Simple Budget Calculator

What is simple budget calculator?

A simple budget calculator is a tool that helps individuals or businesses track and manage their finances. It allows users to input their income and expenses and calculates their total budget. By providing a clear overview of financial standing, a simple budget calculator enables users to make informed decisions about their money.

What are the types of simple budget calculator?

There are several types of simple budget calculators available:

Basic budget calculator: This calculator allows users to input their income and expenses and provides a simple overview of their budget.

Expense tracking budget calculator: This type of calculator focuses on tracking expenses and categorizing them to provide a detailed breakdown of spending habits.

Debt repayment budget calculator: This calculator helps users create a plan to pay off their debts by determining how much they can allocate towards debt repayment each month.

Savings goal budget calculator: This type of calculator helps users set and track their savings goals by calculating how much they need to save each month to reach their target.

How to complete simple budget calculator

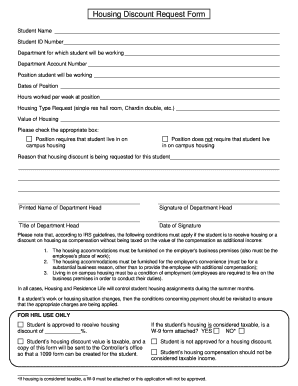

Completing a simple budget calculator is easy and straightforward. Here are the steps to follow:

01

Gather your financial information: Collect all relevant information about your income and expenses, including pay stubs, bills, and receipts.

02

Input your income: Enter your total monthly income into the calculator. This can include your salary, freelance earnings, or any other sources of income.

03

Enter your expenses: List all your monthly expenses, such as rent, utilities, groceries, transportation, and entertainment. Be as specific and accurate as possible.

04

Review and adjust: Double-check your inputs and make any necessary adjustments. Ensure that all your income and expenses are included.

05

Analyze the results: Once you have completed the calculator, review the results. Take note of your total income, total expenses, and the resulting budget surplus or deficit.

06

Make informed financial decisions: Use the information provided by the calculator to make informed decisions about your finances. Adjust your spending habits, set savings goals, or make necessary changes to improve your financial situation.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out simple budget calculator

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What are the 5 steps to creating a budget?

How to create a budget Calculate your net income. List monthly expenses. Label fixed and variable expenses. Determine average monthly costs for each expense. Make adjustments.

How do you create a simple budget plan?

The following steps can help you create a budget. Step 1: Calculate your net income. The foundation of an effective budget is your net income. Step 2: Track your spending. Step 3: Set realistic goals. Step 4: Make a plan. Step 5: Adjust your spending to stay on budget. Step 6: Review your budget regularly.

What are the 7 steps in creating a budget?

7 Steps to a Budget Made Easy Step 1: Set Realistic Goals. Step 2: Identify your Income and Expenses. Step 3: Separate Needs and Wants. Step 4: Design Your Budget. Step 5: Put Your Plan Into Action. Step 6: Seasonal Expenses. Step 7: Look Ahead.

Does Microsoft have a budget template?

DIY with the Personal budget template This Excel template can help you track your monthly budget by income and expenses. Input your costs and income, and any difference is calculated automatically so you can avoid shortfalls or make plans for any projected surpluses.

How do you create a budget layout?

The following steps can help you create a budget. Step 1: Calculate your net income. The foundation of an effective budget is your net income. Step 2: Track your spending. Step 3: Set realistic goals. Step 4: Make a plan. Step 5: Adjust your spending to stay on budget. Step 6: Review your budget regularly.

Does Word have a budget template?

Compare your estimated monthly income against what you spent with this monthly budget template. Use budget templates to track housing, food, entertainment, and transportation expenses. Gain insight into your spending, and inform future decisions.