Filing 1099-MISC tax form online

The number of US taxpayers who opt to file their tax returns electronically continues to grow each year. For all tax submissions, the total has already exceeded over 92%. Taxpayers can submit completed forms directly to the IRS online in minutes instead of filling out documents by hand and having to print and mail them over the course of many days.

This page is for informative purposes only and does not constitute tax or legal advice

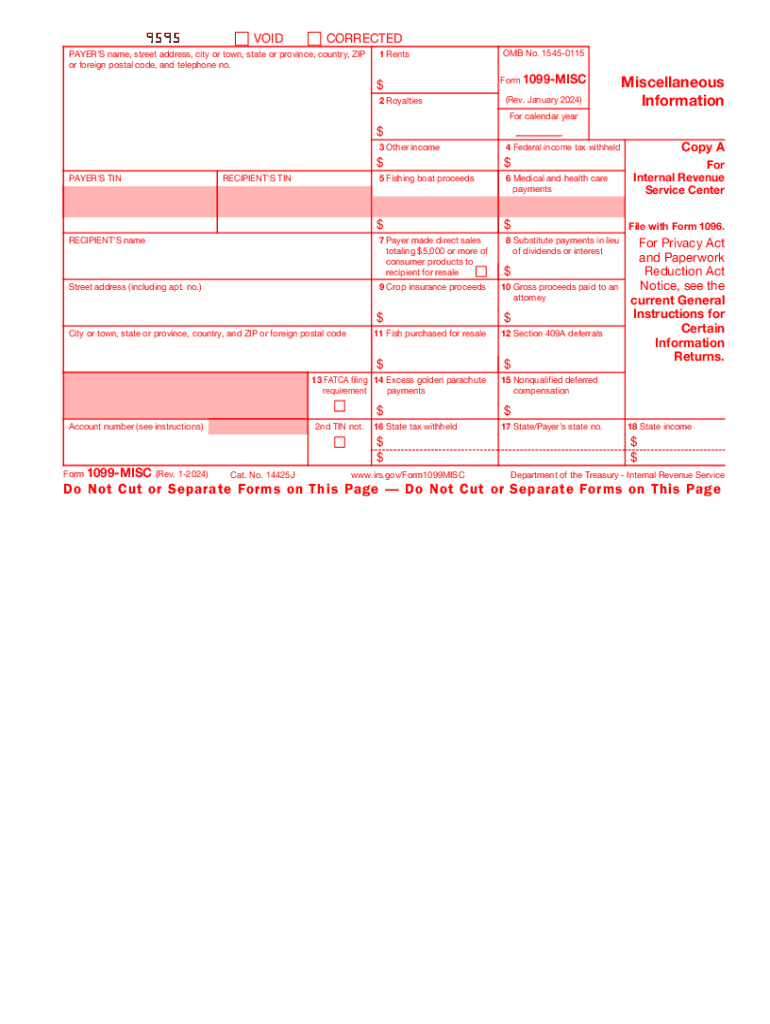

What is the 1099-MISC tax form?

If you perform paid services for a person or legal entity but you’re not a regular employee, you’ll probably receive a

1099-MISC form to fill out. The 1099-MISC is a common type of IRS 1099 form, which is a report of non-employee income. This form is usually filled out by independent contractors, freelancers, and self-employed individuals. You receive the

1099-MISC form if you are paid $10 or more in royalties during a year or if you receive at least $600 in:

Rents

Services performed by someone who is not your employee

Prizes and awards

Other income payments

Medical and health care payments

Crop insurance proceeds

Cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish

Generally, the cash paid from a notional principal contract to an individual, partnership, or estate

Payments to an attorney

Any fishing boat proceeds

Dates: The 1099-MISC submission deadline is January 31 of the following year.

Extensions: You may apply for a 30-day extension by submitting the 8809 form by 1099-MISC tax form due date.

Take into consideration: The 1099-MISC form includes your Social Security Number or Taxpayer Identification Number. So if you don’t report your income, the IRS will know. You don’t have to file the 1099-MISC form if you are registered as a C corporation or S corporation.

E-file your tax forms directly to the IRS

According to new IRS rules, those that file their tax refund forms online will be the first to receive their refunds.

File your W-2, 1099-MISC, and 941 forms with the IRS online

Fill out your tax forms and submit them directly to the IRS with pdfFiller.

Submit your form to the IRS in a single click and email copies to your employees and independent contractors right from your pdfFiller account.

Experience simple, transparent, and stress-free filing from start to finish.

E-filing with pdfFiller is the absolute fastest and safest way to get your refund. All forms that are generated, completed, and sent using pdfFiller are securely stored in your personal account in the cloud, ensuring only you have access to them.

Pay taxes online

It’s more convenient to fill and e-file the 1099-MISC form online due to the fact that the IRS can only scan physical 1099-MISC forms obtained from a tax office. However, you may receive a penalty if you submit a form printed from an online copy. But all in all, paying taxes online has a number of benefits:

Ability to file from anywhere

Ensured accuracy

Time and money savings

Avoid added interest and penalties

Welcome to the pdfFiller forms catalog

Browse Versions and Schedules for All Relevant Forms

IRS Forms with Versions and Schedules

Edit professional templates, download them in any text format or send via pdfFiller’s advanced sharing tools. See also Top Forms by user votes.

1099-MISC form

Miscellaneous Income

W2 form

Wage and Tax Statement is used to report wages paid to employees and the taxes withheld from them

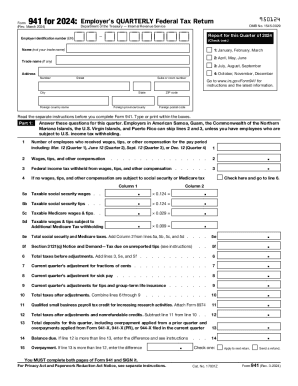

941 form

Don't use Form 941-V to make federal tax deposits. Use Form 941-V when making any payment with...

How to fill out other forms

Find the form you need, fill it out, and sign faster than ever before.

W-9 tax form

Request for Taxpayer Identification Number and Certification. For business owners and independent...

Read guide

W-4 tax form

Employee’s Withholding Certificate. Submitted to employers by employees

Read guide

1040-es tax form

Estimated Tax for Individuals. Helps self-employed with taxable income calculations

Read guide

1099-nec tax form

Wage and Tax Statement is used to report wages paid to employees

Read guide

All-in-one PDF software

A single pill for all your PDF headaches. Edit, fill out, eSign, and share – on any device.