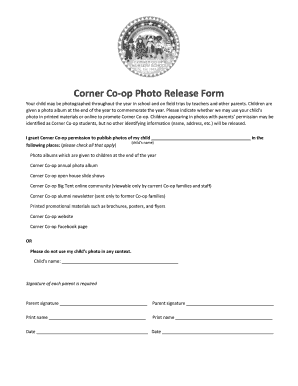

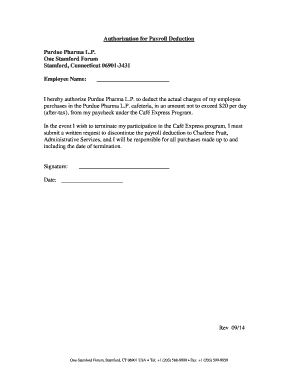

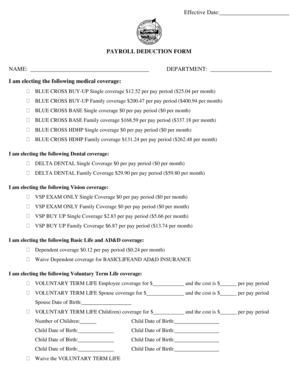

Payroll Deduction Form For Employee Purchases

What is a payroll deduction form for employee purchases?

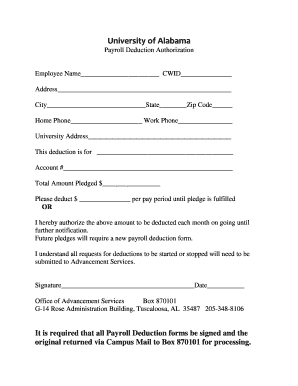

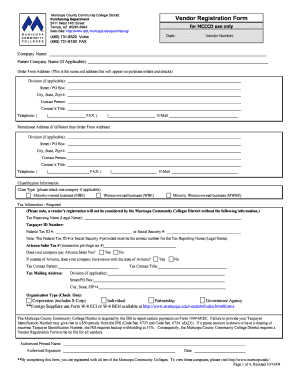

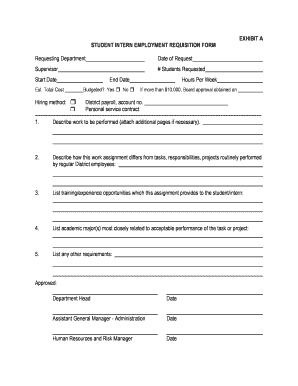

A payroll deduction form for employee purchases is a document that allows employees to authorize deductions from their paychecks for the purpose of making purchases. This form enables employees to pay for various goods or services through automatic deductions from their salaries.

What are the types of payroll deduction form for employee purchases?

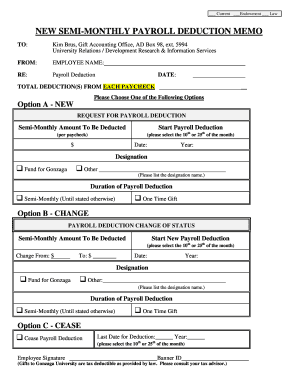

There are several types of payroll deduction forms for employee purchases. These include: 1. General Purchase Deduction: This type of form allows employees to deduct a specified amount from their paychecks for general purchases. 2. Benefit Deduction: This form enables employees to authorize deductions for specific benefits such as health insurance or retirement plans. 3. Loan Repayment Deduction: A payroll deduction form can also be used for employees to authorize deductions for loan repayments. 4. Savings Deduction: Employees may use this form to authorize deductions for savings purposes, such as contributing to a company-sponsored savings plan. 5. Charity Deduction: Some employers offer the option for employees to make charitable contributions through payroll deductions. A specific form can be used for this purpose.

How to complete a payroll deduction form for employee purchases?

Completing a payroll deduction form for employee purchases is a simple process. Here are the steps: 1. Obtain the form: Check with your employer or human resources department to get a copy of the payroll deduction form. 2. Provide personal information: Fill in your personal details such as name, employee ID, and contact information. 3. Specify the deduction type: Indicate the type of deduction you want to authorize by selecting the appropriate option. 4. Set the deduction amount: Enter the amount you wish to deduct from each paycheck. 5. Signature and date: Sign and date the form to authorize the deductions. 6. Submit the form: Return the completed form to the designated department or person responsible for processing payroll deductions.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.