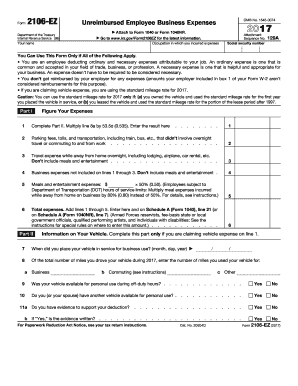

Unreimbursed Employee Business Expenses

The templates you get with the Unreimbursed Employee Business Expenses forms package

Fill out and share the Unreimbursed Employee Business Expenses forms package online using pdfFiller. Get all the forms missing from your workflow at once, and also save money with exclusive package deals.You can also opt out the templates you won't need if it's the case.

Form packages by pdfFiller are categorized and contain the most popular paperwork cases such as tax submission, various applications, and agreements. The forms included in the package are organized for any particular use case. Proceeding to the pdfFiller's editing tool, you can complete the required document, sign it electronically, and securely send out - in a single browser window..

To start working on your Unreimbursed Employee Business Expenses forms package, click Fill Now on one of the forms. You’ll be instantly taken to the editing tool. In order to make the completion process more simple, follow the Wizard tool's tips. This tool guides you through the document and displays the fields you need to fill out. Thus, you will never miss a thing and save time on resubmissions and amends. After you finish a form, click Done and proceed with other forms from the bundle.

Form 2106-EZ: Unreimbursed Employee Business Expenses was a tax form distributed by the Internal Revenue Service (IRS) and used by employees to deduct ordinary and necessary expenses related to their jobs.

Form 1040NR is a version of the IRS income tax return that nonresident aliens may have to file if they engaged in business in the United States during the tax year or otherwise earned income from U.S. sources throughout the year.

Unreimbursed Employee Business Expenses FAQs

I use PDFiller constantly. In some ways, better than Acrobat,

What do you dislike?

Price of a subscription. (Being forced to write 40 characters or more is absurd.) Also, the survey is too long and time consuming.

Recommendations to others considering the product:

Would be helpful if png's were accepted and converted to pdf's.

What problems are you solving with the product? What benefits have you realized?

Had one problem a long time ago, which was quickly resolved by a PDFiller staffer.