile device?

Use the pdfFiller mobile app to complete and sign gift acceptance policy on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit gift acceptance policy on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign gift acceptance policy right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Fill out your gift acceptance policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.