Bid Bond

What is bid bond?

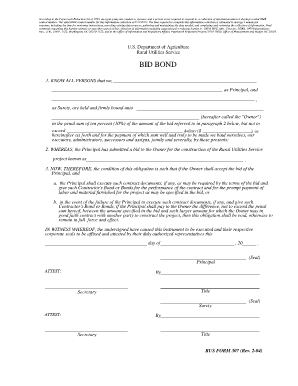

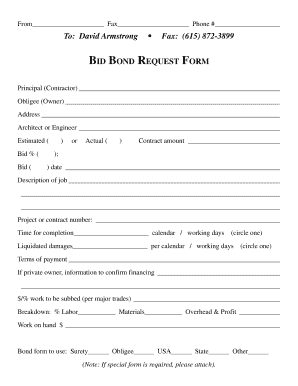

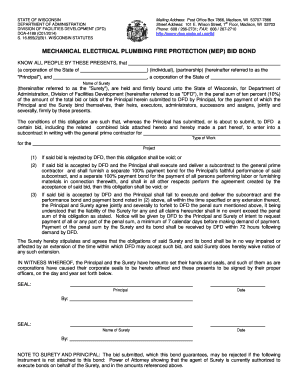

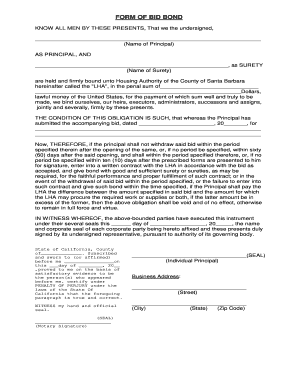

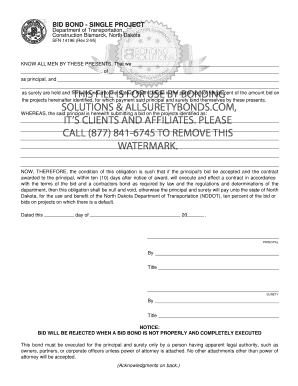

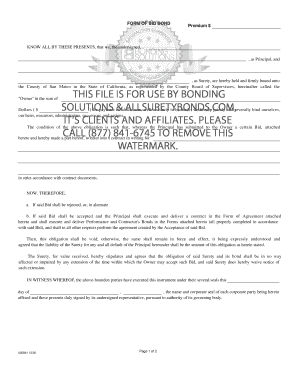

A bid bond is a legal document used in the construction industry to provide assurance to the project owner that the bidder will honor their bid and enter into a contract if selected. It serves as a guarantee that the bidder has the financial capability to undertake the project and is committed to completing it according to the terms specified in the bid. Bid bonds protect project owners from potential financial loss in case a bidder withdraws their bid or fails to fulfill their obligations.

What are the types of bid bond?

There are two main types of bid bonds commonly used in the construction industry: 1. Conditional Bid Bond: This type of bid bond guarantees that the bidder will enter into a contract with the project owner if their bid is accepted. If the bidder fails to comply with the conditions stated in the bid, the bond can be claimed by the project owner to cover any resulting costs. 2. Unconditional Bid Bond: Unlike a conditional bid bond, an unconditional bid bond is irrevocable and guarantees that the bidder will immediately enter into a contract with the project owner upon acceptance of their bid.

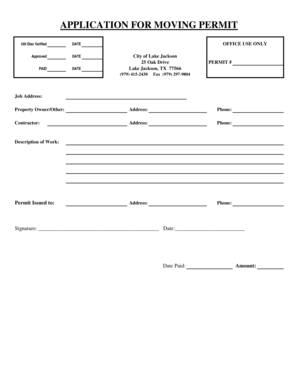

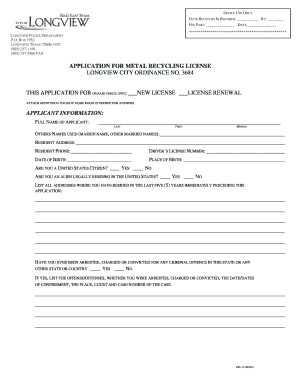

How to complete bid bond

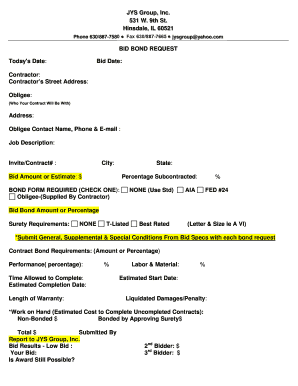

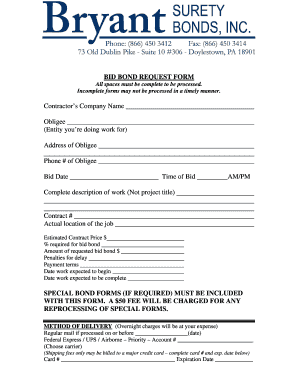

Completing a bid bond is a straightforward process that requires attention to detail. Here are the steps to complete a bid bond: 1. Identify the bid bond form: Obtain the specific bid bond form required by the project owner or the organization issuing the bid bond. 2. Fill in the necessary information: Provide accurate information such as the bidder's name, contact details, bid amount, project details, and any additional information required in the bid bond form. 3. Obtain a surety bond: Contact a reputable surety bond company to secure the bid bond. The surety bond company will assess the bidder's financial capacity and issue the bond accordingly. 4. Sign the bid bond: Once the bid bond form is completed and the surety bond is obtained, the bidder and the surety bond company representative must sign the bid bond document. 5. Submit the bid bond: Submit the completed and signed bid bond document to the project owner or the organization issuing the bid bond before the specified deadline.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.