Get the free Form IT-203-ATT:2011:Other Tax Credits and Taxes:IT203ATT - wiltonlibrary

Show details

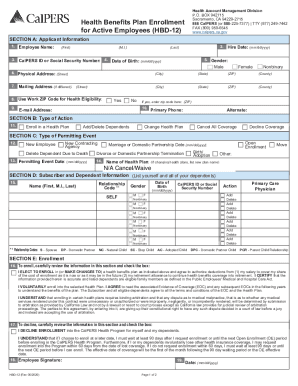

Attach this form to your Form IT-203. Part 1 Other tax credits. Attach all applicable forms. Section A New York State nonrefundable, non-carryover credits ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form it-203-att2011oformr tax credits form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form it-203-att2011oformr tax credits form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form it-203-att2011oformr tax credits online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form it-203-att2011oformr tax credits. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

How to fill out form it-203-att2011oformr tax credits

How to fill out form it-203-att2011oformr tax credits?

01

Obtain a copy of form it-203-att2011oformr tax credits from the appropriate tax authority.

02

Read the instructions carefully to understand the requirements and eligibility criteria for claiming tax credits.

03

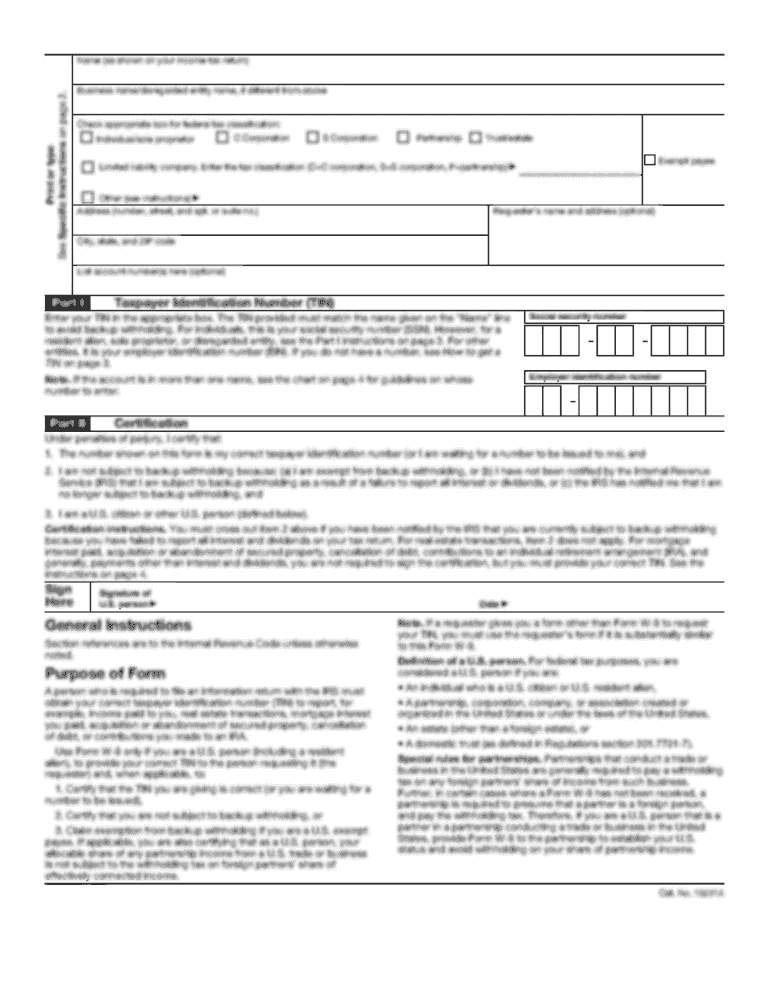

Fill in your personal information accurately, including your name, address, Social Security number, and filing status.

04

Provide details of your income, deductions, and credits in the relevant sections of the form.

05

Make sure to attach any necessary supporting documents, such as W-2 forms or receipts for eligible expenses.

06

Double-check all the information entered on the form to ensure accuracy and completeness.

07

Sign and date the form before submitting it to the tax authority.

Who needs form it-203-att2011oformr tax credits?

01

Individuals who are eligible to claim specific tax credits available in their jurisdiction.

02

Taxpayers who have incurred expenses or meet certain criteria that qualify them for tax credits.

03

Individuals who want to reduce their tax liability or receive refunds based on eligible credits they are entitled to.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form it-203-attoformr tax credits?

Form IT-203-ATTOFORMR tax credits is a form used by individuals in New York to claim certain tax credits, such as the Alternative Fuels Vehicle Credit and the Empire State Jobs Retention Program Credit.

Who is required to file form it-203-attoformr tax credits?

Individuals who meet the eligibility requirements for specific tax credits in New York may be required to file Form IT-203-ATTOFORMR tax credits. This includes individuals who have purchased or leased qualifying alternative fuel vehicles or those who have participated in eligible job retention programs.

How to fill out form it-203-attoformr tax credits?

To fill out Form IT-203-ATTOFORMR tax credits, you will need to provide information about your eligibility for the specific tax credits you are claiming. This may include details about your alternative fuel vehicle purchase or lease, or documentation related to your participation in an eligible job retention program. You should carefully review the instructions provided with the form and include any necessary supporting documentation.

What is the purpose of form it-203-attoformr tax credits?

The purpose of Form IT-203-ATTOFORMR tax credits is to allow individuals in New York to claim certain tax credits provided by the state. These credits are designed to incentivize activities that promote alternative fuels and job retention, ultimately benefiting the economy and environment of the state.

What information must be reported on form it-203-attoformr tax credits?

The specific information that must be reported on Form IT-203-ATTOFORMR tax credits will depend on the tax credits being claimed. Typically, you will need to provide information such as your personal details, the type of tax credit being claimed, the qualifying activity or purchase, and any supporting documentation as required by the instructions.

When is the deadline to file form it-203-attoformr tax credits in 2023?

The deadline to file Form IT-203-ATTOFORMR tax credits in 2023 will be determined by the New York Department of Taxation and Finance. It is recommended to refer to the official guidelines and announcements from the department to ensure compliance with the filing deadline.

What is the penalty for the late filing of form it-203-attoformr tax credits?

The penalty for the late filing of Form IT-203-ATTOFORMR tax credits will be determined by the New York Department of Taxation and Finance. It is advisable to review the official guidelines provided by the department to understand the potential penalties and consequences of late filing.

How can I edit form it-203-att2011oformr tax credits from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including form it-203-att2011oformr tax credits. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send form it-203-att2011oformr tax credits to be eSigned by others?

When your form it-203-att2011oformr tax credits is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an electronic signature for signing my form it-203-att2011oformr tax credits in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your form it-203-att2011oformr tax credits directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Fill out your form it-203-att2011oformr tax credits online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.