Get the free Guia de bonificaciones/reducciones a la Seguridad Social a trabajadores autonomos. G...

Show details

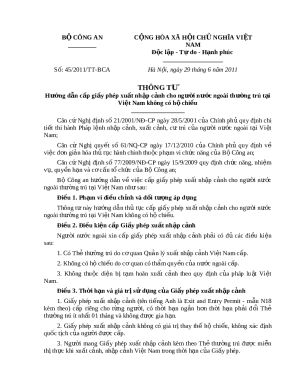

Los autonomous

y Los emprendedoresNormativa de reference

9 Articles 31, 32, 36 y 38 DE la La

20/2007, DE 11 de Julio, Del Statute Del

Plead Autonomy, modified POR la

La 31/ 2015, DE 9 de September,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your guia de bonificacionesreducciones a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your guia de bonificacionesreducciones a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit guia de bonificacionesreducciones a online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit guia de bonificacionesreducciones a. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out guia de bonificacionesreducciones a

How to fill out guia de bonificacionesreducciones a:

01

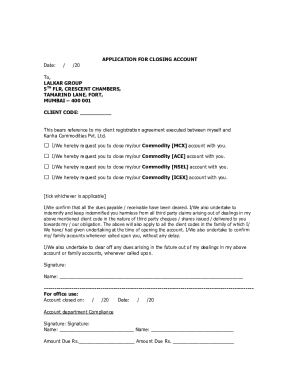

Start by gathering all the necessary information and documents. You will need details about the company or organization you are applying for bonifications or reductions, such as their name, address, and tax identification number.

02

Identify the specific bonifications or reductions you are applying for. Guia de bonificacionesreducciones a might cover various types of incentives or tax deductions, so it's important to know which ones are applicable to your situation.

03

Fill in the required sections of the form. The guia de bonificacionesreducciones a form will typically ask for information regarding the type of bonifications or reductions, the period they apply to, and any supporting evidence or documentation. Make sure to provide accurate and up-to-date information.

04

Double-check your entries and review the form for any errors or omissions. It's crucial to ensure that all the information provided is correct and complete. Mistakes or missing details could result in delays or even the rejection of your application.

Who needs guia de bonificacionesreducciones a:

01

Businesses or organizations seeking to take advantage of tax incentives or deductions may need to fill out guia de bonificacionesreducciones a. These incentives can vary depending on the country or region and are designed to promote certain activities, such as job creation or investment in specific industries.

02

Employers looking to reduce labor costs or provide employees with certain benefits may also require guia de bonificacionesreducciones a. By properly filling out the form, they can apply for bonifications or reductions related to particular employment programs or initiatives.

03

Individuals or professionals responsible for managing a company's tax-related matters may need to fill out guia de bonificacionesreducciones a. This could include accountants, tax advisors, or financial experts who are knowledgeable about the various incentives and deductions available and can navigate the application process effectively.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is guia de bonificacionesreducciones a?

It is a form used to report bonuses and reductions in taxes.

Who is required to file guia de bonificacionesreducciones a?

Businesses and individuals who have received or given bonuses or reductions in taxes.

How to fill out guia de bonificacionesreducciones a?

You need to provide details of the bonuses or reductions received or given, along with relevant tax information.

What is the purpose of guia de bonificacionesreducciones a?

To accurately report bonuses and reductions in taxes to the tax authorities.

What information must be reported on guia de bonificacionesreducciones a?

Details of the bonuses or reductions received or given, along with tax identification numbers.

When is the deadline to file guia de bonificacionesreducciones a in 2023?

The deadline is typically by the end of the tax year, which is December 31st.

What is the penalty for the late filing of guia de bonificacionesreducciones a?

Penalties may include fines or interest charges on the outstanding taxes.

Can I sign the guia de bonificacionesreducciones a electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I create an eSignature for the guia de bonificacionesreducciones a in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your guia de bonificacionesreducciones a and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How can I edit guia de bonificacionesreducciones a on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing guia de bonificacionesreducciones a, you can start right away.

Fill out your guia de bonificacionesreducciones a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.