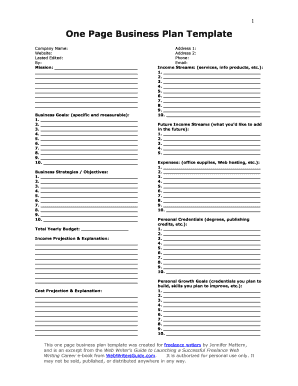

What is Business Budget Template?

A Business Budget Template is a tool used by companies to plan and track their financial activities. It helps businesses set financial goals, allocate resources, and monitor expenses and revenues. With a Business Budget Template, businesses can gain insights into their financial health and make informed decisions to achieve their financial objectives.

What are the types of Business Budget Template?

There are various types of Business Budget Templates available to cater to different business needs. Some common types include:

Sales Budget: This type of budget focuses on estimating and tracking sales revenue.

Operating Budget: It covers all the operational expenses and revenue projections for a specific period.

Cash Flow Budget: This template helps businesses manage their cash inflows and outflows.

Capital Budget: It is used to plan and track long-term investments in assets and infrastructure.

Project Budget: Project-specific budget templates are created to manage expenses and revenue for specific projects.

How to complete Business Budget Template?

Completing a Business Budget Template is a crucial step towards effective financial management. Here is a step-by-step guide to help you complete a Business Budget Template:

01

Set financial goals: Clearly define your financial objectives and what you want to achieve with your budget.

02

Identify revenue sources: Determine all potential revenue sources for your business, such as sales, investments, or loans.

03

Estimate expenses: List out all your expenses, including fixed costs like rent and salaries, as well as variable costs like utilities and marketing expenses.

04

Allocate resources: Distribute your available resources among different expense categories based on their priority and importance.

05

Monitor and review: Continuously track your actual financial performance against the budgeted numbers. Regularly review and make adjustments as needed to stay on track with your goals.

pdfFiller, a leading online document management platform, can empower you to create, edit, and share your Business Budget Template seamlessly. With pdfFiller's unlimited fillable templates and powerful editing tools, you can efficiently manage your finances and achieve your financial targets.