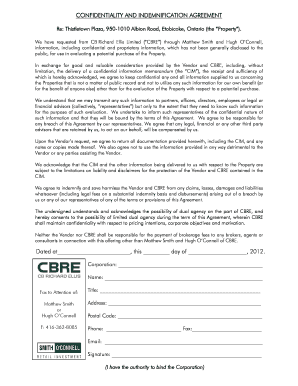

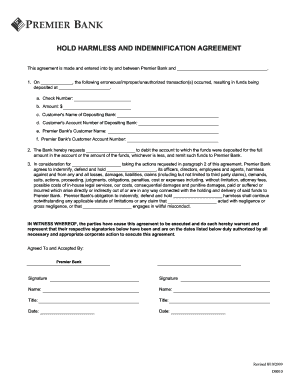

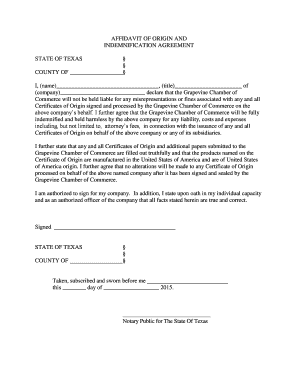

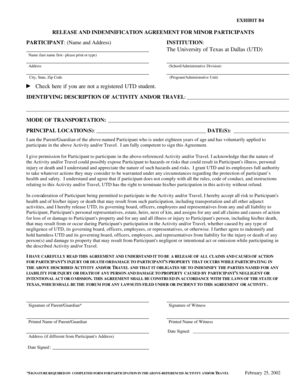

Indemnification Agreement

What is an Indemnification Agreement?

An Indemnification Agreement is a contract whereby one party agrees to protect another party from certain legal risks or liabilities. It is commonly used in business transactions to ensure that one party is held harmless in case of damages, losses, or legal claims.

What are the types of Indemnification Agreement?

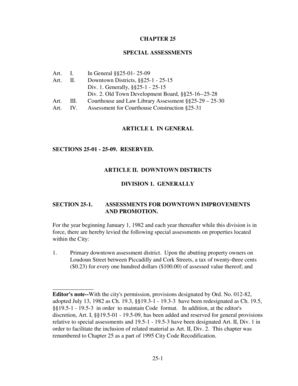

There are several types of Indemnification Agreements that can be used depending on the specific situation. Some common types include:

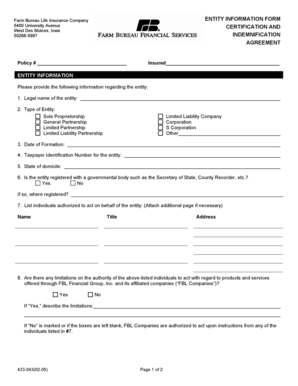

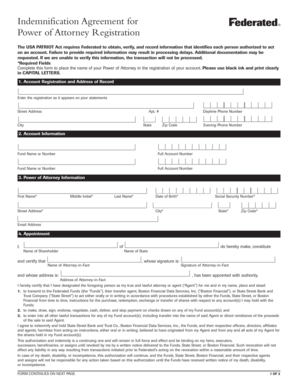

How to complete an Indemnification Agreement

Completing an Indemnification Agreement is crucial to protect both parties involved in a business transaction. Here are some steps to help you complete this agreement:

The user-friendly platform of pdfFiller empowers you to easily create, edit, and share Indemnification Agreements online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to ensure your documents are done accurately and efficiently.