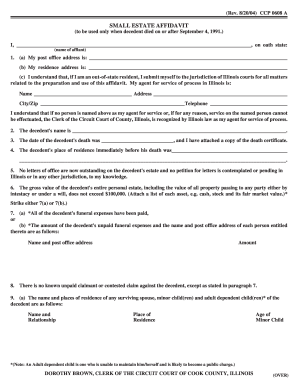

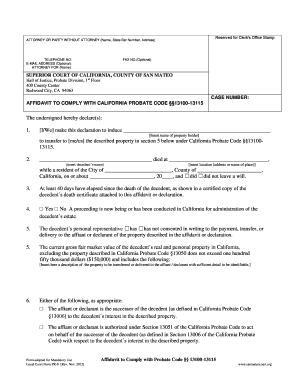

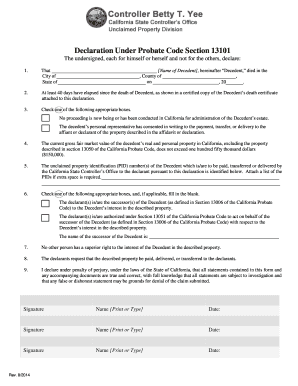

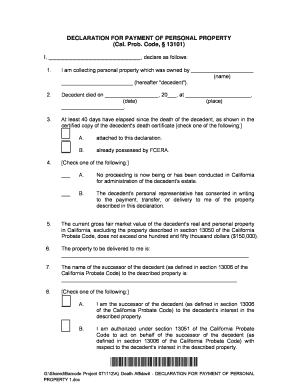

California Probate Form 13100

What is california probate form 13100?

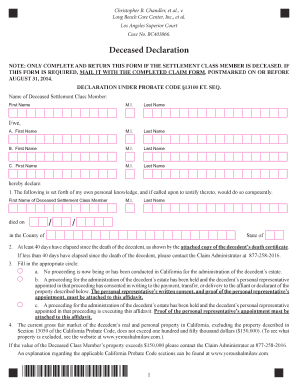

California probate form 13100 is a legal document used in the state of California to simplify the process of transferring property after a person's passing. This form, also known as the Small Estate Affidavit, allows heirs to avoid the lengthy and expensive probate process if the total value of the decedent's estate is $166,250 or less. By completing this form, individuals can claim the assets left by the deceased without going through probate court.

What are the types of california probate form 13100?

There are two types of California probate form 13100: the regular form and the simplified form. The regular form is used when the decedent's assets are valued at $166,250 or less, and no real property is involved. On the other hand, the simplified form is used in cases where the total value of the estate is $166,250 or less, and includes real property such as land or a house. Both forms serve the purpose of expediting the transfer of property to the rightful heirs.

How to complete california probate form 13100

Completing California probate form 13100 is a straightforward process. Here are the steps to follow:

Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done efficiently.