Business Continuity Plan Template For Banks

What is business continuity plan template for banks?

A business continuity plan template for banks is a document that outlines the actions and procedures to be followed in the event of a disruption or disaster that could potentially impact the bank's operations. It provides a framework for ensuring the bank can continue to operate and deliver essential services to its customers during challenging times.

What are the types of business continuity plan template for banks?

There are various types of business continuity plan templates for banks, including:

Emergency response procedures

Business impact analysis

Recovery strategies

Crisis communication plan

Testing and maintenance procedures

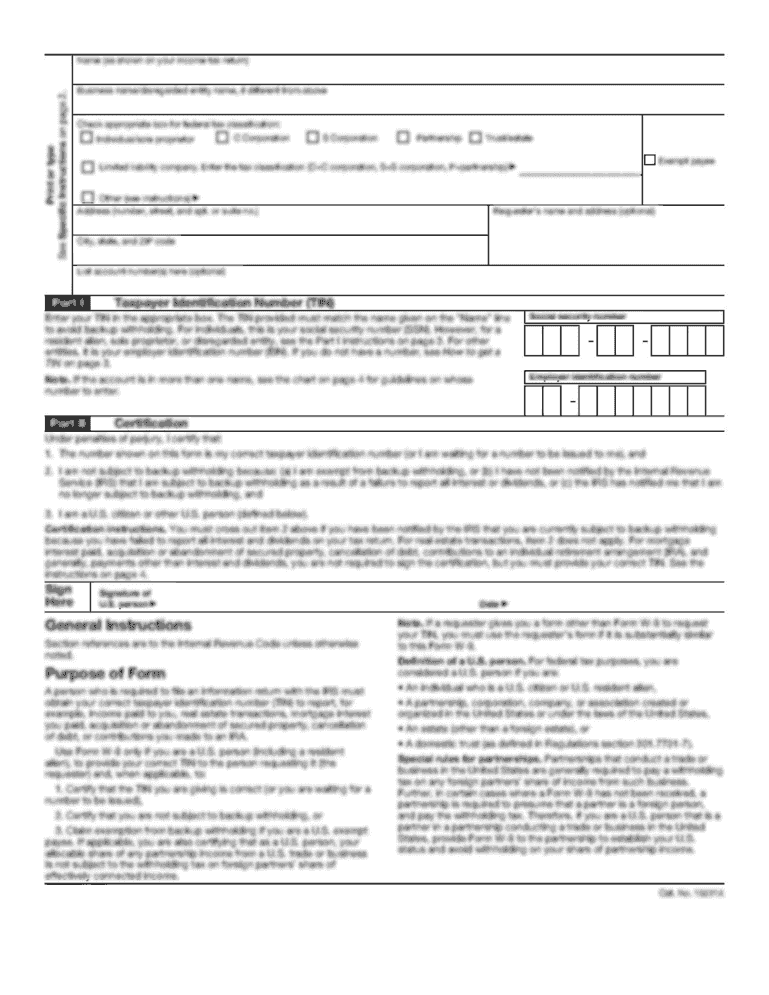

How to complete business continuity plan template for banks

To complete a business continuity plan template for banks, follow these steps:

01

Identify potential risks and vulnerabilities

02

Conduct a business impact analysis to assess the potential impact of disruptions

03

Develop strategies to mitigate risks and ensure business continuity

04

Create an emergency response plan and crisis communication plan

05

Test and review the plan regularly to identify any gaps or areas for improvement

06

Provide training to employees on the plan and their roles during emergencies

Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

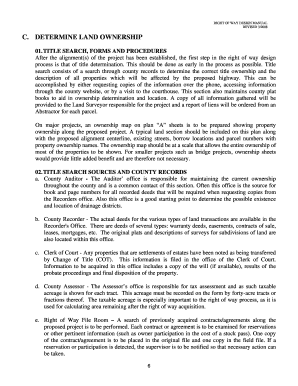

Which of the 4 phases are part of BCM life cycle?

Basically, the business continuity management lifecycle has six phases to it: program management, understanding the organization, determining the BCM strategy, developing and implementing a BCM response, exercising the response, as well as maintaining, reviewing and embedding BCM in the organization's culture.

What is an example of a business continuity plan?

A key component of a business continuity plan (BCP) is a disaster recovery plan that contains strategies for handling IT disruptions to networks, servers, personal computers and mobile devices. The plan should cover how to reestablish office productivity and enterprise software so that key business needs can be met.

What are the four steps of the BCP process?

Four Steps to Developing an Effective Business Continuity Plan Identify threats or risks. Conduct a business impact analysis. Adopt controls for prevention and mitigation. Test, exercise and improve your plan routinely.

What is business continuity plan in banking?

The Bank's Business continuity program is developed to manage the impact of significant disruptions and will endeavour to resume business and operations to an acceptable level within a reasonable time in the event of a disaster.

What must a business continuity plan include?

Your BCP should include: An analysis of all critical functions within your business. A prioritized list of risks that pose a severe or even catastrophic threat to your business. A list of specific strategies (or mitigation activities) that help protect the critical components you identified earlier in the BCP.

What are the 3 elements of business continuity?

A business continuity plan has three key elements: Resilience, recovery and contingency. An organization can increase resilience by designing critical functions and infrastructures with various disaster possibilities in mind. this can include staffing rotations, data redundancy and maintaining a surplus of capacity.

Related templates