Get the free cassie affidavit - jud6

Show details

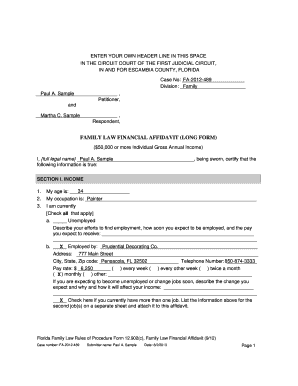

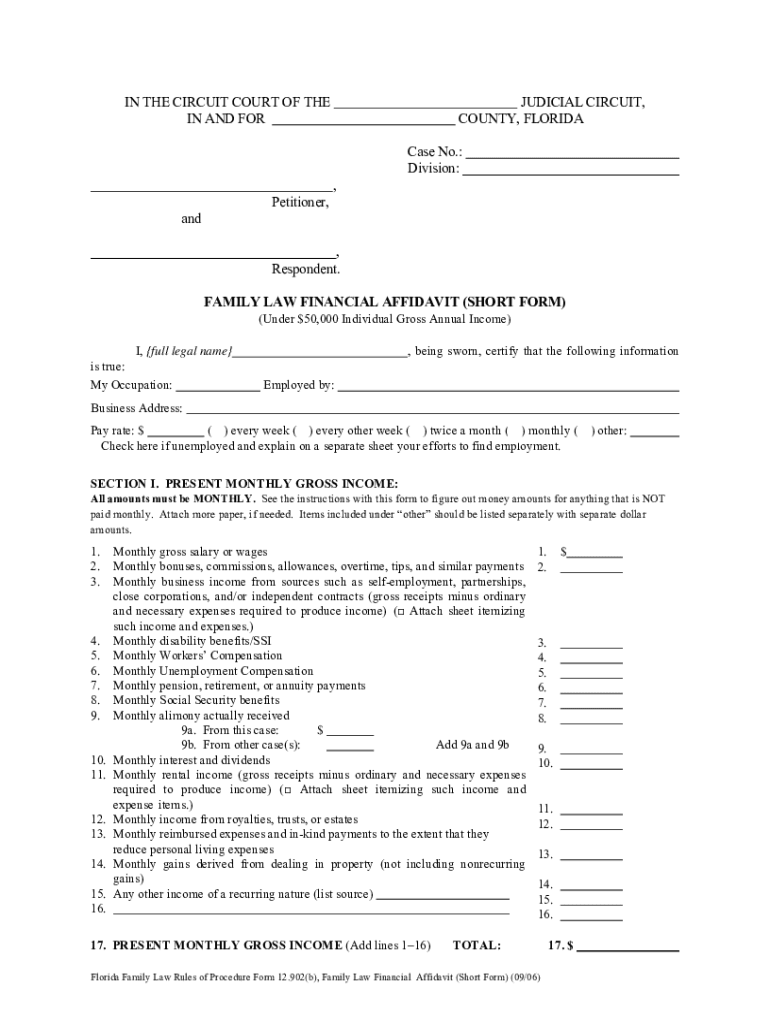

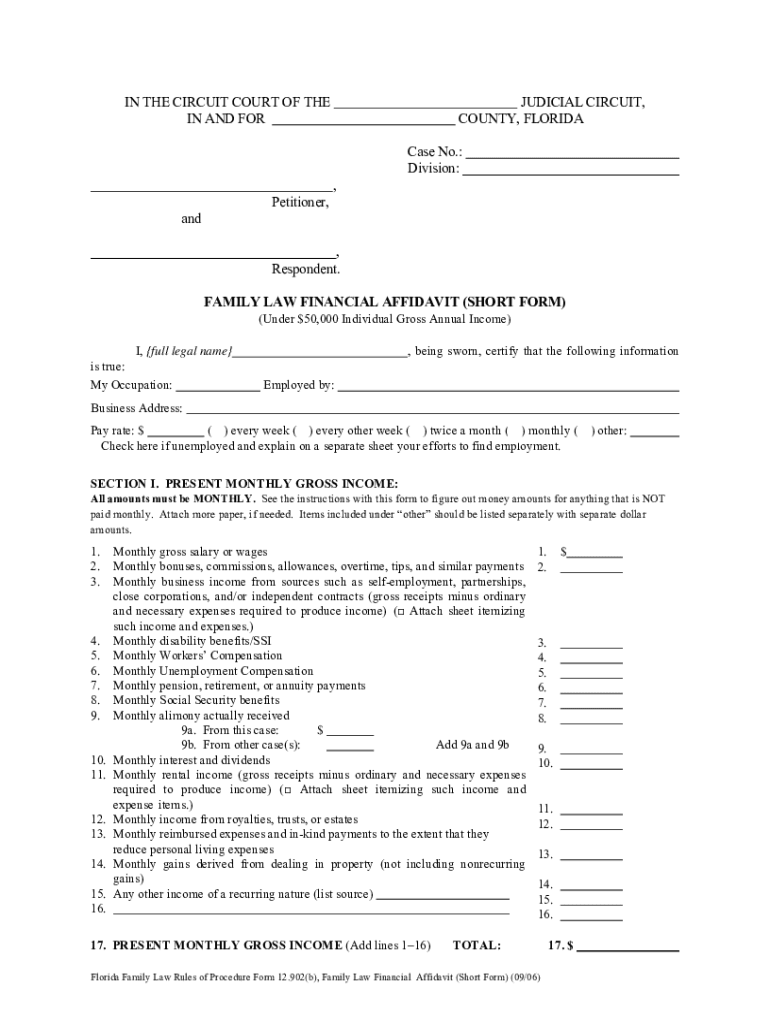

INSTRUCTIONS FOR FLORIDA FAMILY LAW RULES OF PROCEDURE FORM 12.902(b), FAMILY LAW FINANCIAL AFFIDAVIT (SHORT FORM) When should this form be used? This form should be used when you are involved in

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cassie affidavit - jud6

Edit your cassie affidavit - jud6 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cassie affidavit - jud6 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cassie affidavit - jud6 online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit cassie affidavit - jud6. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cassie affidavit - jud6

How to fill out financial affidavit form:

01

Obtain a copy of the financial affidavit form from the relevant institution or website.

02

Read the instructions provided on the form carefully to understand the information required and any specific guidelines.

03

Begin by filling out personal information such as your name, address, and contact details in the designated sections.

04

Provide details about your employment, including your current job, employer's name, and income information.

05

If you have any additional sources of income, such as rental properties or investments, provide the necessary details.

06

List all your expenses, including but not limited to rent or mortgage payments, utilities, groceries, insurance, and transportation costs.

07

Provide information about your assets, such as bank accounts, real estate, vehicles, and investments.

08

If you have any debts or liabilities, detail them in the appropriate section, including credit card balances, loans, and any outstanding obligations.

09

Attach any supporting documents that may be required, such as bank statements, pay stubs, tax returns, or financial statements.

10

Review the completed financial affidavit form thoroughly for accuracy and completeness before submitting it.

Who needs financial affidavit form:

01

Individuals going through divorce or separation proceedings may be required to complete a financial affidavit form as part of the legal process.

02

Applicants for government assistance programs may need to submit a financial affidavit form to determine their eligibility.

03

Individuals applying for loans or mortgages may be asked to provide a financial affidavit form to assess their financial stability and ability to repay the loan.

04

Some court proceedings, such as child custody or child support cases, may require the submission of a financial affidavit form.

05

Executors or administrators of estates may need to complete a financial affidavit form to provide information about the deceased person's assets and debts.

Fill

form

: Try Risk Free

People Also Ask about

What is a Florida Family Law Rules of Procedure financial affidavit?

It is a sworn statement of your income, expenses, assets, and liabilities. The form for the affidavit is prescribed by the Florida Supreme Court. Both parties must file and serve a financial affidavit in a divorce case.

Does a financial affidavit need to be notarized in Florida?

Be sure that your financial affidavit is notarized before filing it with the Court, as the statute requires the document be sworn.

Do I have to file a financial affidavit in Florida?

Even when both parties remain cordial, courts require the financial affidavit in Florida. Without complete financial disclosure, the divorce agreement will not be recognized by the state of Florida. The Family Law Financial Affidavit is required by Florida statute.

How long do you have to file a financial affidavit in Florida?

You must file your financial affidavit for divorce in Florida with the court and serve it on your spouse within 45 days of being served with the divorce petition.

What happens if you lie on a financial affidavit in Illinois?

It is very important to be honest when completing your financial affidavit. If the court discovers that you have lied about your income, property, expenses, or debts, you could face serious repercussions. The court may even find you in contempt of court, which could result in fines or possibly jail time.

What is a financial affidavit?

Meaning of financial affidavit in English a legal document used to prove how much money someone has by listing all of their income, debts, taxes, and other financial responsibilities: Affidavits are also used in financial matters within the court, such as bankruptcy financial affidavit.

What is a financial affidavit Illinois?

It is a document used by the judge to assess your income, expenses, assets, and debts. The information you provide in the affidavit must be true.

Can you waive financial affidavit in Florida?

The requirement that each party file a completed Financial Affidavit cannot be waived and the Affidavit must be filed. If you and the other party agree to waive the requirements of the Mandatory Disclosure Rule you may file a Waiver of Mandatory Disclosure with the court.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my cassie affidavit - jud6 in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign cassie affidavit - jud6 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I make changes in cassie affidavit - jud6?

The editing procedure is simple with pdfFiller. Open your cassie affidavit - jud6 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit cassie affidavit - jud6 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share cassie affidavit - jud6 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is cassie affidavit?

A Cassie affidavit is a legal document used primarily in cases of divorce and child custody to provide a sworn written statement regarding a party's legal status and intentions related to the situation.

Who is required to file cassie affidavit?

Typically, the party seeking a change in custody or visitation arrangements, or one involved in divorce proceedings, is required to file a Cassie affidavit.

How to fill out cassie affidavit?

To fill out a Cassie affidavit, one must accurately complete the form by providing personal details, outlining the circumstances of the case, and specifying the reasons for the affidavit's filing, ensuring all statements are truthful and legally binding.

What is the purpose of cassie affidavit?

The purpose of a Cassie affidavit is to provide a clear and sworn statement of facts pertinent to a legal case, particularly in family law, to assist the court in making informed decisions.

What information must be reported on cassie affidavit?

Information that must be reported on a Cassie affidavit typically includes the affiant's name and contact information, details pertinent to the case, any relevant legal status, and a sworn statement regarding the facts being presented.

Fill out your cassie affidavit - jud6 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cassie Affidavit - jud6 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.