Rental Real Estate Income and Expenses of a Partnership or an...

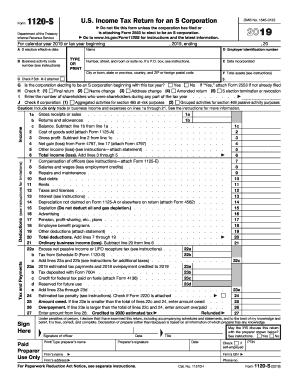

What's included in the Rental Real Estate Income and Expenses of a Partnership or an S Corporation package

Submit and send out the Rental Real Estate Income and Expenses of a Partnership or an S Corporation deal online with pdfFiller. Get all the templates missing from your workflow right away, and also save money with exclusive package deals.Opt out the templates you don't need if it's the case.

On pdfFiller you can find the form packages manually selected to fit a big selection of common paperwork cases, such as tax submission, fees deduction, etc. The templates included in the Rental Real Estate Income and Expenses of a Partnership or an S Corporation forms package have no limits for filling out and you can use them for numerous purposes. Proceeding to the pdfFiller's editing tool, you can complete the required document, sign it electronically, and securely send out - in a single browser tab..

To start modifying the template, click the Fill Now button. Insert your information in the fillable fields. Use the Wizard tool so you don’t miss any important sections. It will highlight the required fields one after another, suggesting the information you should add. Also, take advantage of the field list to be sure that all of them are completed. Once you fill and sign every document you need from the Rental Real Estate Income and Expenses of a Partnership or an S Corporation package, you're good to go.

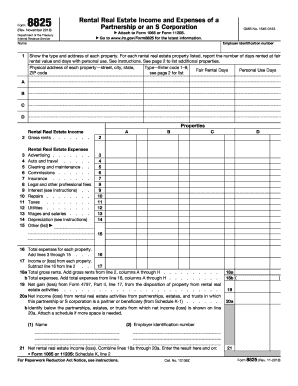

More In Forms and Instructions Partnerships and S corporations use Form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from partnerships, estates, or trusts.

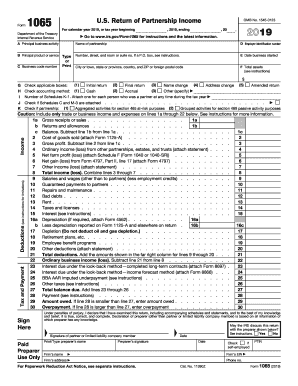

Form 1065: U.S. Return of Partnership Income is a tax document issued by the Internal Revenue Service (IRS) used to declare the profits, losses, deductions, and credits of a business partnership. 1 In addition to Form 1065, partnerships must also submit Schedule K-1, a document prepared for each partner.

Rental Real Estate Income and Expenses of a Partnership or an S Corporation FAQs