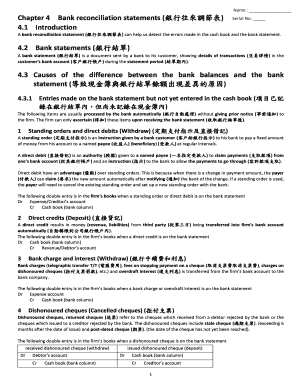

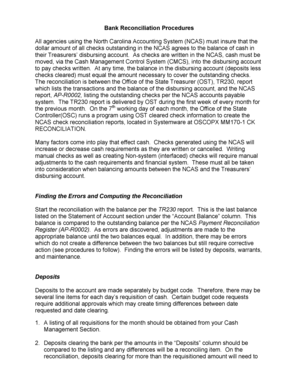

Bank Reconciliation Statement Questions

What is bank reconciliation statement questions?

A bank reconciliation statement is a financial document that compares the bank's records of transactions with an individual or company's own records. It helps in identifying any discrepancies between the two and allows for the correction of any errors. This statement is an essential tool for ensuring the accuracy of financial records and detecting any fraudulent activities.

What are the types of bank reconciliation statement questions?

There are two main types of bank reconciliation statement questions:

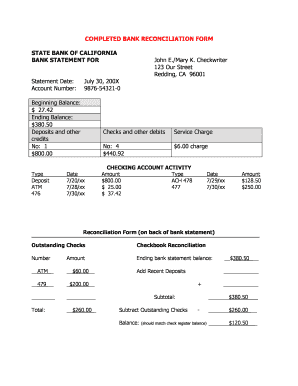

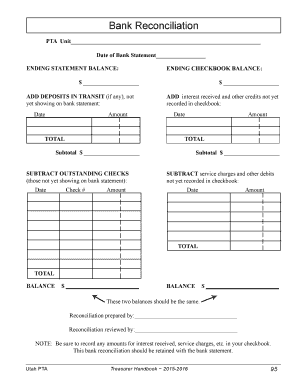

Reconciling Deposits: This type of question focuses on reconciling the deposits made by the individual or company with the bank's records. It involves cross-checking each deposit entry to ensure it matches with the bank's statement.

Reconciling Withdrawals: This type of question involves reconciling the withdrawals made by the individual or company with the bank's records. It requires verifying each withdrawal entry to ensure it matches with the bank's statement.

How to complete bank reconciliation statement questions

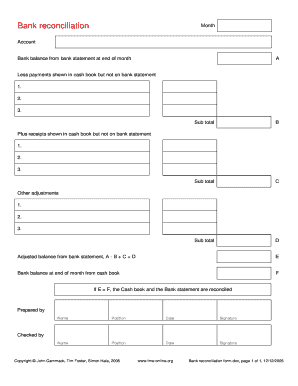

Completing bank reconciliation statement questions can be done by following these steps:

01

Gather all the necessary documents: Collect the bank statement, the individual or company's own records of transactions, and any supporting documents such as receipts or invoices.

02

Compare the records: Go through each transaction on the bank statement and compare it with the records of transactions. Mark off any transactions that match to ensure accuracy.

03

Identify discrepancies: If there are any transactions on the bank statement that do not match with the individual or company's records, investigate further to determine the cause of the discrepancy. It could be due to bank fees, errors in recording transactions, or fraudulent activities.

04

Make necessary adjustments: Once the discrepancies have been identified, make the necessary adjustments to ensure that the bank's records and the individual or company's records align.

05

Reconcile the final balance: Once all the adjustments have been made, reconcile the final balance by comparing it with the bank's statement. The final balance should match, indicating that the bank reconciliation is complete.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out bank reconciliation statement questions

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Related templates