What is balancing a checkbook worksheet?

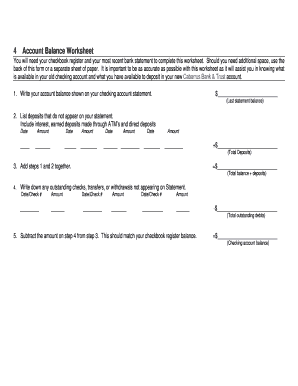

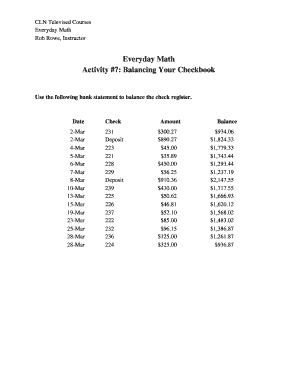

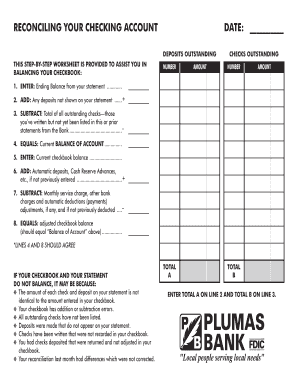

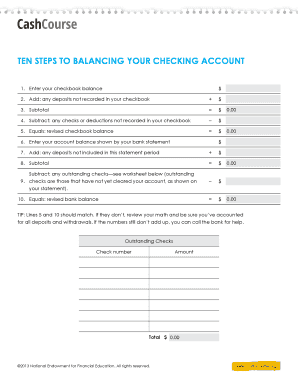

Balancing a checkbook worksheet is a document that helps individuals keep track of their finances and ensure that their bank statements match their recorded transactions. It is a useful tool for managing personal finances and maintaining an accurate account balance.

What are the types of balancing a checkbook worksheet?

There are various types of checkbook worksheets available to assist with balancing finances. Some common types include:

Basic checkbook worksheet: This type of worksheet provides a simple format for recording financial transactions and calculating the account balance.

Digital checkbook worksheet: This type of worksheet is designed to be used on electronic devices, allowing users to input and update information digitally.

Advanced checkbook worksheet: This type of worksheet includes additional features and functions, such as budgeting tools and expense categorization, to provide a more comprehensive financial management experience.

How to complete balancing a checkbook worksheet

Completing a balancing a checkbook worksheet is a straightforward process. Here are the steps to follow:

01

Gather your bank statements: Collect all your recent bank statements to have a starting point for reconciling your transactions.

02

Record your transactions: Note down all your income and expenses, ensuring that each entry is accurate and up-to-date.

03

Calculate your balance: Use the worksheet's built-in formulas or a calculator to calculate your current account balance.

04

Compare with your bank statement: Compare your calculated balance with the ending balance provided on your bank statement.

05

Make adjustments: Identify any discrepancies and make necessary adjustments to ensure that your recorded transactions match your bank statement.

06

Repeat the process: Continuously update your worksheet with new transactions and repeat the balancing process on a regular basis.

It's important to regularly update and maintain your balancing a checkbook worksheet to stay on top of your finances. By keeping accurate records, you can easily identify any discrepancies and ensure that your account balance is always accurate. With the help of pdfFiller, you can conveniently create, edit, and share your checkbook worksheet online. With unlimited fillable templates and powerful editing tools, pdfFiller is the perfect PDF editor to assist you in managing your financial documents effectively.