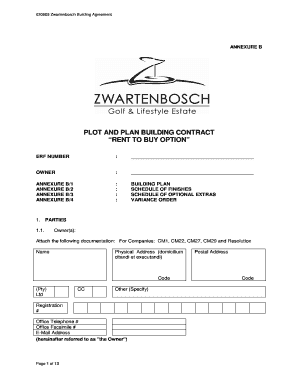

Rent With Option To Buy Contract Form

What is rent with option to buy contract form?

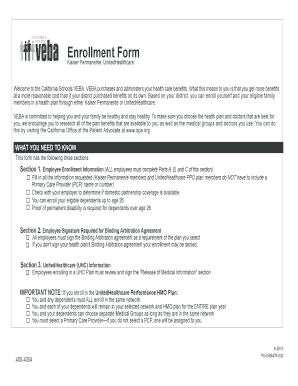

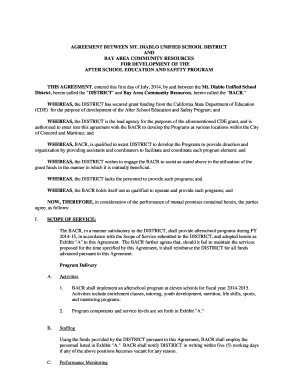

A rent with option to buy contract form is a legal agreement between a landlord and a tenant, where the tenant has the option to purchase the property they are renting at a later date. This type of contract provides the tenant with the opportunity to test out living in the property before committing to a full purchase.

What are the types of rent with option to buy contract form?

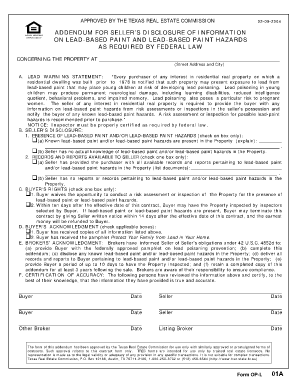

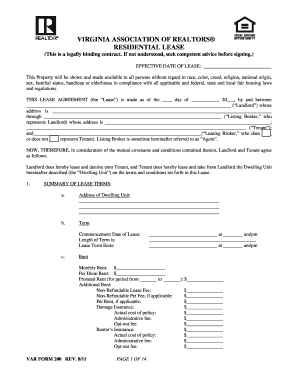

There are several types of rent with option to buy contract forms available. Some common types include: 1. Lease Option Agreement: This type of agreement gives the tenant the option to buy the property at a predetermined price within a specified time frame. 2. Lease Purchase Agreement: In this type of agreement, the tenant is obligated to purchase the property at the end of the lease term. 3. Land Contract: Also known as a contract for deed, this type of agreement allows the tenant to make payments towards the purchase of the property over time, with the title transferring once the final payment is made.

How to complete rent with option to buy contract form

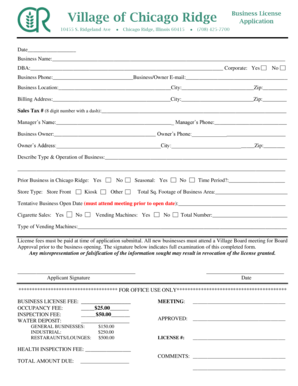

Completing a rent with option to buy contract form is a straightforward process. Here are the steps to follow: 1. Gather necessary information: Collect all the required details, including the names and contact information of the landlord and tenant, property address, agreed purchase price, and duration of the lease option period. 2. Review and customize the template: Use a reliable online platform like pdfFiller to access a ready-made rent with option to buy contract form template. Edit the template to include all the specific details and terms agreed upon by both parties. 3. Add any additional clauses: If there are any additional terms or conditions that need to be included in the contract, make sure to add them clearly and precisely. 4. Review and revise: Carefully review the completed contract form for any errors or missing information. Make any necessary revisions before finalizing the document. 5. Sign and share: Once both parties are satisfied with the contract, sign and date it together. Make copies for each party and store them in a safe place.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.