1098 Form - Page 9

What is 1098 Form?

The 1098 form is a document provided by financial institutions to individuals who paid interest on qualifying loans throughout the tax year. It helps taxpayers report their mortgage interest, student loan interest, or other interest payments for tax purposes.

What are the types of 1098 Form?

There are three main types of 1098 forms:

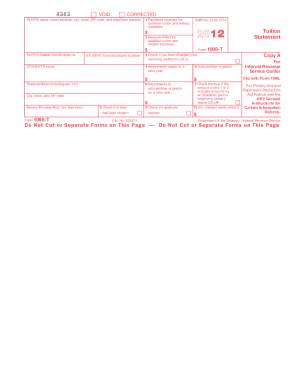

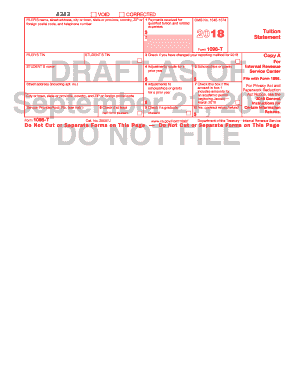

1098 Mortgage Interest Statement – for reporting mortgage interest payments

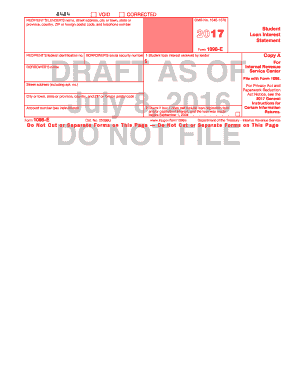

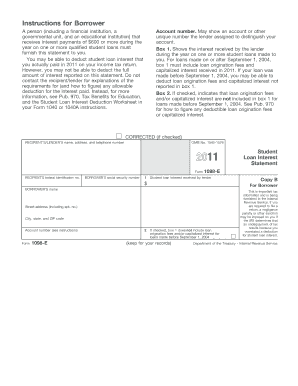

1098-E Student Loan Interest Statement – for reporting student loan interest payments

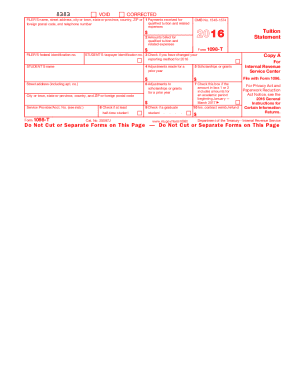

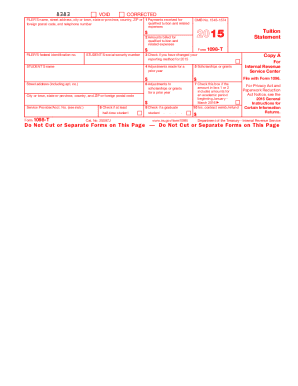

1098-T Tuition Statement – for reporting tuition payments

How to complete 1098 Form

To complete the 1098 form, follow these steps:

01

Gather all necessary information, including your name, address, and taxpayer identification number.

02

Enter the relevant interest payments in the designated boxes on the form.

03

Verify the accuracy of the information provided before submitting the form.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out 1098 Form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Do I have to report 1098 on my tax return?

Do I Need to File 1098? No, you don't have to actually file Form 1098—that is, submit it with your tax return. You only have to indicate the amount of interest reported by the form. And you generally only report this interest if you are itemizing deductions on your tax return.

How do I get a copy of my 1098?

Even if you didn't receive a 1098-E from your servicer, you can download your 1098-E from your loan servicer's website. If you are unsure who your loan servicer is, log in to StudentAid.gov or call the Federal Student Aid Information Center at 1-800-4-FED-AID (1-800-433-3243. TTY 1-800-730-8913).

Where do I get 1098 mortgage interest?

The current Instructions for Form 1098. To order these instructions and additional forms, go to www.irs.gov/EmployerForms. Caution: Because paper forms are scanned during processing, you cannot file certain Forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the IRS website. Filing and furnishing.

How much interest do you have to pay to get a 1098?

Form 1098-E Student Loan Interest Statement reports student loan interest received from you by a lender throughout the year. Lenders are required to fill out this form if you paid them $600 or more in interest over the year.

Does everyone with a mortgage get a 1098?

When might a mortgage lender not be obligated to provide Form 1098? Lenders do not have to provide a Form 1098 if they received less than $600 in interest, mortgage insurance premiums, or points during the year.

When should I get my 1098 mortgage form?

Your mortgage lender sends your Form 1098 to you, generally by the end of January of the filing year.

Related templates