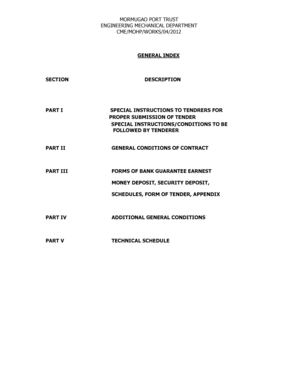

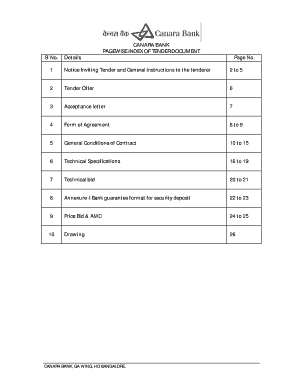

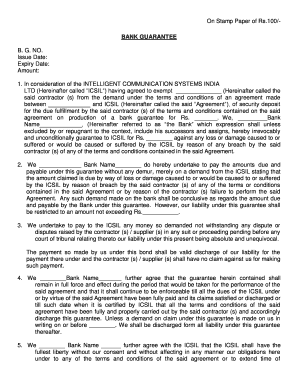

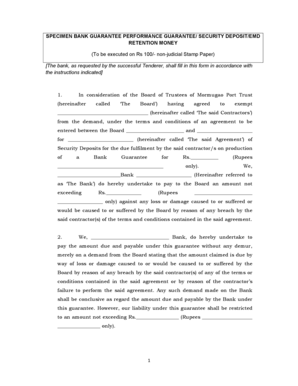

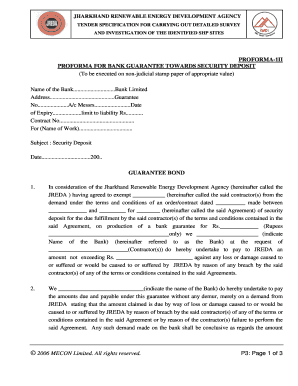

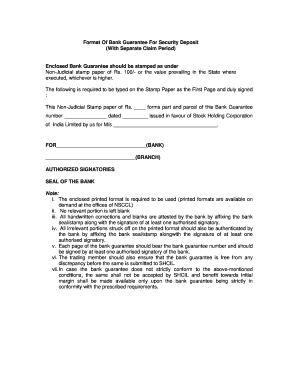

Bank Guarantee Format For Security Deposit

What is Bank Guarantee Format For Security Deposit?

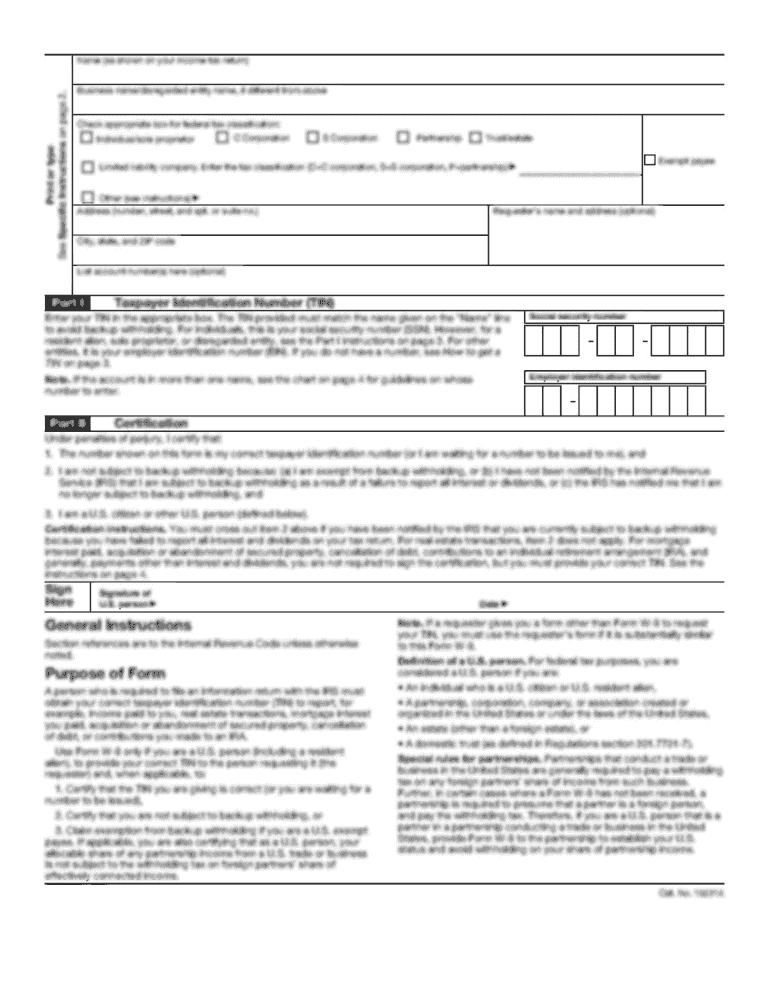

A Bank Guarantee Format For Security Deposit is a document that ensures a financial institution will cover a certain amount of money in case a party fails to fulfill their obligations or defaults on their payment. This format serves as a guarantee to protect the interests of the recipient of the guarantee.

What are the types of Bank Guarantee Format For Security Deposit?

There are several types of Bank Guarantee Formats For Security Deposit that can be utilized depending on the specific requirements and agreements between the parties involved. Some common types include:

How to complete Bank Guarantee Format For Security Deposit?

Completing the Bank Guarantee Format For Security Deposit requires attention to detail and adherence to the specific requirements set forth by the issuing bank. Here are the general steps to complete the format:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.