What is Business Travel Expense Log?

A Business Travel Expense Log is a document used to track and record all expenses incurred during business travel. It helps individuals and businesses keep a detailed record of their travel expenses for reimbursement, tax purposes, and financial planning. By keeping a well-maintained expense log, users can easily monitor their spending, identify potential cost-saving opportunities, and stay organized with their travel-related finances.

What are the types of Business Travel Expense Log?

There are different types of Business Travel Expense Logs available to cater to various needs and preferences. Some commonly used types include:

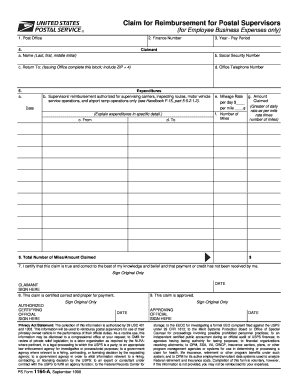

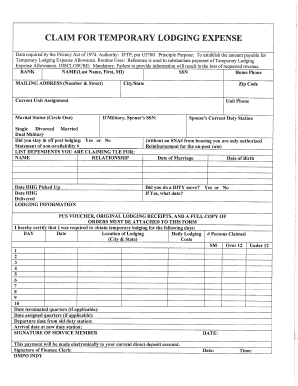

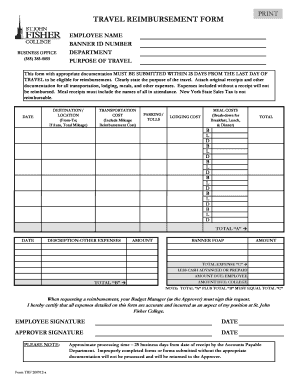

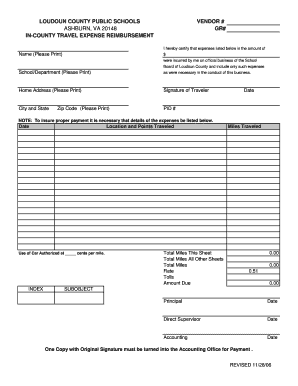

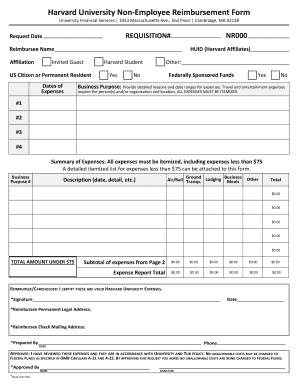

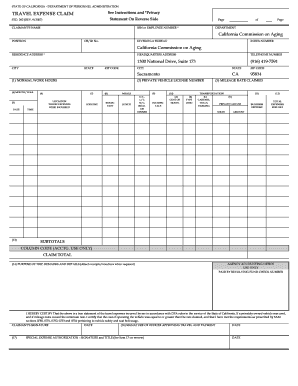

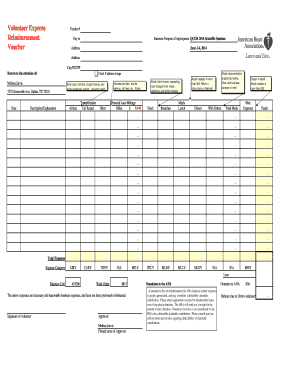

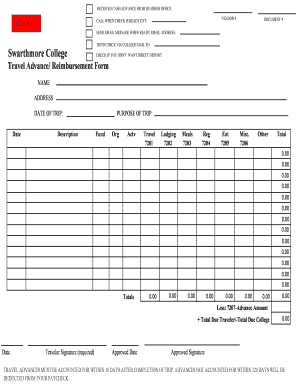

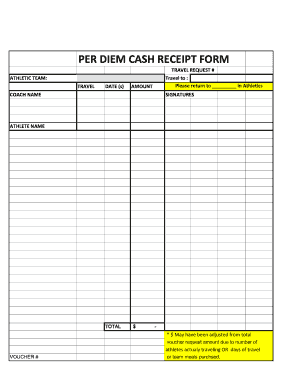

Paper-based logbooks: These are traditional logbooks designed for manual entry of expenses. Users can easily write down their travel expenses along with relevant details such as dates, descriptions, and amounts.

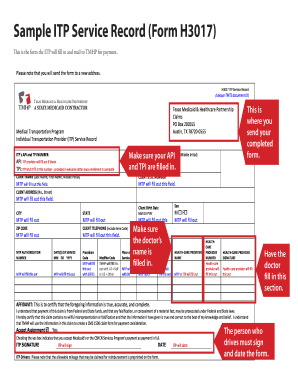

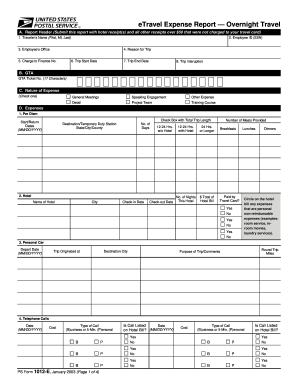

Digital forms: These are digital versions of expense logs that can be filled out on a computer, tablet, or smartphone. They offer the convenience of automatic calculations, easy editing, and the ability to store and access records electronically.

Expense tracking apps: These mobile applications provide advanced features for expense tracking. They often integrate with other tools like accounting software, allowing users to seamlessly manage their travel expenses alongside other financial activities.

Cloud-based platforms: These online platforms enable users to create and manage expense logs from any device with internet connectivity. They offer collaborative features, data security, and easy sharing of expense records.

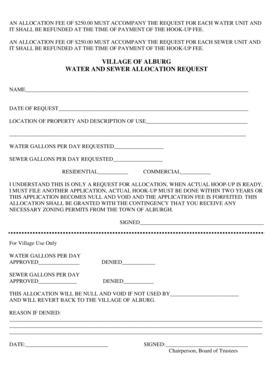

Custom templates: Some users prefer creating their own expense log templates that align with their specific requirements. This allows for maximum customization and flexibility in tracking travel expenses.

How to complete Business Travel Expense Log

Completing a Business Travel Expense Log is simple and can be done in a few steps. Here's a guide to help you:

01

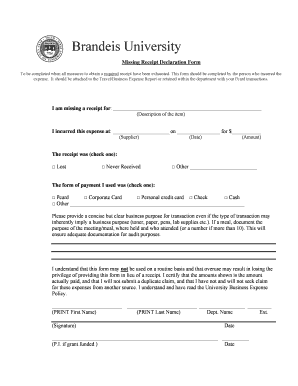

Gather all your receipts and invoices related to the business travel expenses. Make sure to collect all the necessary documentation for accurate record-keeping.

02

Open the Business Travel Expense Log template, whether it's a paper-based logbook, a digital form, or an online platform like pdfFiller.

03

Enter the date of the expense, a brief description or purpose of the expense, and the amount spent.

04

Specify the category or type of expense, such as transportation, meals, accommodation, or miscellaneous.

05

If applicable, indicate any reimbursement received or expected for each expense.

06

Continue entering all the expenses incurred during the business travel, ensuring that each entry is clear, accurate, and well-documented.

07

Review and double-check the completed expense log to ensure all entries are correct. Make any necessary corrections or additions.

08

Save the expense log or generate a printable copy for your records. If using an online platform like pdfFiller, you can also share the log with relevant parties, such as your employer or accounting department.

With pdfFiller, completing your Business Travel Expense Log becomes even more convenient. Empowering users to create, edit, and share documents online, pdfFiller offers unlimited fillable templates and powerful editing tools. It is the only PDF editor users need to efficiently and effectively manage their expense logs and other important documents.