Business Term Sheet Template

What is a business term sheet template?

A business term sheet template is a document that outlines the key terms and conditions of a business agreement or transaction. It serves as a preliminary agreement before the final contract is drafted, helping parties negotiate and agree on the major points before moving forward.

What are the types of business term sheet templates?

There are several types of business term sheet templates commonly used in various industries. Some of the most common types include:

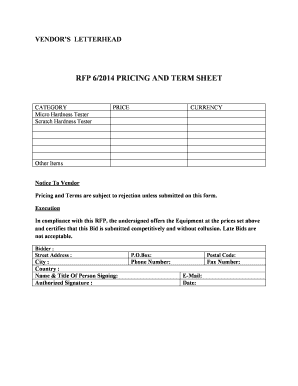

Asset Purchase Term Sheet

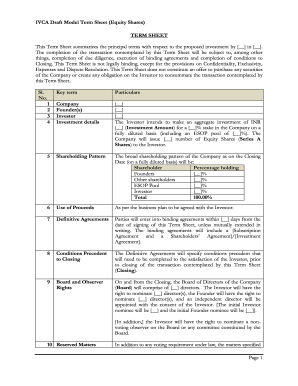

Equity Financing Term Sheet

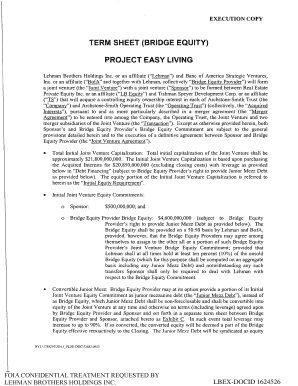

Joint Venture Term Sheet

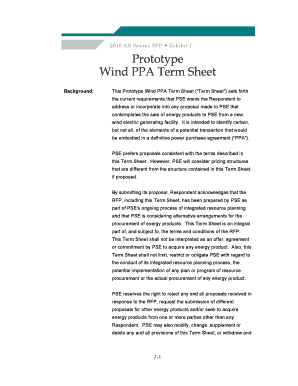

Licensing Term Sheet

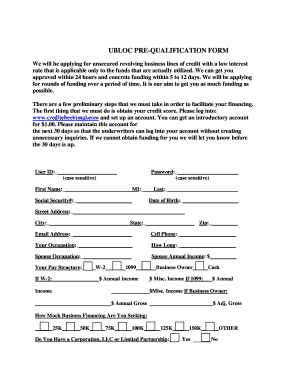

How to complete a business term sheet template

Completing a business term sheet template can be a simple process if you follow these steps:

01

Fill in the parties' names and contact information

02

Specify the key terms of the agreement, such as price, payment terms, and timelines

03

Include any special conditions or contingencies that need to be met for the deal to proceed

04

Review the document carefully to ensure all terms are accurately reflected

05

Sign and date the term sheet to make it legally binding

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What should be included in a term sheet?

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. Securities being issued. Board rights. Investor protections. Dealing with shares. Miscellaneous provisions.

How do you structure a term sheet?

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

What is a term sheet template?

Term Sheet Template A term sheet outlines the basic terms and conditions of an investment opportunity and is a non-binding agreement that serves as a starting point for more detailed agreements – like a commitment letter, definitive agreement (share purchase agreement), or subscription agreement.

What is a good term sheet?

A term sheet lays out the terms and conditions for investment. It's used to negotiate the final terms, which are then written up in a contract. A good term sheet aligns the interests of the investors and the founders, because that's better for everyone involved (and the company) in the long run.

What is the purpose of a term sheet?

A term sheet is a nonbinding agreement outlining the basic terms and conditions under which an investment will be made. Term sheets are most often associated with start-ups. Entrepreneurs find that this document is crucial to attracting investors, such as venture capitalists (VC) with capital to fund enterprises.

What should be included in a term sheet?

All term sheets contain information on the assets, initial purchase price including any contingencies that may affect the price, a timeframe for a response, and other salient information. Term sheets are most often associated with startups.

Related templates