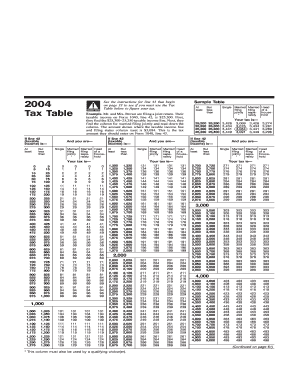

2013 Irs Tax Tables

What is 2013 irs tax tables?

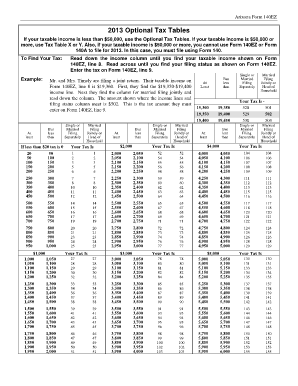

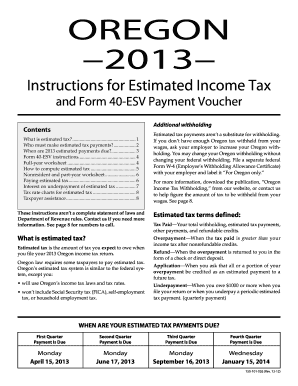

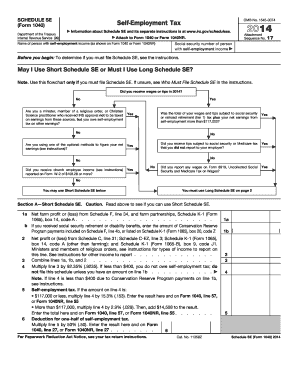

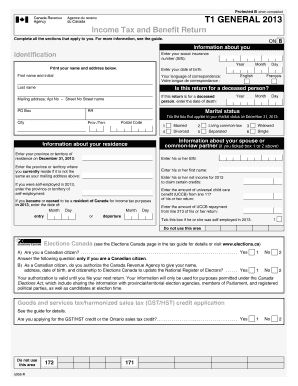

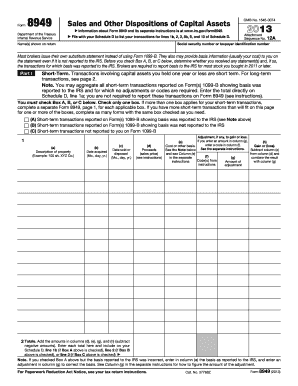

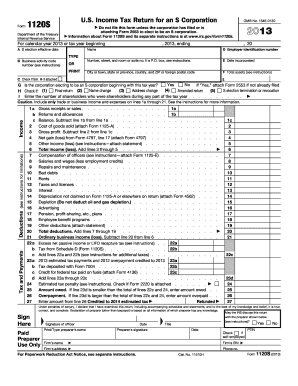

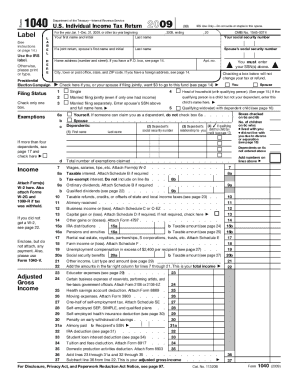

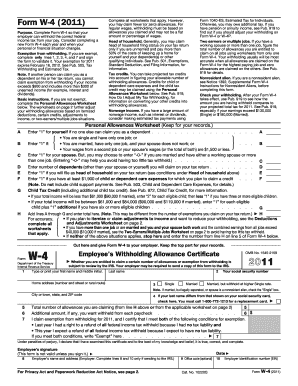

The 2013 IRS tax tables are official documents that provide taxpayers with detailed information on income tax rates and brackets for the year 2013. These tables are published by the Internal Revenue Service (IRS) and are used to calculate the amount of federal income tax owed by individuals and businesses for that particular year. The tax tables take into account a taxpayer's filing status, taxable income, and the applicable tax rates for each income bracket.

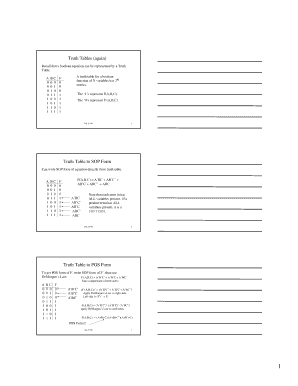

What are the types of 2013 irs tax tables?

The types of 2013 IRS tax tables include:

How to complete 2013 irs tax tables

Completing the 2013 IRS tax tables is a straightforward process. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.