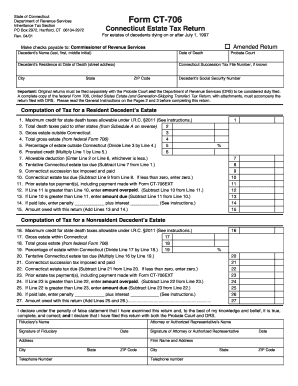

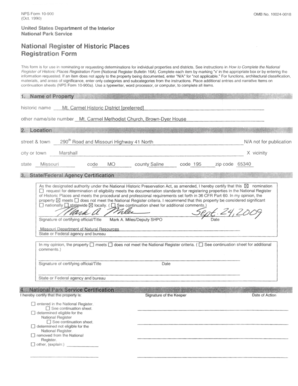

Get the free usda statement for customs template form

Show details

Ingredient used in the food product(s) identity ed on the APHID permit application. If this condition is not met, ISIS will advise APHID that the imported food product.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your usda statement for customs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your usda statement for customs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing usda statement for customs template online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit usda statement for customs template. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

How to fill out usda statement for customs

How to fill out usda statement for customs?

01

Obtain the necessary forms from the USDA or download them from their website.

02

Fill in your personal information, such as your name, address, and contact details.

03

Provide detailed information about the items you are shipping, such as the type of product, quantity, and country of origin.

04

Include any necessary supporting documentation, such as certificates of analysis or phytosanitary certificates.

05

Declare any applicable fees or charges associated with your shipment.

06

Review the completed form for accuracy and make any necessary corrections before submitting it to the customs department.

Who needs usda statement for customs?

01

Individuals or companies that are exporting or importing agricultural products, including fruits, vegetables, plants, or animal products.

02

Shippers who are sending packages internationally that may require inspection or approval by the USDA.

03

Any person or business involved in the import or export of agricultural goods that are subject to regulations enforced by the USDA and customs authorities.

Fill form : Try Risk Free

People Also Ask about usda statement for customs template

How do I import plants to USA?

What is the CBP form AI 625?

Can I import seeds into the US?

How do I fill out a Lacey form?

How do I get an import declaration form?

What is PPQ 505?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is usda statement for customs?

The United States Department of Agriculture (USDA) does not have an official statement specifically regarding customs. However, the USDA is responsible for enforcing numerous regulations and inspections related to the import and export of agricultural products. They work closely with U.S. Customs and Border Protection to ensure compliance with these regulations, protect plant and animal health, and prevent the introduction of harmful pests and diseases.

Who is required to file usda statement for customs?

Importers of agricultural products or items subject to regulation by the United States Department of Agriculture (USDA) are generally required to file a USDA statement with US Customs and Border Protection (CBP). The USDA statement is a precondition for the release of such goods into the United States.

How to fill out usda statement for customs?

To fill out a USDA statement for customs, follow these steps:

1. Download the USDA statement form from the official United States Department of Agriculture (USDA) website. Ensure you have the latest version of the form.

2. Read the instructions carefully before filling out the form. Familiarize yourself with the purpose and guidelines for completing the statement.

3. Enter the current date at the top of the form.

4. Provide the required general information, such as your name, address, city, state, ZIP code, telephone number, and email address. These details typically go in the designated fields on the form.

5. If applicable, include your USDA permit number or the name and address of the USDA office where you obtained the permit.

6. Identify the importer information, including their name, address, city, state, ZIP code, and telephone number. If you are the importer, provide your details; otherwise, provide the actual importer's information.

7. Specify the origin and destination of the product you are importing. Include the country where the product originates and the final destination in the United States.

8. Indicate the transportation method used, such as air, sea, or land.

9. Describe the commodity being imported accurately and in detail. Include the product name, quantity, packaging type, and any applicable identification numbers, such as lot numbers or serial numbers.

10. Provide additional information if required by the form or customs agency. This may include details about any treatments the product has undergone, such as fumigation or irradiation.

11. Sign and date the statement form to verify that the information provided is accurate and complete.

12. Submit the statement form according to the instructions given. This typically involves attaching the form to your shipment or providing it to the appropriate customs officer.

Remember, it is essential to carefully review and comply with all instructions provided by the USDA and the customs agency to ensure a smooth and legal importation process.

What is the purpose of usda statement for customs?

The purpose of the USDA (United States Department of Agriculture) statement for customs is to provide information about any agricultural products being imported or exported. This statement ensures that the products comply with the relevant regulations and requirements set by the USDA, particularly regarding plant and animal health, food safety, and agricultural trade. By verifying the adherence to these standards, the USDA statement for customs aids in protecting the domestic agricultural industry, preventing the introduction of pests and diseases, and promoting fair and safe trade practices.

What information must be reported on usda statement for customs?

When reporting statement for customs, the USDA requires the following information to be included:

1. Shipper and consignee details: This includes the name, address, and contact information of the party shipping the goods and the party receiving the goods.

2. Commodity details: A description of the commodity being imported/exported, including the scientific name (if applicable), quantity, weight, and any relevant codes or identifiers.

3. Origin of the commodity: The country or region of origin where the commodity was produced or grown.

4. Harmonized System (HS) code: The HS code is an internationally standardized system for classifying traded products. It serves as a universal language for customs authorities to identify and classify commodities. The USDA requires the HS code for the imported/exported commodity to be provided.

5. Phytosanitary or animal health requirements: If the commodity being imported/exported is subject to any phytosanitary (plant health) or animal health requirements, these must be specified in the statement. This may include information regarding inspections, treatments, or certifications required.

6. Additional documentation: Depending on the specific commodity and trade regulations, additional documentation may be required to accompany the USDA statement. This can include certificates of origin, sanitary certificates, permits, or other relevant documents.

It is important to note that these are general guidelines, and the specific information required for a USDA statement may vary depending on the nature of the commodity and the destination country's specific customs requirements. Therefore, it is advisable to consult with the USDA or a customs broker for the accurate and up-to-date information.

What is the penalty for the late filing of usda statement for customs?

The penalty for the late filing of a USDA statement for customs can vary depending on the specific circumstances and the importing country's regulations. However, generally, late filing of documents can result in penalties and fines imposed by the customs authorities. These penalties are usually determined based on the length of the delay and the value of the goods being imported. It is advisable to contact the USDA or a customs expert to get precise information on the penalties associated with late filing in a specific situation.

How do I complete usda statement for customs template online?

With pdfFiller, you may easily complete and sign usda statement for customs template online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit usda statement for customs template online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your usda statement for customs template to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I complete usda statement for customs template on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your usda statement for customs template. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your usda statement for customs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.