Bank Reconciliation Statement Rules

What is bank reconciliation statement rules?

Bank reconciliation statement rules are guidelines that help individuals and businesses ensure that their bank account records match the transactions recorded by the bank. These rules provide a systematic approach to identifying and resolving discrepancies between the two sets of records.

What are the types of bank reconciliation statement rules?

There are several types of bank reconciliation statement rules that can be followed:

Comparing bank statements with internal records

Matching deposits and withdrawals

Verifying outstanding checks and deposits

Investigating and resolving discrepancies

Reconciling any remaining differences

How to complete bank reconciliation statement rules

Completing bank reconciliation statement rules involves following a step-by-step process:

01

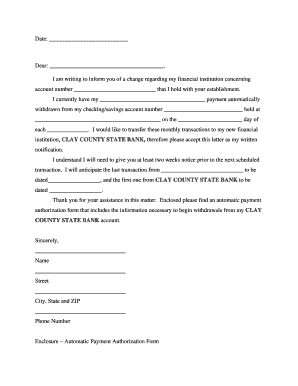

Start by obtaining your bank statement and gather all relevant financial records.

02

Compare the transactions listed in your bank statement with your internal records.

03

Identify any discrepancies and investigate the reasons behind them.

04

Adjust your records to account for any necessary changes.

05

Reconcile any remaining differences and ensure that your records match the bank's transactions.

06

Document the completed bank reconciliation statement for future reference.

pdfFiller offers a comprehensive solution for creating, editing, and sharing documents online. With unlimited fillable templates and powerful editing tools, it is the go-to PDF editor for individuals and businesses alike.

Video Tutorial How to Fill Out bank reconciliation statement rules

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you format a bank reconciliation statement?

Bank Reconciliation Procedure On the bank statement, compare the company's list of issued checks and deposits to the checks shown on the statement to identify uncleared checks and deposits in transit. Using the cash balance shown on the bank statement, add back any deposits in transit. Deduct any outstanding checks.

What is the format of bank reconciliation?

A bank reconciliation statement is a schedule prepared by a company in an electronic or paper format as part of a bank reconciliation process that compares the company's general ledger cash account with its bank statement to ensure every transaction is accounted for and the ending balances match.

What is the reconciliation statement?

A bank reconciliation statement is a summary of banking and business activity that reconciles an entity's bank account with its financial records. The statement outlines the deposits, withdrawals, and other activities affecting a bank account for a specific period.

What are the 10 steps to reconciling a bank statement?

Bank reconciliation steps Get bank records. You need a list of transactions from the bank. Get business records. Open your ledger of income and outgoings. Find your starting point. Run through bank deposits. Check the income on your books. Run through bank withdrawals. Check the expenses on your books. End balance.

What are the steps in preparing a bank reconciliation statement and give example?

Steps in Preparation of Bank Reconciliation Statement Check for Uncleared Dues. Compare Debit and Credit Sides. Check for Missed Entries. Correct them. Revise the Entries. Make BRS Accordingly. Add Un-presented Cheques and Deduct Un-credited Cheques. Make Final Changes.

What is bank reconciliation statement rules?

A bank reconciliation statement is a document that compares the cash balance on a company's balance sheet to the corresponding amount on its bank statement. Reconciling the two accounts helps identify whether accounting changes are needed.

Related templates