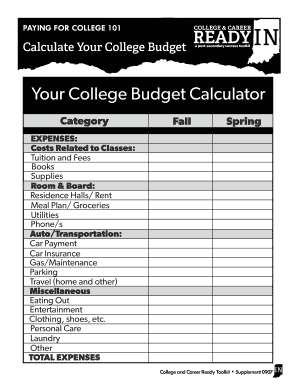

What is free budget calculator?

A free budget calculator is a tool that helps individuals or businesses track their income and expenses to create a financial plan. It allows users to input their sources of income and various expenses, such as bills, groceries, and entertainment. The calculator then calculates the total income, total expenses, and provides a breakdown of where the money is being spent. By using a free budget calculator, users can gain a better understanding of their financial situation and make more informed decisions about their spending and saving habits.

What are the types of free budget calculator?

There are several types of free budget calculators available to suit different needs and preferences. Some common types include:

Basic budget calculator: This type of calculator helps users track their income and expenses in a simple and straightforward manner.

Advanced budget calculator: This type of calculator offers more features and capabilities, such as the ability to set savings goals, track investments, and generate detailed reports.

Debt repayment calculator: This type of calculator focuses on helping users create a plan to pay off their debts efficiently. It takes into account interest rates, minimum payments, and additional payments.

Retirement savings calculator: This type of calculator assists users in determining how much they need to save for retirement based on their current income, desired retirement age, and other factors.

Family budget calculator: This type of calculator is designed for families and helps track and manage finances for multiple members.

Business budget calculator: This type of calculator is tailored for business owners and helps track income, expenses, and profitability for their business.

How to complete free budget calculator

Completing a free budget calculator is a simple and straightforward process. Here are the steps to follow:

01

Gather your financial information: Collect all relevant financial statements, such as bank statements, pay stubs, bills, and receipts.

02

Identify your income sources: Make a list of all your sources of income, including wages, investments, and any other sources of money coming in.

03

Determine your expenses: Categorize your expenses into different categories, such as housing, transportation, groceries, and entertainment.

04

Input your income and expenses: Use the budget calculator to input your income and expenses in the respective fields.

05

Review and analyze the results: Once you have entered all your financial information, review the results provided by the budget calculator. Pay attention to your total income, total expenses, and the breakdown of your expenses.

06

Make adjustments if necessary: If you find that your expenses exceed your income, consider making adjustments to your spending habits to achieve a more balanced budget.

07

Set financial goals: Use the insights gained from the budget calculator to set financial goals, such as saving a certain amount each month or paying off debt.

08

Track your progress: Regularly update and track your budget using the calculator to monitor your progress towards your financial goals.

09

Make updates as needed: As your financial situation changes, such as a change in income or expenses, make updates to your budget calculator accordingly.

By following these steps, you can effectively complete a free budget calculator and gain greater control over your finances.