Get the free axa annuity withdrawal form

Show details

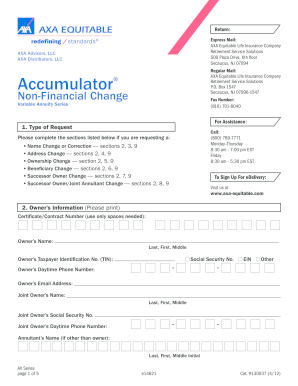

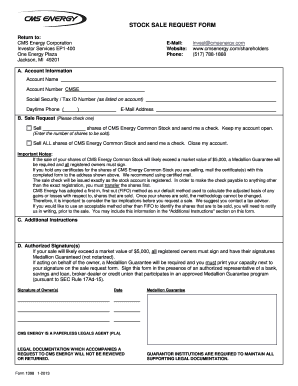

Accumulator Variable Annuity Series Automatic Required Minimum Distribution (RED) Withdrawal Service express mail: AXAEquitableLifeInsuranceCompany RetirementServiceSolutions 500PlazaDrive,6thFloor

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your axa annuity withdrawal form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your axa annuity withdrawal form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing axa annuity withdrawal form online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit axa equi vest disbursement form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

How to fill out axa annuity withdrawal form

How to fill out axa withdrawal form:

01

Ensure you have all the necessary information and documents required for the withdrawal form, such as your policy number, personal identification, and bank account details.

02

Start by carefully reading through the instructions provided on the withdrawal form. Make sure you understand the requirements and any specific guidelines mentioned.

03

Fill in your personal details accurately, including your full name, address, contact information, and policy number. Double-check the information for any errors or missing details.

04

Specify the reason for your withdrawal, whether it is a partial or full withdrawal, and indicate the amount you wish to withdraw. Include any additional information or instructions as necessary.

05

Provide your bank account details for the funds to be transferred. Enter your bank name, branch address, account number, and any other relevant information requested.

06

If required, obtain any necessary signatures from other policyholders or authorized signatories on the form.

07

Review the completed form carefully to ensure it is accurate and complete. Make any necessary corrections or additions before submitting.

08

Keep a copy of the filled-out withdrawal form for your reference and records.

Who needs axa withdrawal form:

01

Policyholders who wish to withdraw funds from their axa account.

02

Individuals who have reached the maturity date of their policy and want to withdraw the accumulated amount.

03

Beneficiaries or legal representatives of policyholders who have passed away and are claiming the death benefit as per the policy terms.

Fill axa 1035 exchange form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

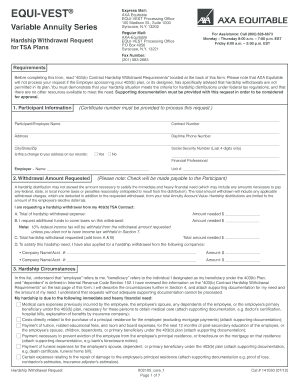

What is axa withdrawal form?

AXA withdrawal form is a document provided by AXA, an insurance and financial services company, to facilitate the withdrawal of funds from an insurance policy or investment account. This form typically requires the policyholder or account holder to provide information such as their name, policy or account number, the amount they wish to withdraw, and their preferred method of receiving the funds. The purpose of the form is to ensure that the withdrawal process is properly authorized and the requested funds are distributed as requested by the policyholder or account holder.

Who is required to file axa withdrawal form?

Individuals who are policyholders with AXA and wish to withdraw funds from their policy may be required to file an AXA withdrawal form. However, specific requirements and procedures for withdrawal may vary based on the policies and terms agreed upon at the time of policy purchase. It is recommended to directly contact AXA or refer to the policy documents to determine the exact requirements and process for withdrawing funds.

How to fill out axa withdrawal form?

To fill out an AXA withdrawal form, follow these steps:

1. Obtain the withdrawal form: You can either download the withdrawal form from the AXA website or request it directly from your AXA insurance agent.

2. Gather necessary information: Collect all the information you will need to complete the withdrawal form. This typically includes your personal information, policy details, policy number, and the amount you wish to withdraw.

3. Policy details: Fill in your policy number, policyholder's name, and address. Ensure that the information matches the details provided on your insurance policy documents.

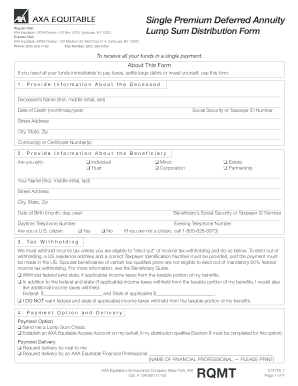

4. Withdrawal information: Indicate the reason for the withdrawal and specify the amount you want to withdraw from your AXA policy. Make sure the amount does not exceed the available cash value of your policy.

5. Payment details: Provide your preferred payment method for the withdrawal. Options may include direct deposit, check payment, or wire transfer. Fill in the appropriate details for your selected payment method.

6. Signature: Sign and date the form. Ensure that the signature matches the one on the insurance policy documents to avoid any discrepancies.

7. Review and submit: Double-check the information you have provided to ensure accuracy and completeness. Review the form one last time before submission. If required, make a copy of the completed form for your records.

8. Submission: Deliver the completed withdrawal form to AXA through the requested method, whether it's mailing it to the designated address or submitting it electronically through their online portal. If mailing it, consider using a secure and trackable mail service to ensure safe delivery.

Remember to keep a copy of the completed form and any accompanying documents for your reference and records. It's also advisable to follow up with AXA to confirm receipt and track the progress of your withdrawal request.

What is the purpose of axa withdrawal form?

The purpose of an AXA withdrawal form is to request the withdrawal or removal of funds from an investment or insurance product provided by AXA. This form enables policyholders or investors to specify the amount they wish to withdraw, the reason for the withdrawal, and any necessary details or instructions to complete the transaction. It is a formal request that facilitates the processing of the withdrawal and ensures that the correct amount is disbursed to the policyholder or investor according to their instructions.

What information must be reported on axa withdrawal form?

When filling out a withdrawal form for AXA, the following information typically needs to be reported:

1. Personal Information: The form will usually require details like your full name, address, date of birth, social security number, and contact information.

2. Account Information: You will need to provide the account number or policy number related to the withdrawal.

3. Withdrawal Amount: Indicate the specific amount you wish to withdraw from your account. It may be mentioned in both numerical and written formats to avoid any confusion.

4. Bank Details: Include your bank's name, routing number, and account number where you want the withdrawal funds to be deposited. This ensures a smooth transfer of money from your AXA account to your bank account.

5. Signatures: The form usually requires your signature(s) to validate the withdrawal request. In some cases, the form may also require a witness signature or notary public certification.

6. Reason for Withdrawal: Depending on the type of withdrawal you are making, you may need to specify the reason for the withdrawal, such as retirement, financial hardship, medical expenses, or other specified criteria.

It's essential to carefully review the instructions and requirements stated on the withdrawal form provided by AXA, as they may vary slightly depending on the specific product or policy you hold.

What is the penalty for the late filing of axa withdrawal form?

The penalty for the late filing of an AXA withdrawal form can vary depending on the specific policies and terms of your individual AXA plan. It is important to note that AXA itself does not impose a penalty for late withdrawal filing. However, there may be consequences such as delayed processing or potential loss of interest or investment gains during the time period between the intended withdrawal date and the actual filing. It is recommended to review your AXA plan documents or contact AXA customer service directly for specific information regarding any potential penalties or consequences for late withdrawal filing.

Can I create an electronic signature for the axa annuity withdrawal form in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How can I edit axa equi vest disbursement form on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing axa com withdrawal form right away.

How do I complete axa annuities withdrawal forms pdf on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your axa accumulator surrender form. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your axa annuity withdrawal form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Axa Com Withdrawal Form is not the form you're looking for?Search for another form here.

Keywords relevant to equi vest disbursement form

Related to axa equitable 403 b withdrawal form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.